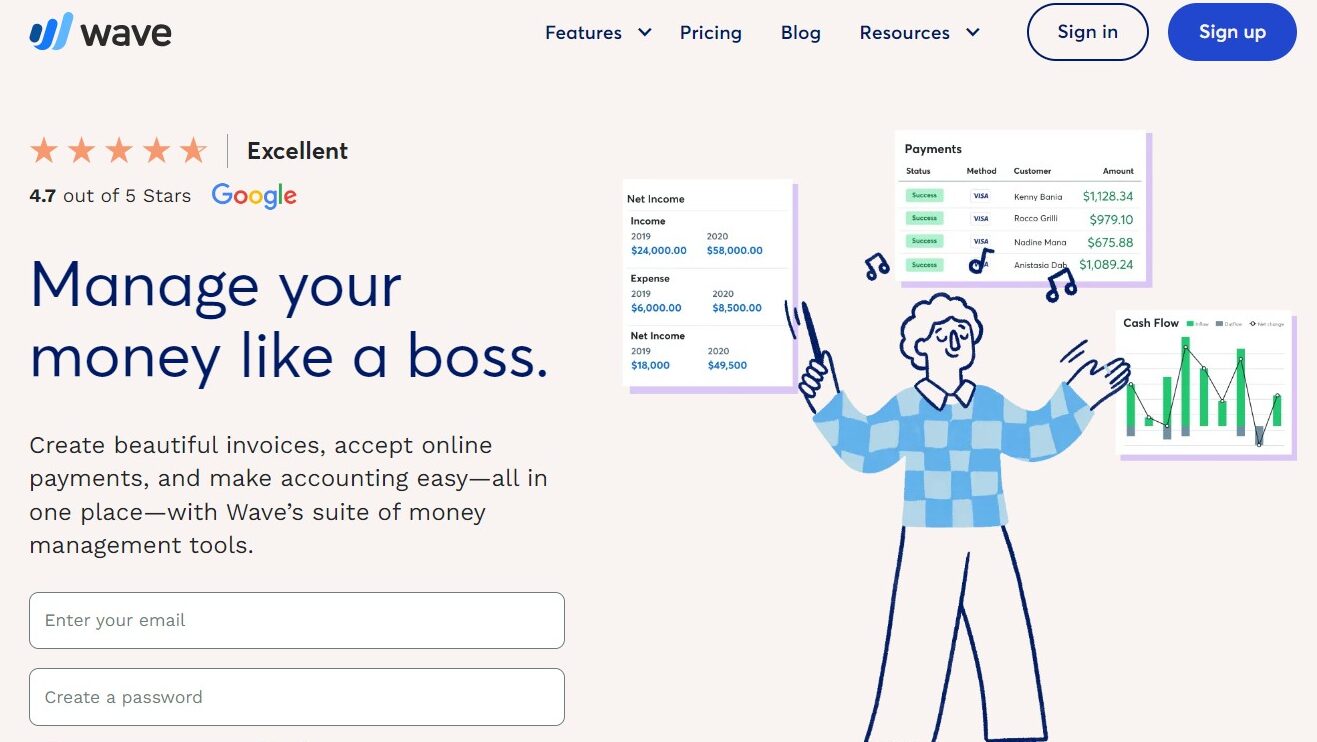

What is Wave?

Ditch the inefficiencies of juggling multiple financial tools and the complexities of traditional accounting software. Wave isn’t just another accounting platform; it’s a user-friendly and comprehensive solution designed to empower businesses to manage their finances effortlessly and gain valuable insights. Ditch the frustration and focus on what matters most: growing your business. Wave empowers you to send invoices, accept payments, track expenses, and manage payroll, all in one centralized location.

Why Choose Wave?

Struggling with scattered financial data, limited features, and complex user interfaces? Wave offers a compelling solution:

