Wallester is an innovative solution in the Corporate Cards category, offering businesses an advanced platform for managing corporate payments, expense tracking, and financial operations. Wallester streamlines the financial workflow by combining corporate card issuance with an intuitive expense management system. This all-in-one platform enhances financial transparency, simplifies expense tracking, and ensures faster approvals for transactions.

Explore exclusive deals. For alternative solutions, consider Pleo, Payhawk, and Ramp.

Why Use Wallester?

Choosing Wallester offers several compelling benefits:

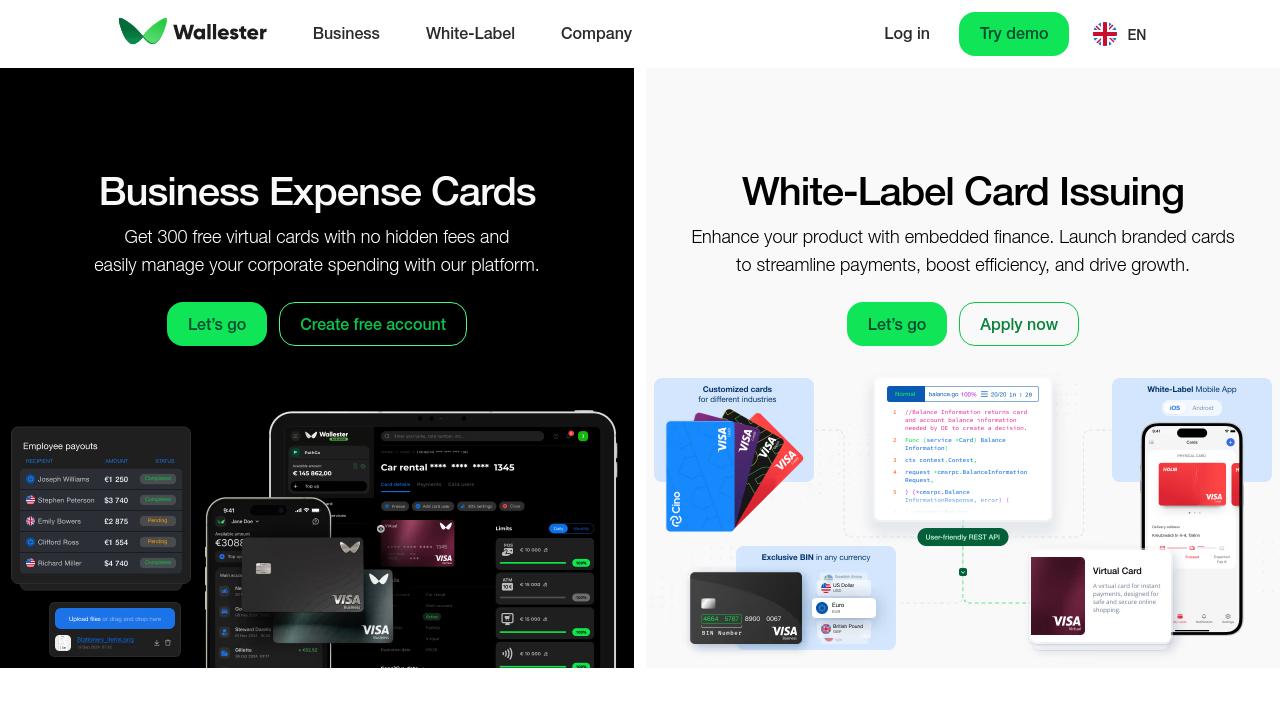

- Corporate Card Issuance: Seamlessly issue physical and virtual cards for employees, with flexible settings to customize card usage, spending limits, and PIN management.

- Expense Management Features: Access tools like real-time expense tracking, transactions monitoring, smart budgeting, digital receipt uploads, and customizable financial reports.

