Katabat is the leading provider of debt collections software designed specifically for banks, agencies, and alternative lenders. Founded in 2006 and developed by a team of experienced lending executives and top software engineers, Katabat pioneered digital collections and continues to drive innovation in the industry. With a mission to solve debt resolution challenges from both the lender and borrower perspectives, Katabat offers a comprehensive solution that adapts to the needs of modern financial institutions.

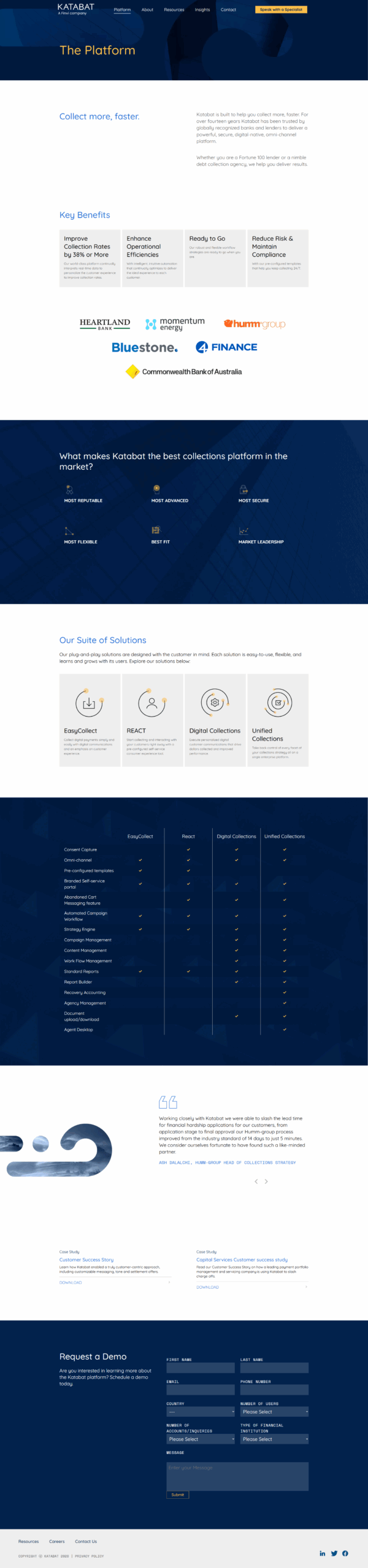

At its core, Katabat provides an end-to-end omni-channel debt-collection platform that facilitates digital transformation. It delivers complete visibility across the entire consumer lifecycle, empowering organizations to design and manage multifaceted contact strategies. The platform’s intelligent, pre-trained machine learning capabilities help users streamline collections, ensuring that the right messages and settlement offers are sent through customers’ preferred communication channels.

Katabat’s unified platform is built for ease of use without compromising on power. Its flexible, customer-centric approach allows organizations to create customized messaging and workflows while integrating seamlessly with legacy systems. This results in optimized operations—from strategy formulation and workflow management to execution and governance. The platform’s robust strategy engine supports multiple parallel workflows, giving businesses the ability to test new ideas and adapt quickly to industry changes.

Security and compliance are of utmost importance at Katabat. The platform is designed to meet strict regulatory requirements and provide a secure environment for sensitive financial data. This makes it an ideal solution for market-leading financial institutions that manage large-scale collections, as it ensures that operational policies and compliance demands are consistently met.

Katabat offers a host of benefits, including:

- Enhanced Digital Transformation: Experience a unified platform that provides full lifecycle visibility, streamlining both collection and customer engagement processes.

- Intelligent Automation: Leverage pre-trained machine learning to boost collection efficiency, shorten cycle times, and deliver personalized communications.

- Custom Workflow Management: Utilize flexible, multi-strategy workflows to optimize creditor and debtor interactions while ensuring adherence to strict compliance standards.

- Customer-Centric Communication: Customize messaging, tone, and settlement offers to engage customers through their preferred channels, enhancing overall satisfaction.

For organizations looking to modernize their debt collection efforts, Katabat represents a strategic investment that integrates advanced technology with deep industry expertise. To explore exclusive offerings, visit the deal page and discover how Katabat can help transform your collections process.

Explore Alternative Solutions

Katabat is a trusted choice in the Debt Collection Software category, helping organizations achieve operational excellence and improved customer outcomes in a dynamic industry.