Introducing Loandisk

Loandisk is a cloud‐based lending software designed to streamline both loan origination and servicing for microfinance and lending companies. Built with a user‐friendly interface, Loandisk empowers financial institutions to manage customer loans, repayments, savings, and even payroll in one centralized environment. Whether you are a startup or an established microfinance institution, Loandisk offers an efficient solution that minimizes paperwork and simplifies administrative tasks.

Loandisk is purpose‐crafted to help teams track every detail—from client loan booking to expense management and beyond. Its secure, cloud‐based platform ensures that authorized users enjoy easy access to essential functions, while borrower security remains a top priority. With intuitive navigation and clear, comprehensive reporting tools, Loandisk enables organizations to keep track of key performance indicators without the steep learning curve many complex systems bring.

Key Features

- Centralized Loan Management: Manage all client loans and savings accounts remotely, reducing the need for bulky paperwork and manual record-keeping.

- Real-Time Reporting & Analytics: Access detailed statistics, charts, and reports that help monitor loan portfolios and financial performance.

- Automated SMS Notifications: Send timely reminders to borrowers, ensuring on-time repayments and improved cash flow management.

- Payroll & Expense Management: Simplify your financial processes by keeping track of your expenses and staff payroll within a unified system.

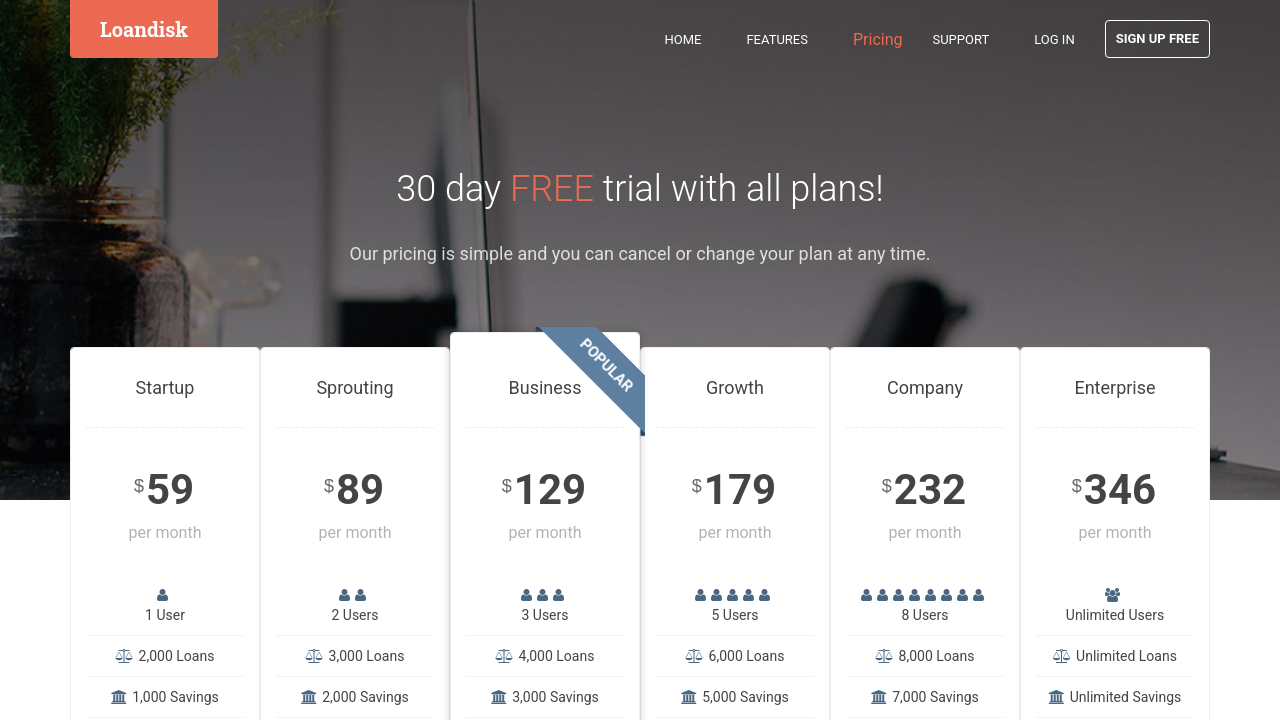

- Flexible Subscription Plans: With a monthly subscription model and the option to make longer-term commitments, Loandisk adapts to the unique staffing needs of each business.

Why Choose Loandisk?

- Ease of Use: The platform’s straightforward design minimizes the learning curve, making it quick for new users to get acquainted with its environment.

- Cost-Effective Solution: Ideal for microfinance institutions, Loandisk provides valuable features without the need for heavy initial investments or long-term contracts.

- Enhanced Operational Efficiency: By automating loan and repayment processes, the software helps reduce administrative overhead and potential errors.

- Scalability & Reliability: As your lending business grows, Loandisk scales with you, ensuring consistent performance even with expanding customer bases.

Discover more about Loandisk on its homepage and take advantage of exclusive deals designed specifically for forward-thinking financial institutions. Loandisk is an excellent match for organizations seeking a robust yet accessible tool that transforms how loans are managed.

Loandisk belongs to the Loan Origination and Servicing category, positioning itself as a leading, agile solution for streamlining financial operations and ensuring seamless loan tracking.

Alternative Solution