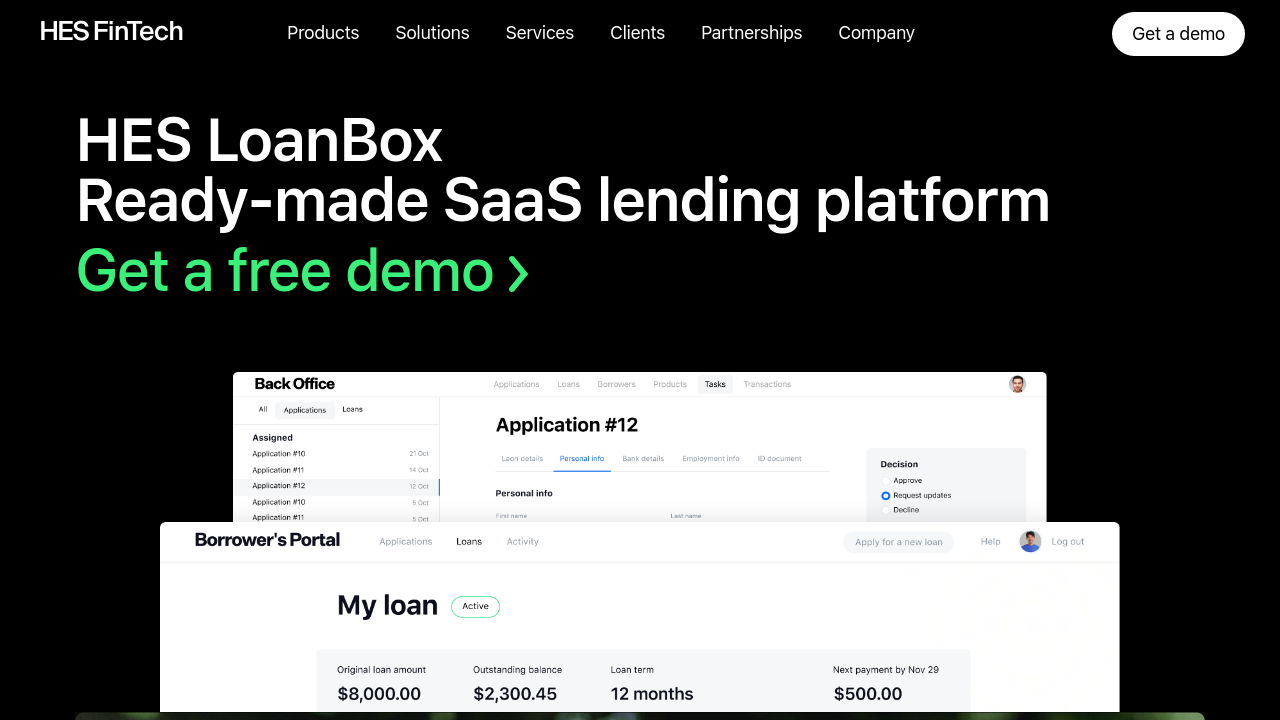

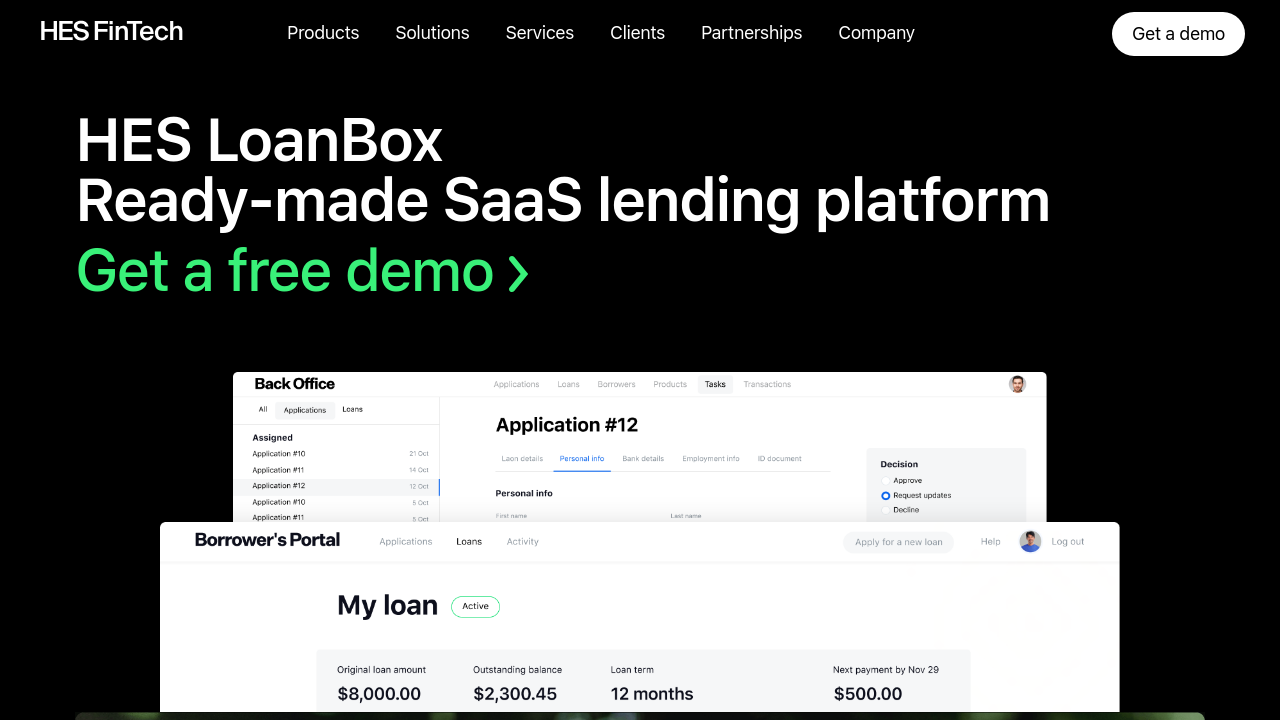

HES LoanBox is a powerful loan origination and servicing platform designed to automate and optimize lending operations. Developed by HES FinTech, a pioneer in lending automation since 2012, LoanBox consolidates the entire lending lifecycle from digital customer onboarding to robust back-office management. Suitable for banks, alternative lenders, and in-house financing businesses, this white-label solution transforms complex loan processes into streamlined, efficient workflows that reduce manual effort and operational costs.

Built on extensive expertise derived from over 160 projects across 31 countries, HES LoanBox offers a comprehensive suite of preconfigured modules to manage loan origination, servicing, and debt collection seamlessly. The platform features smart scoring, digital onboarding, and a highly functional borrower portal. Integrated with essential services including SMS, email, KYC checks, credit bureau connections, and payment gateways, LoanBox minimizes manual interventions and simplifies compliance tracking. Its flexible architecture supports various loan types, from consumer and retail to commercial lending, ensuring scalability and adaptability for evolving business needs.

Highlights

- Rapid Deployment: Launch your lending solution in as little as three months with a ready-to-use platform.

- White-Label Customization: Tailor the interface and experience to match your brand identity.

- End-to-End Automation: Streamline processes from loan origination to servicing and debt collection.

- Seamless Integrations: Connect effortlessly with SMS, email, KYC, credit bureaus, and payment providers.

