TaxAct Business is a robust online tool designed to simplify the entire process of preparing, e-filing, and printing business tax returns. With an intuitive interface and automated, step-by-step guidance, TaxAct Business empowers business owners and accounting professionals to handle tax filing with ease, even for complex returns. Integrated depreciation reports help you quickly review current, future, and accumulated assets, ensuring that every detail is accounted for during tax preparation.

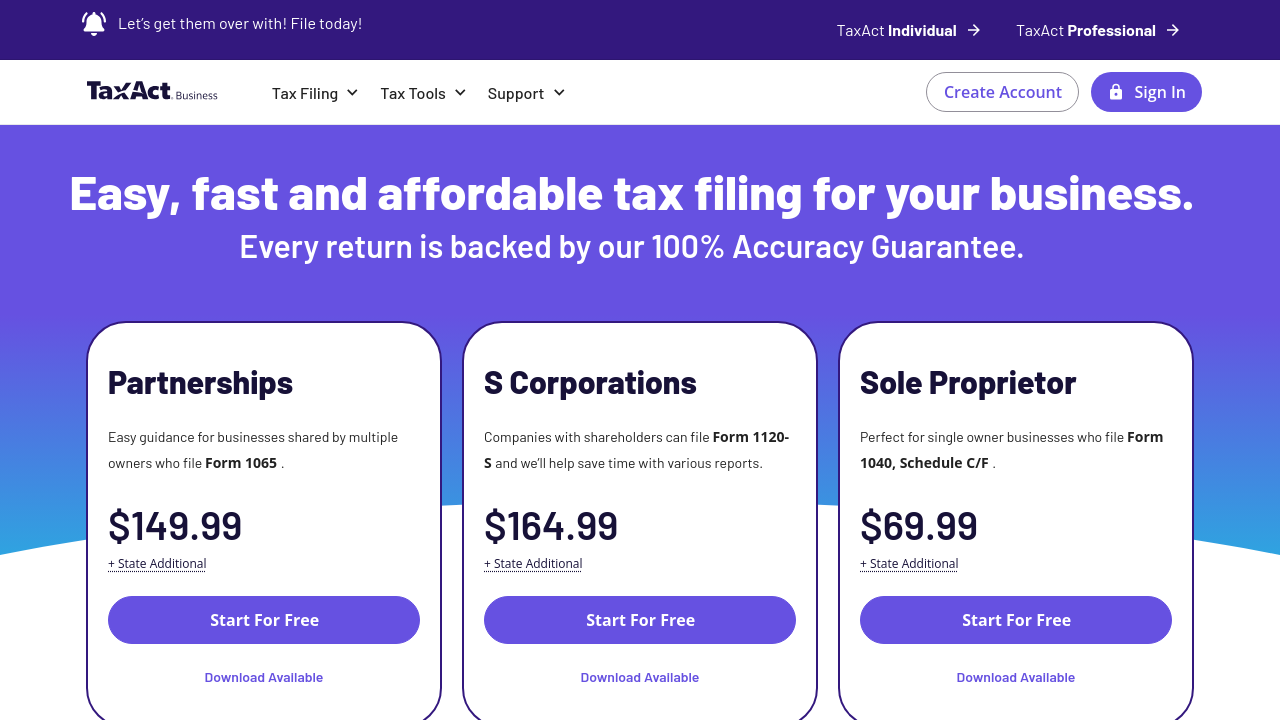

Positioned in the Accounting and Financial Management space, TaxAct Business focuses on providing a cost-effective and user-friendly solution for a variety of business tax needs. Whether you are a sole proprietor or managing a growing business, this software takes the headache out of tax season by guiding you through every step, from entering basic financial data to completing the final filing.

Key Features and Benefits

- Step-by-Step Guidance: The intuitive interview process walks you through each question, ensuring that every necessary detail is captured and reducing the risk of errors.

- Depreciation Reports: Easily review your current, future, and accumulated assets, which simplifies financial planning and maximizes tax deductions.

- Versatile Filing Options: Prepare one return for tax-exempt organizations or choose from a range of editions that include solutions for Federal and State filing, catering to a variety of business requirements.

- User-Friendly Interface: The clear layout and defined terms guarantee that even first-time tax filers can navigate the software confidently.

- Cost-Effective: With multiple pricing plans available, including free federal options and affordable bundles for additional services, TaxAct Business offers flexible pricing that suits diverse financial needs.

TaxAct Business combines powerful functionality with ease of use, making it an ideal choice for business owners who want to take control of their tax filing process. Its comprehensive tools eliminate the need for expensive professional services while ensuring that your returns are accurate and compliant with tax regulations. The platform’s design saves valuable time by importing previous year data and offering built-in quality checks before you file.

For those looking to maximize their savings, explore exclusive deals at the TaxAct Business Deals Page. TaxAct Business is the all-in-one solution that helps streamline your tax preparation process, ensuring you never miss out on potential deductions or credits.

Alternative Solutions

Embrace a smarter approach to tax preparation with TaxAct Business—your partner in efficient, accurate, and affordable tax management.