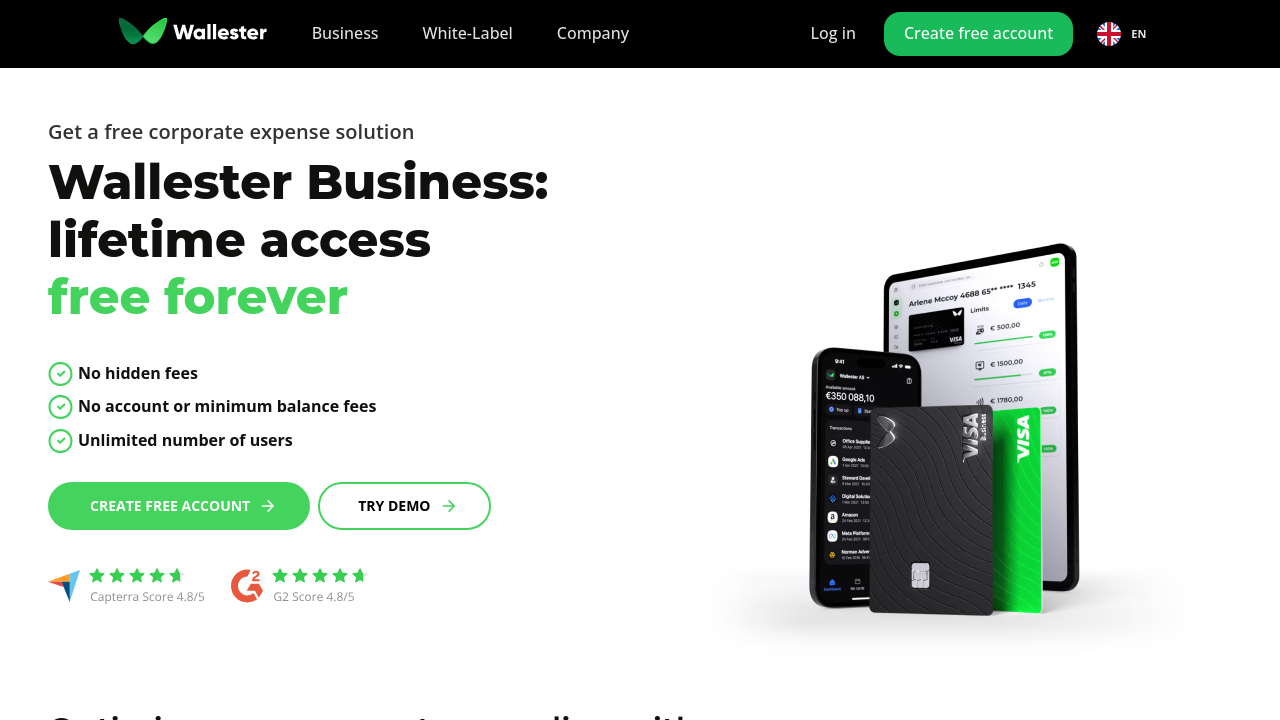

- Scalable Plans: From free plans with 300 virtual cards to enterprise-level customization, Wallester caters to businesses of all sizes.

- Security First: Built-in fraud protection, compliance with PCI DSS standards, advanced tokenization, and 3D-secured transactions ensure top-notch payment safety.

- API Integration: Easily integrate with existing accounting and payroll systems, enabling greater organizational efficiency.

- Multi-Currency Functionality: Support for transactions in different currencies simplifies international payments and expense management.

Who is Wallester For?

Wallester is a versatile platform, ideal for:

- Startups and SMEs: Monitor cash flows effectively while keeping track of expenses with customizable virtual cards and no added costs under entry-level plans.

- Large Enterprises: Streamline financial management with advanced tools such as expense tracking, real-time analytics, and dedicated account managers at enterprise levels.

- Finance Teams: Facilitate budgeting, manage approvals, and reduce fraud risks with Wallester’s analytical tools and corporate card controls.

- Technology-Driven Organizations: Boost operational scalability via seamless API integrations and automation of financial processes.

Wallester is designed to meet diverse financial management needs, ensuring transparent, efficient, and secure corporate expense management. Whether you’re a fast-growing startup or a large-scale enterprise, Wallester provides flexible solutions to optimize your financial operations.