In the competitive Loan Origination and Servicing category, HES LoanBox distinguishes itself with advanced automation, flexibility, and ease of integration. Its intuitive borrower portal and powerful employee back-office enable organizations to manage risk effectively and make informed decisions. By harmonizing digital onboarding, comprehensive loan processing, and regulatory compliance, the platform drives operational efficiency while lowering costs. This advanced system ensures that your lending operations can scale and adapt as market requirements change, supporting multiple loan formats and dynamic business models.

Explore exclusive deals for HES LoanBox by visiting the dedicated deal page. The streamlined deployment process and fully integrated ecosystem empower financial institutions to boost performance and deliver superior service to borrowers. With its proven capability to transform lending operations, this advanced solution meets the needs of varied market segments while ensuring compliance with international standards.

Learn more about HES LoanBox and its extensive features by visiting the product homepage. This digital lending platform is engineered to help you stay ahead in a rapidly evolving financial landscape, delivering a robust and scalable solution that streamlines every step of the loan process.

For additional options, consider exploring alternatives. Alternatives:

HES LoanBox is an end-to-end digital lending solution powered by a decade of financial technology innovation. It simplifies loan origination and servicing, offering unmatched integration, customization, and performance capabilities. Whether you are a small financial institution or a large bank, LoanBox is engineered to propel your lending operations into the future with speed, efficiency, and reliability. Today.