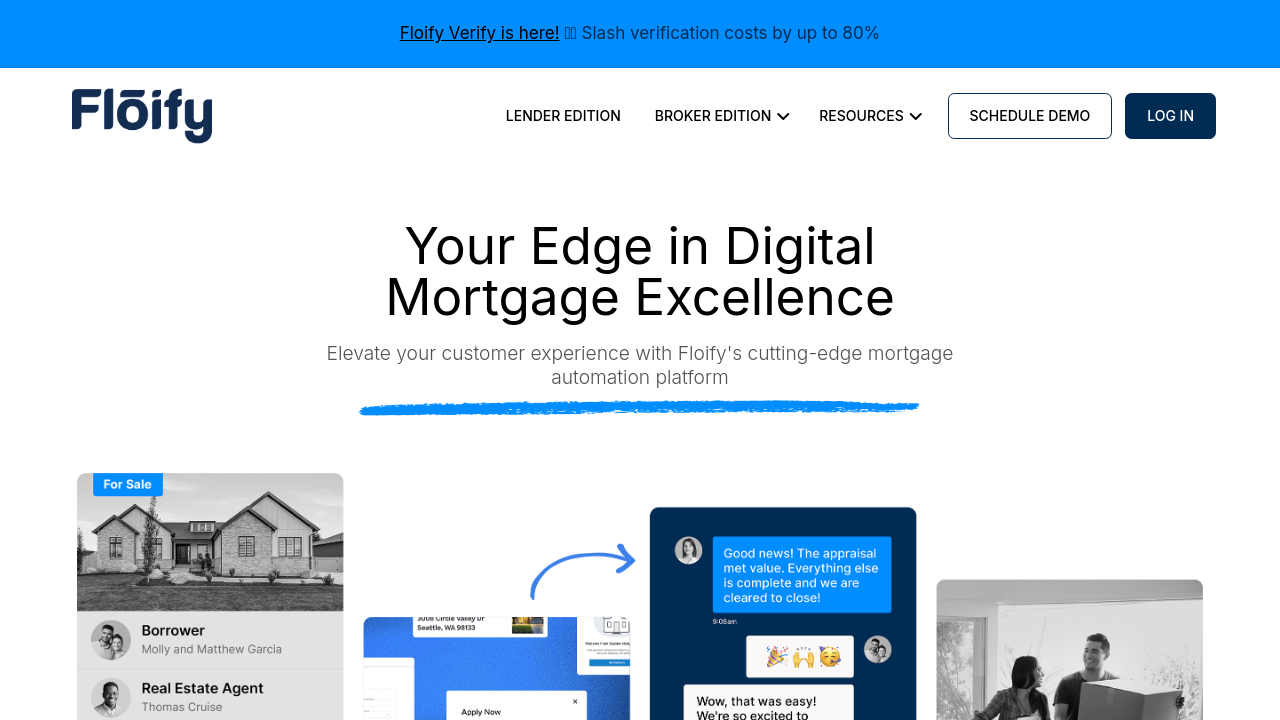

Floify is a revolutionary digital mortgage processing platform designed for lenders, originators, and their borrowers. It streamlines the entire homeownership journey—from pre-approval and application submission to clear-to-close, and even post-closing processes—by automating repetitive tasks while keeping human interactions at the forefront. As part of the Mortgage Origination category, Floify caters specifically to the unique needs of mortgage professionals, delivering a highly configurable solution that adapts to any lender’s workflow, ensuring a smooth and efficient experience for both the team and clients.

Key Features of Floify:

- Secure Borrower Portal: Empower borrowers with a safe and easy way to upload and access important documentation at any time.

- Automated Communication: Stay connected with borrowers using automated status and milestone updates via email, text, and mobile notifications, minimizing manual follow-ups.

- Customizable Workflows: Tailor the system to meet specific business needs with white-labeled templates and customizable digital applications.

- Comprehensive Integration: Enhance productivity with built-in integrations for automated asset and income verifications and mortgage calculators that include lead capture functionalities.

- Mobile-Ready Platform: Access progressive web apps and native mobile apps for flexible management of loan processes on the go.

