Pleo is Europe’s leading spending solution in the Expense Management Software category. By reinventing how companies manage employee expenses, Pleo provides a smart company card that empowers teams to make purchases without the hassle of chasing receipts. The intuitive digital platform automatically creates expense reports, tracks spending in real time, and integrates seamlessly with popular accounting systems. This innovative approach not only reduces administrative burdens but also offers enhanced transparency and control over company finances.

With Pleo’s robust automation features, organizations can focus on the work that matters most. Instead of sifting through paper receipts or manually matching invoices, finance teams gain an immediate overview of every transaction. The platform automatically categorizes expenses and notifies managers as soon as purchases occur, ensuring that budgets remain on track. Pleo’s flexible spending limits allow for individualized card management, giving administrators confidence that every purchase is both justified and within approved guidelines. This level of control supports a culture of trust and accountability while streamlining financial operations.

Why Use Pleo?

- Streamlined Expense Management: Automatically generate and approve expense reports, reducing time spent on administrative tasks and manual data entry.

- Real-Time Visibility: Gain immediate insights into spending habits, enabling proactive financial management and reducing month-end surprises.

- Enhanced Control: Set specific spending limits on individual company cards and monitor transactions as they occur, ensuring that every purchase complies with company policies.

- Digital Receipt Capture: Quickly snap and upload receipts via a mobile app, eliminating the need for paper records and simplifying bookkeeping.

Who Is Pleo For?

- Small Business Owners and Entrepreneurs: Streamline expense tracking with an easy-to-use solution that eliminates tedious manual processes.

- Growing Teams: Empower employees with smart cards that allow them to manage day-to-day expenses while providing managers full oversight of spending.

- Larger Organizations: Integrate Pleo seamlessly into existing financial systems to reduce administrative workload and enhance transparency across departments.

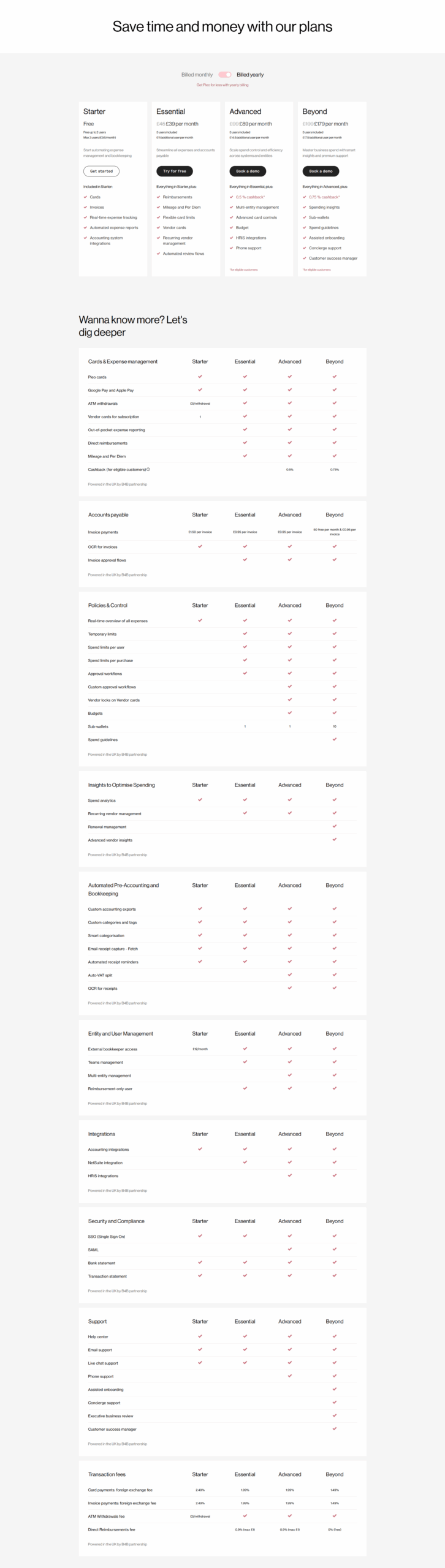

Pleo’s adaptable pricing plans—from a free Starter option for micro companies to comprehensive packages for larger organizations—ensure that every business can find a plan that meets its unique requirements. This flexibility, combined with an emphasis on efficiency and digital innovation, makes Pleo an ideal solution for companies seeking to eliminate manual expense reconciliation and reclaim valuable time.

Discover exclusive deals for Pleo today and experience a modern solution designed to revolutionize your expense management process. For those considering other options, top alternatives include Spendesk, Airbase, and Wallester.