Loanzify is a modern mortgage origination solution designed to elevate the lending experience for mortgage professionals and borrowers alike. Developed with a fully customizable point of sale platform, Loanzify streamlines the loan process, enabling teams to close more loans with faster turnaround times while delivering a superior, fully cohesive borrower experience.

Loanzify is a cutting-edge software solution in the Mortgage Origination category. It revolutionizes the way mortgage professionals manage client interactions, document uploads, and overall loan application processes. With Loanzify’s robust client and loan management tools, users can seamlessly integrate their website and native mobile app, bringing a unified experience to the entire loan lifecycle.

Developed by a company with deep industry roots since 2003, Loanzify has built a reputation for providing innovative solutions that respond to the dynamic needs of the lending market. The platform is tailored to help both small brokerages and larger institutions optimize their operations, reduce manual processes, and enhance overall productivity. Its intuitive design ensures that borrowers can easily navigate the application process while mortgage professionals benefit from comprehensive tools that simplify complexity.

Key Benefits of Loanzify:

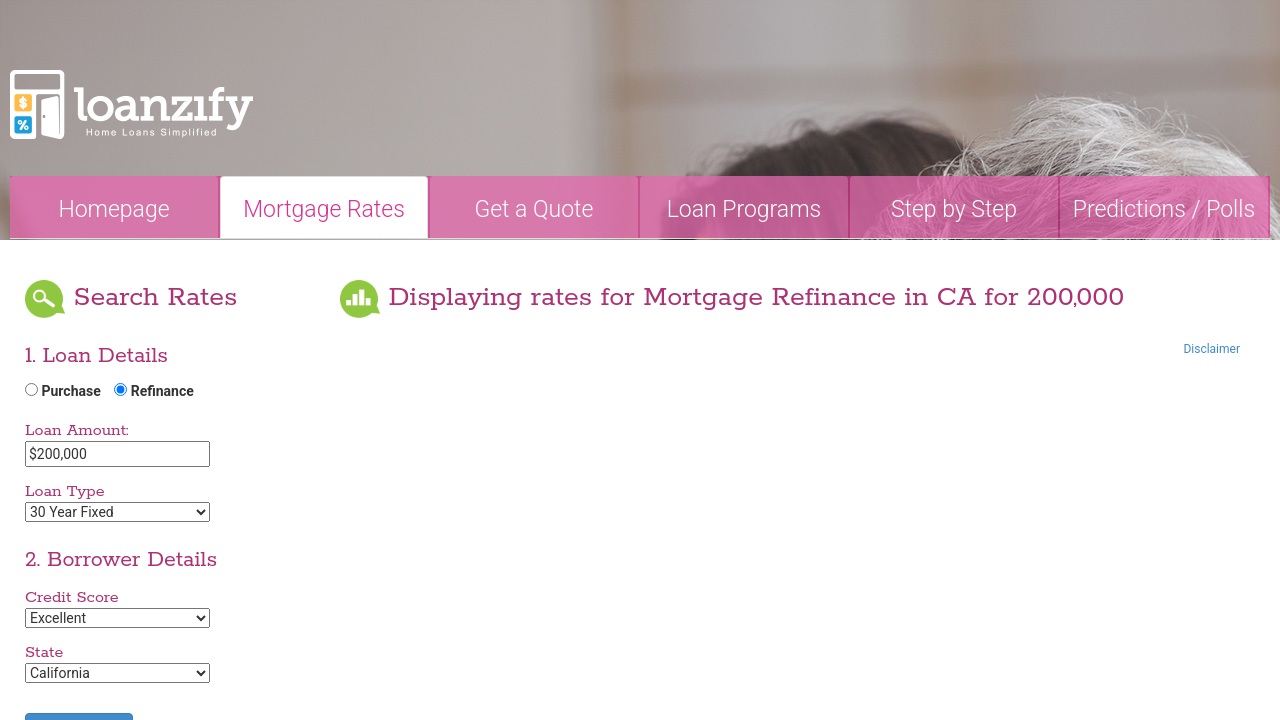

- Customizability and Integration: Loanzify allows for a customized loan application process that integrates effortlessly with a variety of lender operating systems and digital tools.

- Seamless Borrower Experience: By unifying website and mobile functionalities, the platform ensures that borrowers enjoy an efficient and secure experience when submitting applications and documents.

- Enhanced Operational Efficiency: The software’s automated triggers and integrated document retrieval system free up staff time, allowing mortgage professionals to focus more on closing loans than on administrative tasks.

- Streamlined Workflows: With clear, user-friendly interfaces and customizable process flows, Loanzify reduces operational bottlenecks and accelerates application processing.

Loanzify is the ideal solution for mortgage professionals seeking a reliable, secure, and efficient software platform to manage the entire origination process. Its thoughtful design and integrated features support a smooth transition from lead capture to loan closing. Additionally, its secure document portals and automated reminders help ensure compliance and timeliness throughout the process.

Explore exclusive deals on Loanzify and see how it can transform your mortgage origination process. For professionals interested in evaluating alternatives, consider exploring options like Floify and LendingPad for additional insights into the evolving landscape of mortgage technology.