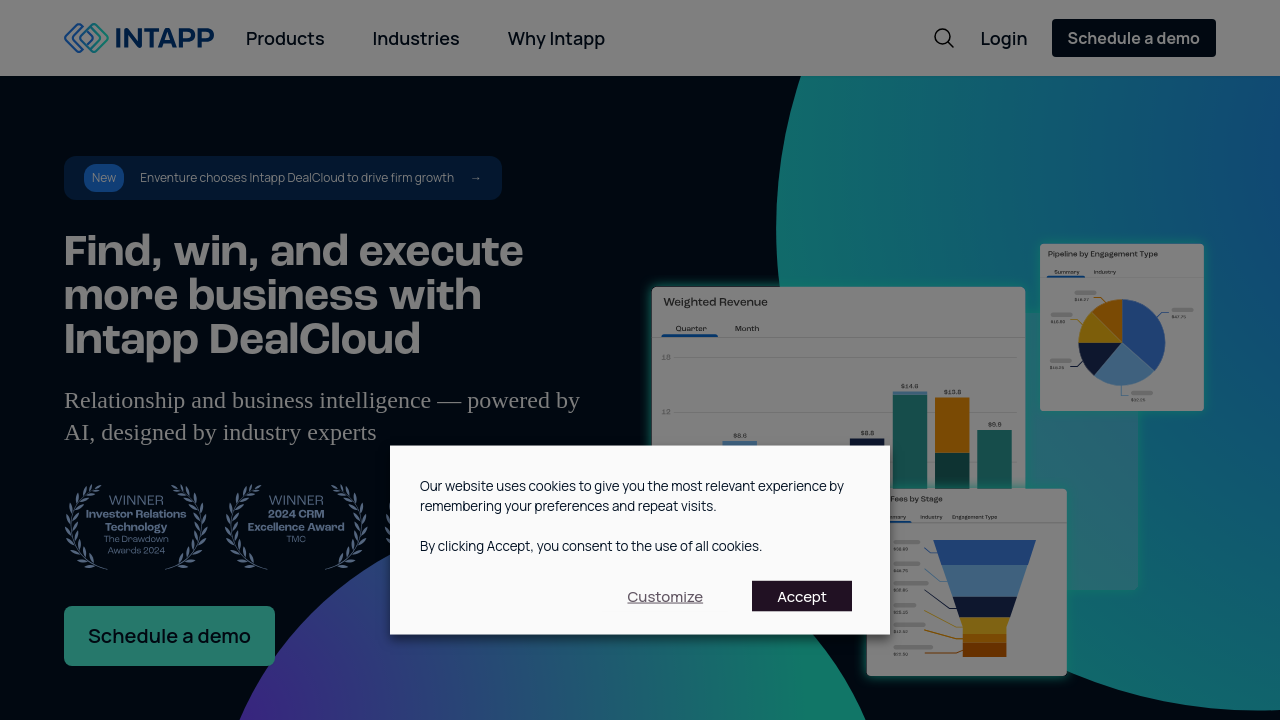

DealCloud is a premier platform designed to address the unique needs of private capital markets. Focused on deal sourcing, origination, and management, this solution empowers financial services professionals – including investment banks, principal investing firms, and operating companies – to efficiently centralize and manage their relationships and deal pipelines. With its data-powered approach and robust customization options, DealCloud stands out as an indispensable tool for modern capital markets operations.

Built with flexibility in mind, DealCloud is purpose‑built for the dynamic nature of the financial services industry. Its seamless integration capabilities ensure that users can easily connect with external solutions and third‑party data providers, further enhancing the platform’s ability to deliver accurate and actionable insights. By consolidating all aspects of deal information into one comprehensive system, DealCloud greatly simplifies internal collaboration and communication, ensuring that teams remain aligned throughout the deal lifecycle.

Why Use DealCloud?

- Comprehensive Deal Management: The platform streamlines the entire deal process from initial contact through to deal execution, providing a single source of truth for all deal-related data and activities.

- Customizable Workflow: DealCloud offers tailored configuration options that adapt to the specific needs of each firm, making it easier to track relationships, update pipelines, and generate insights from complex data sets.

- Seamless Integration: With robust connectivity to external solutions and data providers, financial professionals can enhance their decision‑making processes without the hassle of disparate systems.

- Data‑Driven Insights: The platform’s advanced analytics facilitate accurate performance measurement and help uncover key statistics that drive smarter investment strategies.

- Industry‑Focused Support: Recognizing that every firm’s needs are unique, the DealCloud team provides personalized assistance and rapid customization to keep operations running smoothly.

DealCloud is categorized under Venture Capital Tools, making it an ideal solution for professionals operating in the fast‑paced venture capital and private equity sectors. Whether you are looking to streamline your deal management processes or gain deeper insights into your investment portfolio, DealCloud’s robust functionality is designed to deliver efficiency and clarity.

For those ready to experience the benefits of an industry‑tailored solution, explore the platform’s features by visiting the official homepage via the link above. Additionally, you can check out exclusive deals that offer a great way to get started with this comprehensive system.

Alternatives

Overall, DealCloud offers financial services professionals an all‑in‑one tool that unifies relationship and deal management, streamlines workflows, and delivers powerful analytics. Its tailored approach and seamless integrations make it a compelling choice for modern capital markets teams wishing to stay ahead in today’s competitive investment landscape.