Floify combines the power of automation with user-friendly design to eliminate the hassle of traditional paper-based processes. Its dashboard provides a centralized view of all loan activities, helping team members stay organized and informed. By consolidating every step of the mortgage process into one platform, Floify not only speeds up transactions but also facilitates better communication between borrowers, loan officers, and referral partners.

Why Choose Floify?

- Enhanced Efficiency: Automate menial tasks and reduce redundant communications, giving teams more time to focus on customer relationships and strategic initiatives.

- Customization at Its Core: With an industry-leading level of configurability, Floify aligns with a lender’s brand and operational needs, ensuring a seamless fit into any workflow.

- Comprehensive Service Offering: Enjoy world-class support and partnership throughout your journey, from setup and onboarding to daily operations, ensuring your success every step of the way.

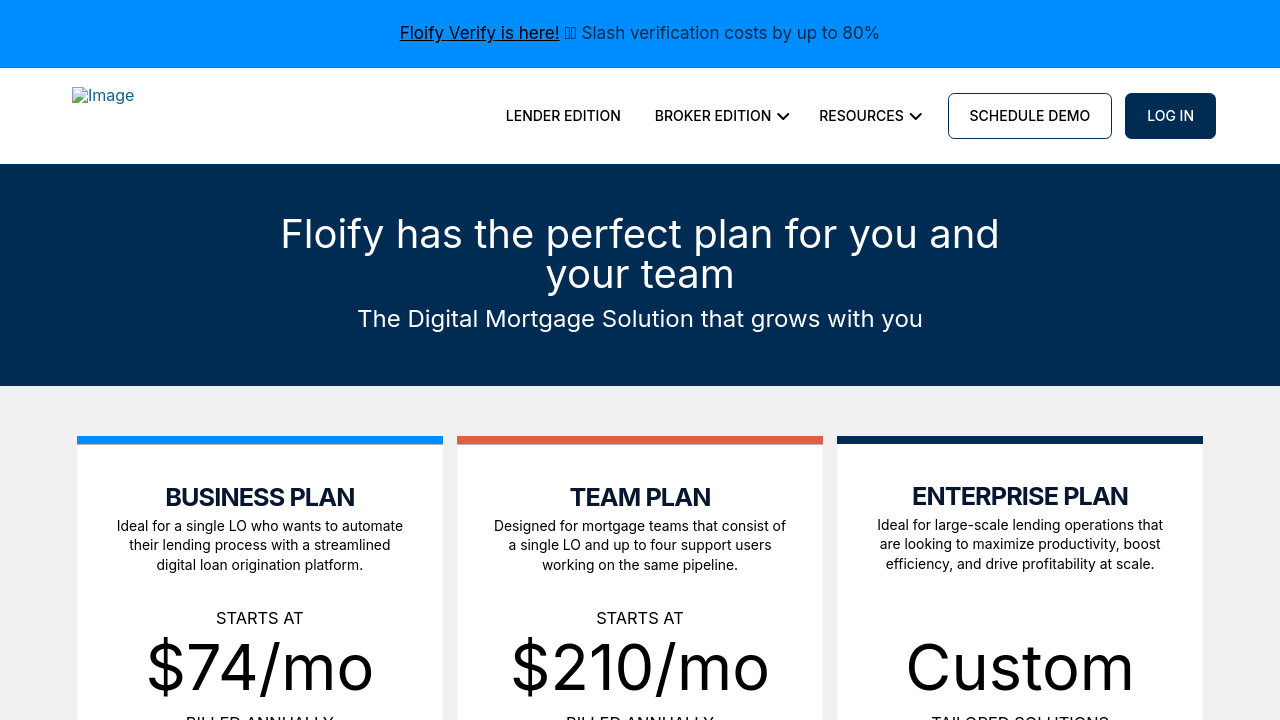

Floify is an ideal solution for mortgage professionals looking to increase productivity, secure document handling, and faster loan closings. To explore exclusive offers, visit the Floify deals page today.

For those considering alternative solutions, you might also explore LendingPad as a noteworthy option.

Ultimately, Floify is more than just a digital solution—it’s a comprehensive platform that transforms the mortgage origination process into an efficient and engaging experience for everyone involved.