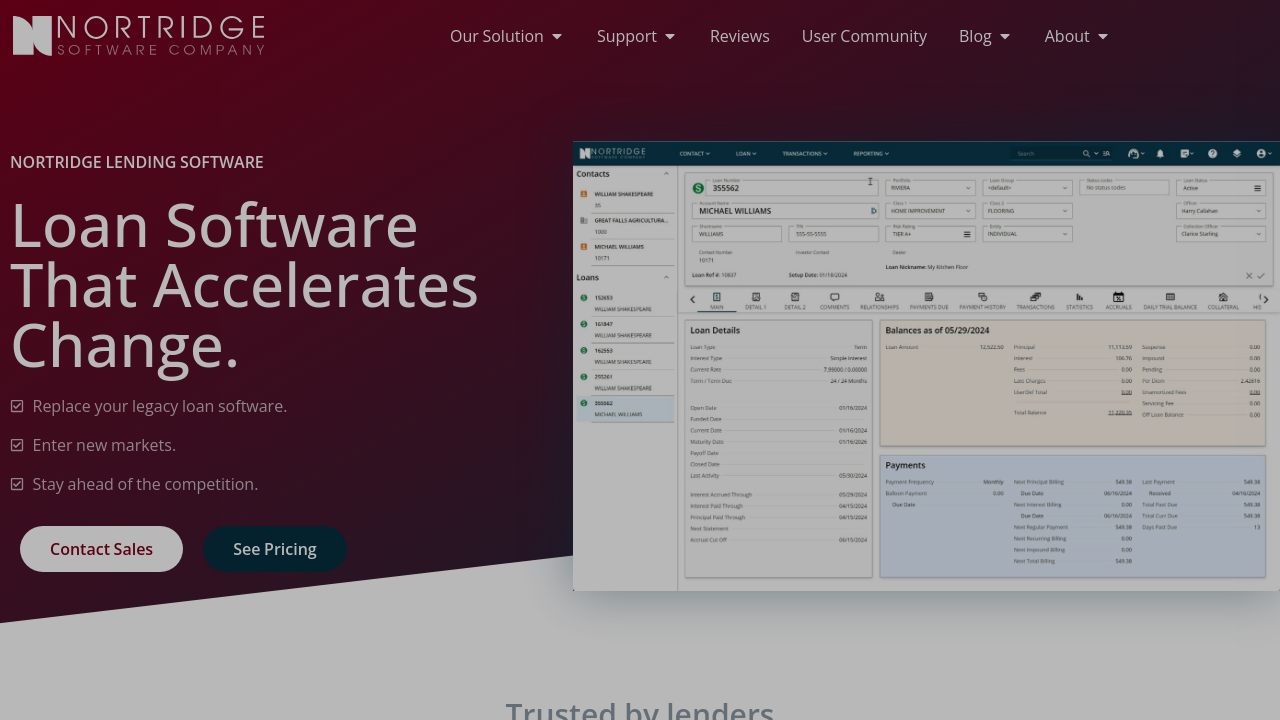

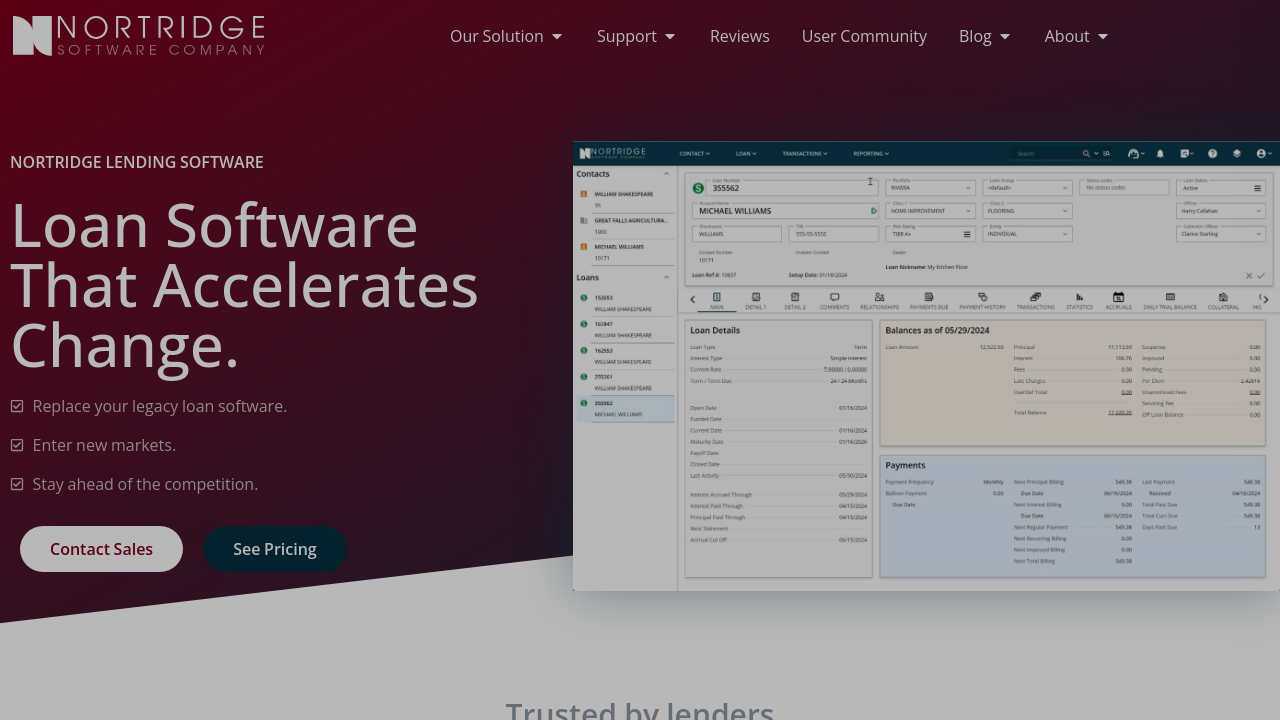

The Nortridge Loan System is a leading solution in the Loan Origination and Servicing category. Designed for enterprises, it simplifies loan origination, servicing, collections, and reporting across diverse loan portfolios. Its modular framework includes core functionalities such as Origination, Customer Relationship Management (CRM), Servicing, and Collections, offering a customizable and robust platform adaptable to various financial institutions. Discover exclusive deals. For alternatives, explore LendingPad, BankOne, and Bankingly.

Why Choose The Nortridge Loan System?

The Nortridge Loan System stands out for its exceptional functionality aimed at optimizing loan lifecycle management:

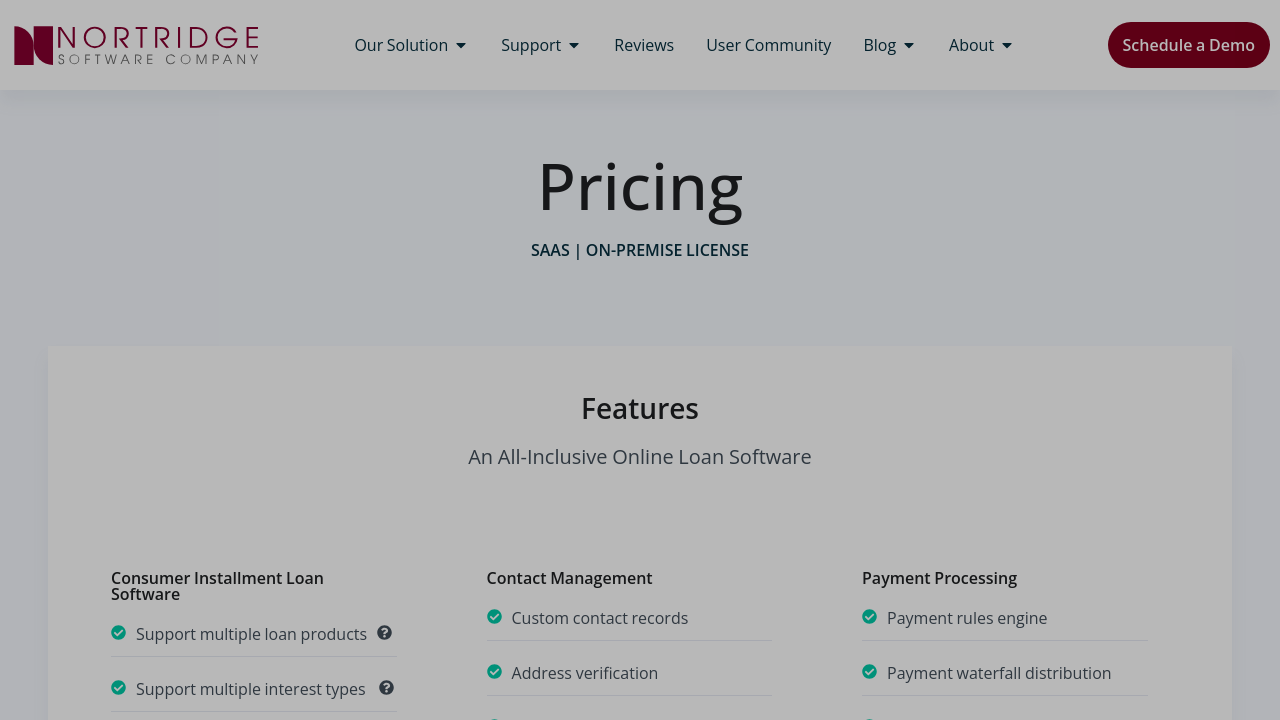

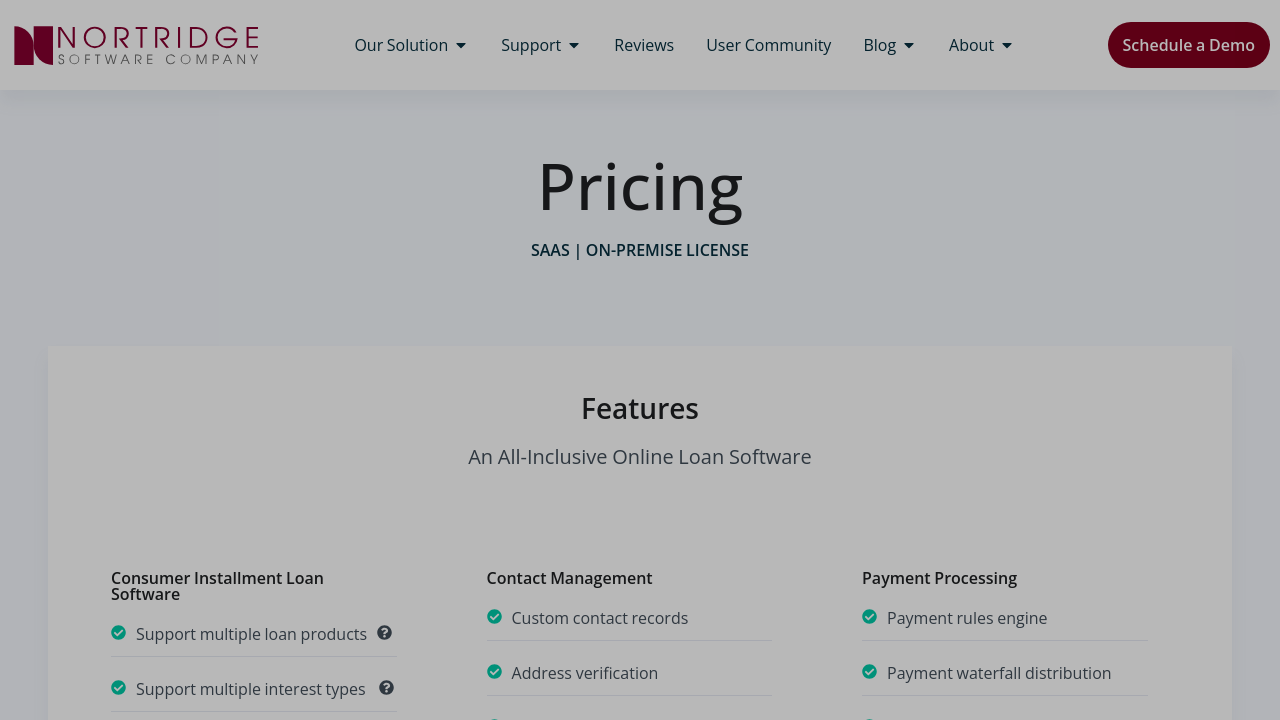

- Comprehensive Loan Management: Supports a wide range of loan types, enabling institutions to enter new markets and streamline workflows efficiently.

- Customization: Highly customizable with scripting capabilities, allowing tailored workflows, field-level adjustments, and personalized reporting to meet unique business needs.

- Automation: Automates routine tasks such as ACH processing and credit reporting, boosting productivity and operational ease.

- Integration Ready: Easy to integrate with third-party applications, ensuring seamless data exchange and enhanced financial operations.

- Scalability: Well-suited for growing portfolios, supporting businesses from small firms to enterprise-level lenders.

Who Benefits from The Nortridge Loan System?

The system caters to diverse user groups:

- Financial Institutions: Ideal for banks, credit unions, and lenders seeking advanced servicing capabilities for their loan portfolios.

- IT Teams: Developers can customize and integrate the system to align with existing infrastructure.

- Operations Teams: Provides tools for efficient loan processing and reporting, minimizing manual efforts.

- Managers and Executives: Offers insightful analytics and reporting features to aid decision-making and growth strategies.

The Nortridge Loan System is a powerful tool for loan management, helping businesses reduce errors, ensure compliance, and maximize efficiency. Its highly flexible and secure platform meets modern financial demands, ensuring long-term success for lending operations. Explore its full capabilities by visiting its homepage.