Overview

What is MoneyMonk?

MoneyMonk is a comprehensive financial management platform designed for freelancers, entrepreneurs, and small businesses. With features tailored to simplify invoicing, expense tracking, and financial reporting, MoneyMonk helps users streamline their financial processes and gain better insights into their business finances.

Why Use MoneyMonk?

In the realm of financial management tools, MoneyMonk stands out for several reasons:

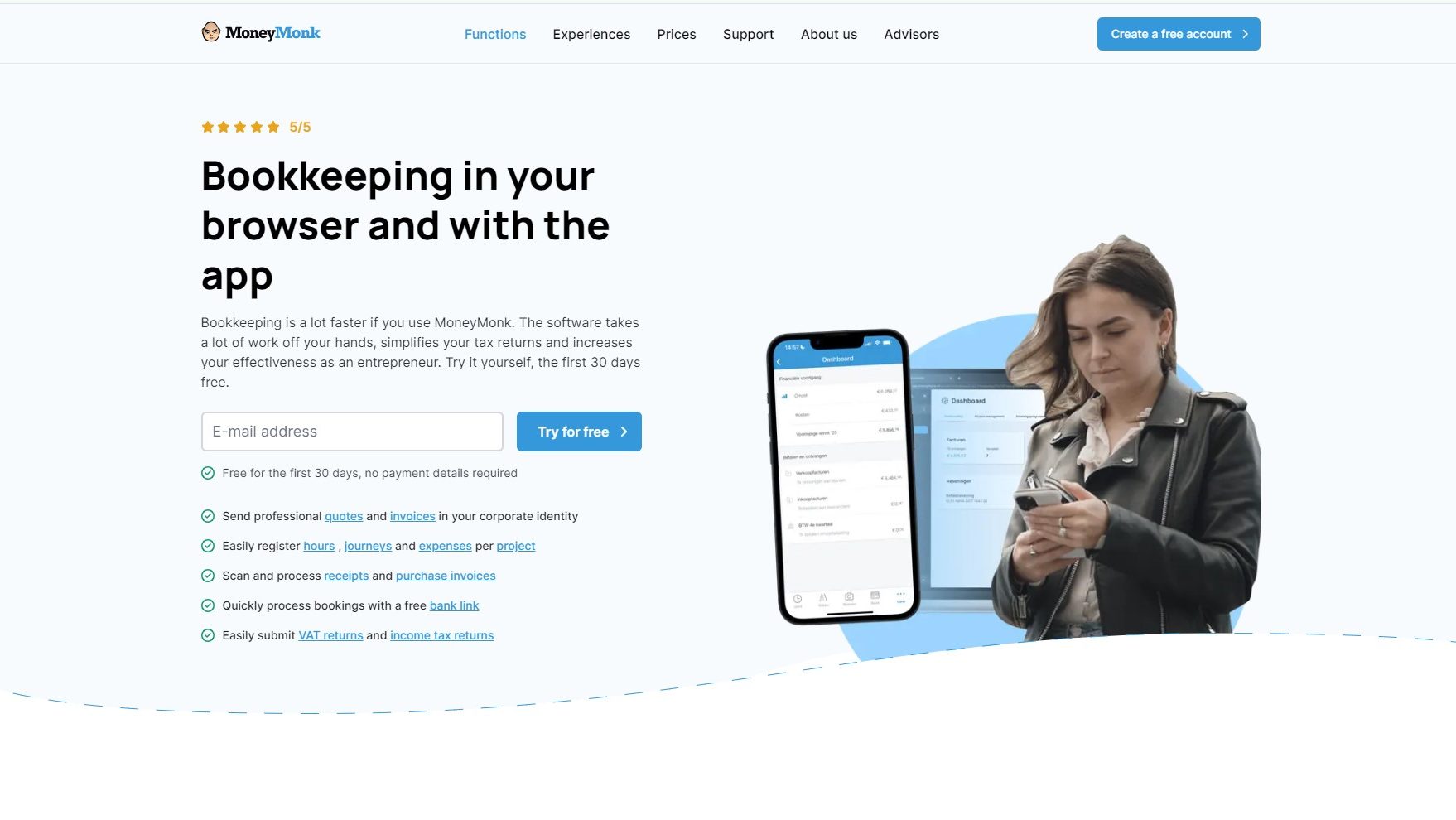

- Efficient Invoicing: MoneyMonk offers easy-to-use invoicing tools that allow users to create professional invoices, send them to clients, and track payment status effortlessly. This feature helps users maintain a steady cash flow and stay on top of their billing.

- Expense Tracking: With MoneyMonk, users can track their expenses in a simple and organized manner. By categorizing expenses and linking them to specific projects or clients, users can gain a clear understanding of their spending habits and make informed financial decisions.

- Financial Reporting: MoneyMonk provides robust reporting capabilities, allowing users to generate detailed financial reports, analyze key metrics, and monitor the health of their business. These insights help users identify trends, track performance, and plan for future growth.

- Integration with Accounting Software: MoneyMonk seamlessly integrates with popular accounting software, enabling users to sync their financial data across platforms and streamline their accounting processes. This integration saves time and reduces the risk of manual errors.

Who is MoneyMonk For?

MoneyMonk caters to a wide range of users in the freelance, entrepreneurial, and small business sectors:

- Freelancers: Freelancers benefit from MoneyMonk’s invoicing and expense tracking features, which help them manage their finances efficiently and focus on their core business activities.

- Entrepreneurs: Entrepreneurs use MoneyMonk to gain insights into their business finances, track performance metrics, and make informed decisions to drive growth and profitability.

- Small Businesses: Small businesses leverage MoneyMonk for its comprehensive financial management tools, which enable them to streamline their financial processes, improve cash flow, and maintain financial health.

- Consultants: Consultants rely on MoneyMonk to track billable hours, create detailed invoices for clients, and manage their financial operations with ease. The platform simplifies financial management for consultants working on various projects.

In summary, MoneyMonk is a valuable financial management solution for freelancers, entrepreneurs, and small businesses looking to simplify their invoicing, expense tracking, and financial reporting processes. Whether you’re a freelancer managing client invoices, an entrepreneur analyzing business finances, or a small business owner seeking to streamline financial operations, MoneyMonk offers the tools and features to support your financial needs.