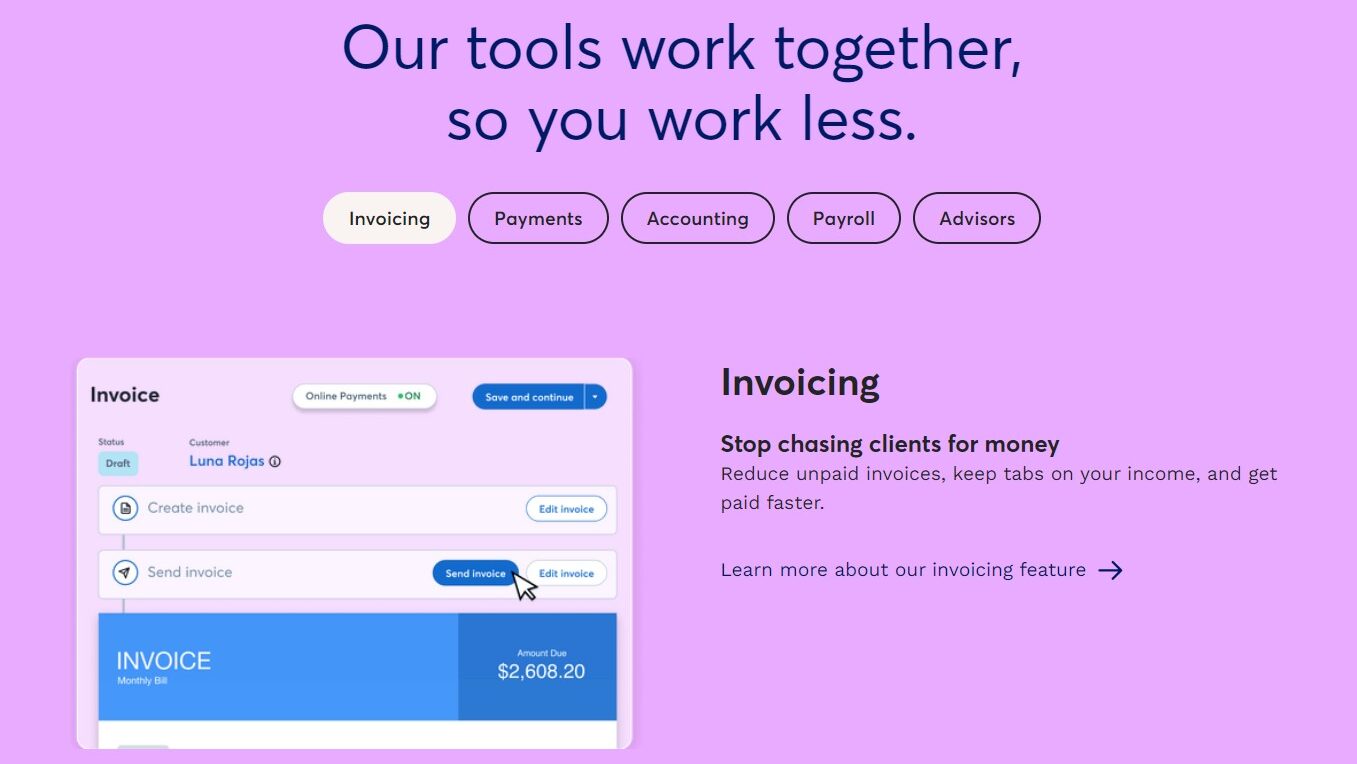

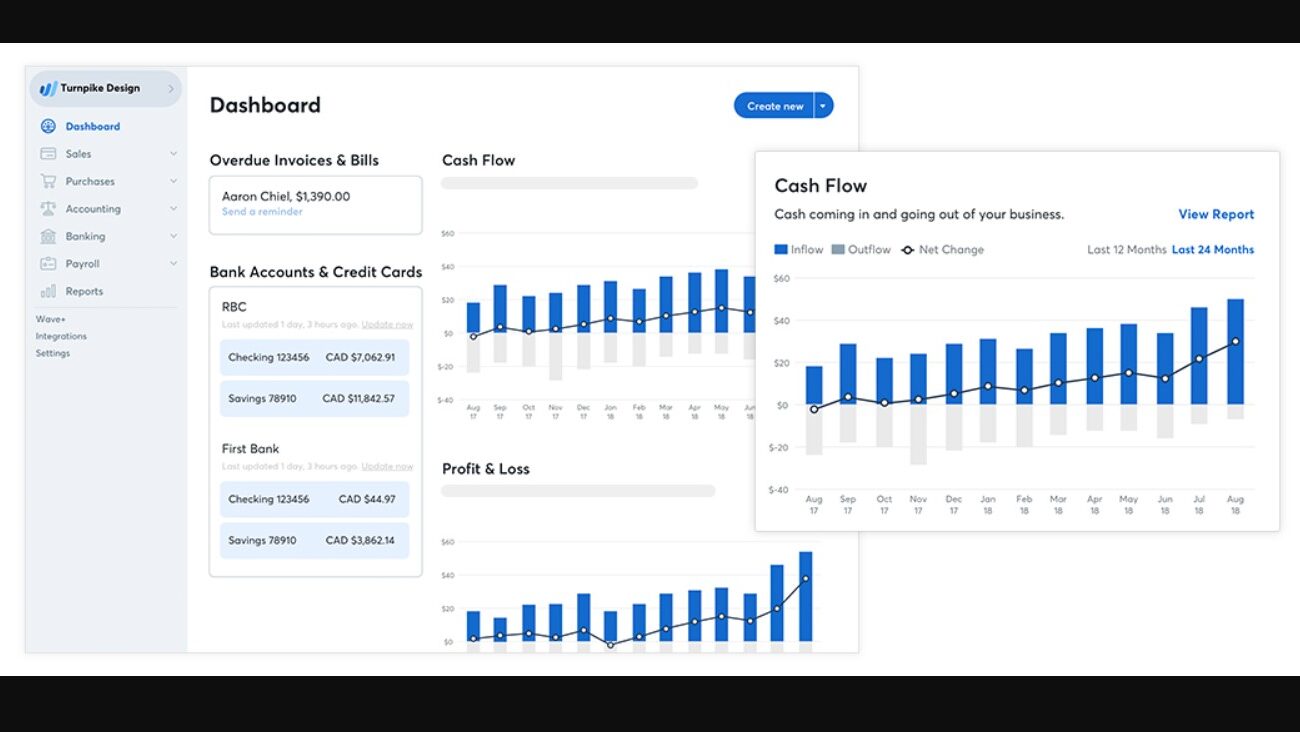

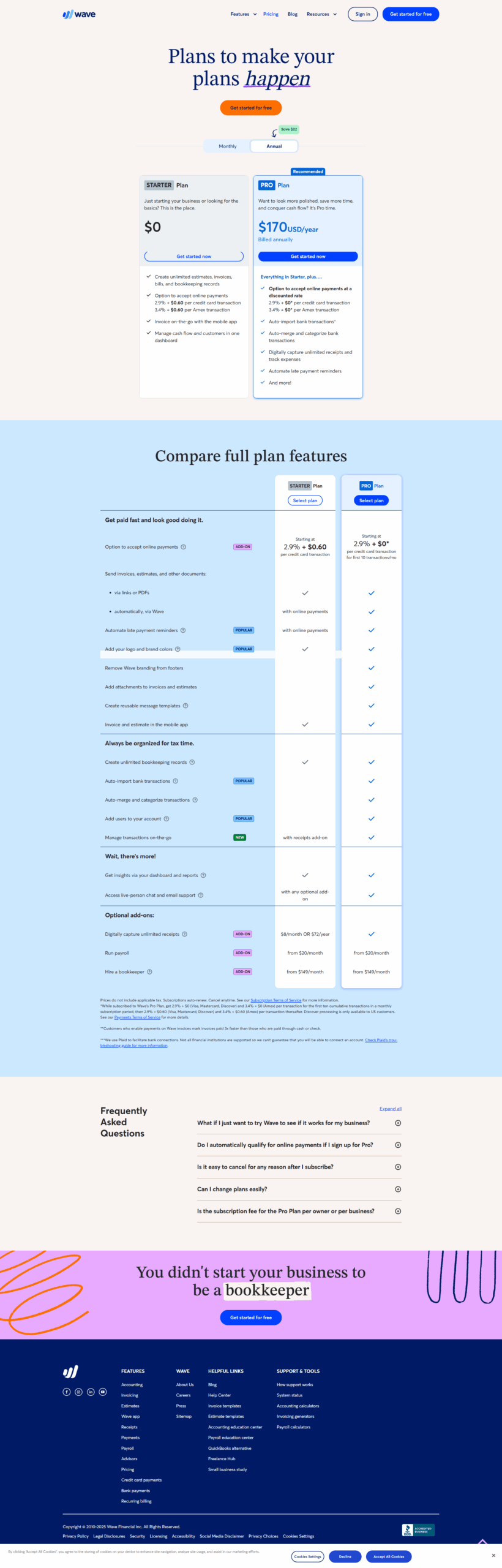

- All-in-One Functionality: Simplify your financial management with invoicing, payments, expense tracking, payroll, and banking features, all seamlessly integrated.

- User-Friendly Interface: Enjoy an intuitive and easy-to-use interface, making it perfect for businesses of all sizes and technical backgrounds.

- Automated Features: Automate tasks like sending invoices, collecting payments, and categorizing expenses, saving you valuable time and effort.

- Secure Cloud Storage: Access your financial data from any device with peace of mind, knowing it’s securely stored in the cloud.

- Real-Time Insights: Gain valuable insights into your cash flow, income, and expenses with easy-to-understand reports and dashboards.

- Affordable Pricing: Choose a pricing plan that fits your business needs and budget, making Wave an accessible solution for any entrepreneur or small business owner.

Who is Wave For?

Wave empowers businesses of all shapes and sizes:

- Freelancers and Solopreneurs: Manage your finances efficiently, send professional invoices, and track your income and expenses effortlessly.

- Small Businesses: Streamline your financial operations, accept online payments, and gain valuable insights to make informed financial decisions.

- Non-Profit Organizations: Simplify fundraising efforts, manage donations, and track expenses with ease.

- Startups and Growing Businesses: Scale your financial management efficiently with a cost-effective and user-friendly solution.

Wave stands out as a game-changer in the financial management landscape for small businesses and entrepreneurs. Its commitment to an all-in-one approach, user-friendly interface, automated features, secure cloud storage, and valuable insights makes it an attractive choice for any business seeking to ditch the financial complexities and focus on achieving their goals. Whether you’re a freelancer, solopreneur, or running a small business, Wave empowers you to manage your finances with confidence and unlock the potential for growth.