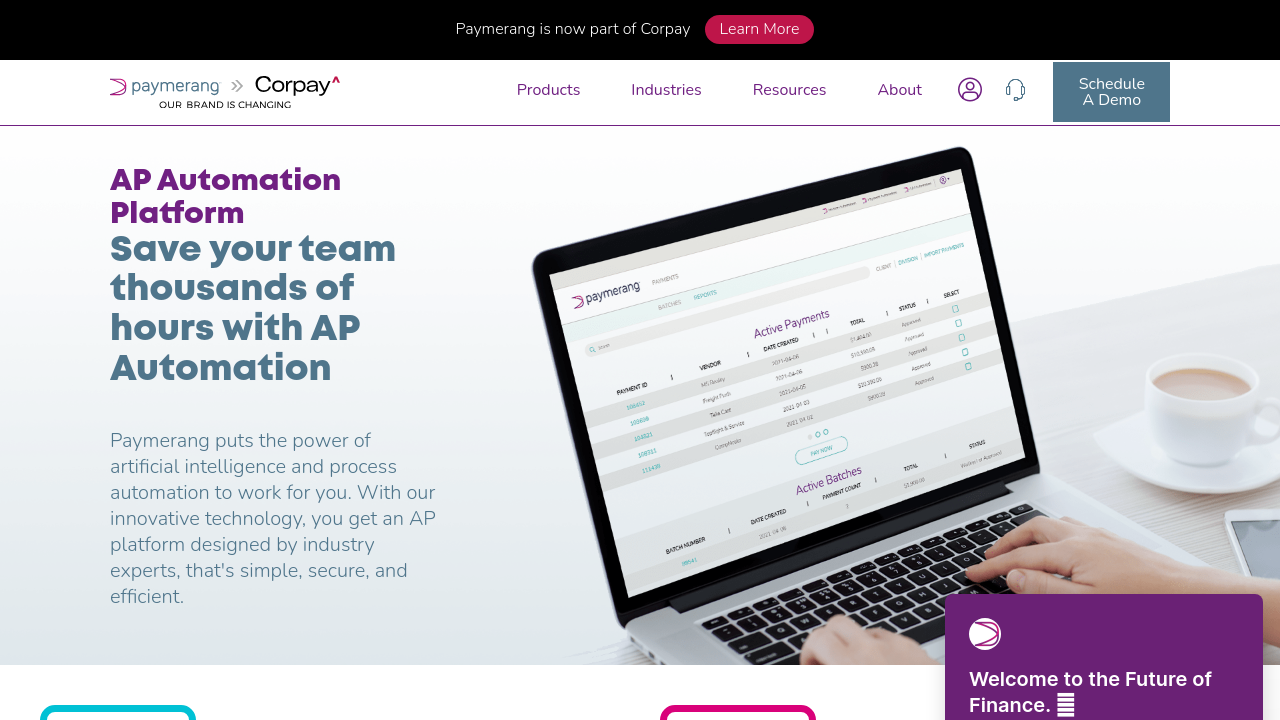

Paymerang is a comprehensive, modern solution redefining the way businesses manage their accounts payable. As a leader in the Accounts Payable Management category, Paymerang delivers a streamlined invoice and payment automation platform designed to save time, boost accuracy, and enhance financial controls. By automating invoice processing and payment workflows, this solution reclaims hundreds of hours annually for finance teams, allowing them to focus on higher-priority strategic initiatives.

Paymerang’s platform is built with advanced features that cater to every step of the payment process. From electronic invoice capture and secure payment processing to robust reporting and fraud management, businesses can trust Paymerang to reduce paper usage, lower operating costs, and minimize fraud risks. The platform integrates seamlessly with popular accounting systems and ERP solutions, ensuring that financial data is consolidated and accessible in real time. This connectivity helps organizations maintain reliable records and simplifies reconciliation across multiple channels.

Key Features and Benefits:

- Invoice Automation: Automatically capture, store, and process invoices using advanced workflows that reduce manual intervention and errors.

- Secure Payment Processing: Utilize encryption and vendor checks to safeguard sensitive financial information, ensuring that every transaction is protected against fraud.

- Batch Processing and Scheduling: Manage large volumes of payments efficiently, enabling automated batch processing and tailored scheduling based on predefined criteria.

- Comprehensive Integrations: Benefit from agnostic integrations and plugins that connect with various accounting platforms, payment gateways, and ERP systems for streamlined financial management.

- Detailed Reporting & Analytics: Gain actionable insights with consolidated reporting that aids in tracking payments, identifying risks, and reinforcing audit processes.

- Online Payment Portals: Offer vendors an intuitive, self-service portal to submit invoices and check payment statuses, enhancing communication and transaction transparency.

Paymerang is particularly advantageous for finance departments looking to modernize their processes. Its user-friendly interface and minimal setup requirements allow teams to quickly adopt the platform without extensive training. The solution’s ability to automate complex workflows and ensure error-free transactions means that organizations not only save time but also transform their internal processes into a more strategic resource.

For businesses interested in maximizing efficiency and cash flow management while reducing administrative overhead, Paymerang offers a robust set of tools designed to meet these needs head on. Explore exclusive offers on the deal page to learn how you can leverage this platform for improved accounts payable operations. For alternative solutions in the same space, consider exploring Stampli as another option to streamline your processes.