Overview

What is PayStand?

PayStand is a cutting-edge B2B billing and payment software platform operating on a SaaS model and leveraging blockchain technology. PayStand’s mission is to revolutionize B2B payments by utilizing modern Internet, Blockchain, and SaaS technologies. Through its innovative “Payments as a Service” model, PayStand creates a smart billing and payment network designed to digitize receivables, automate processing, reduce time-to-cash, lower transaction costs, and enable new revenue opportunities.

Why Use PayStand?

In the landscape of B2B billing and payment solutions, PayStand excels by offering several key benefits:

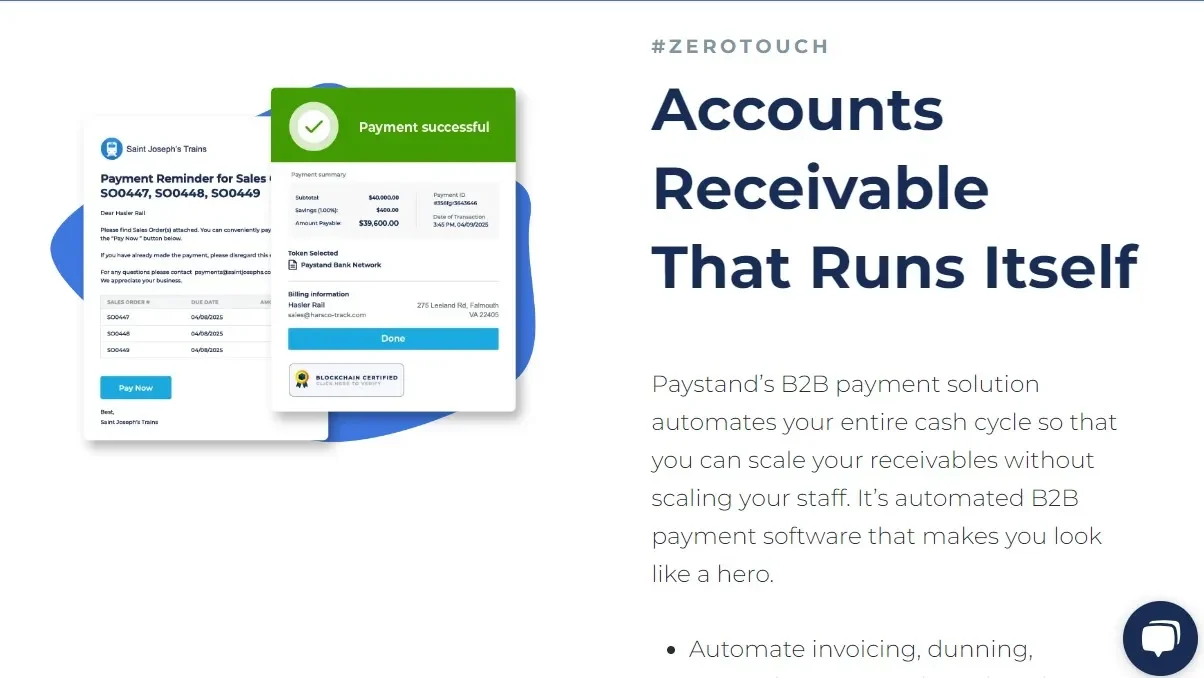

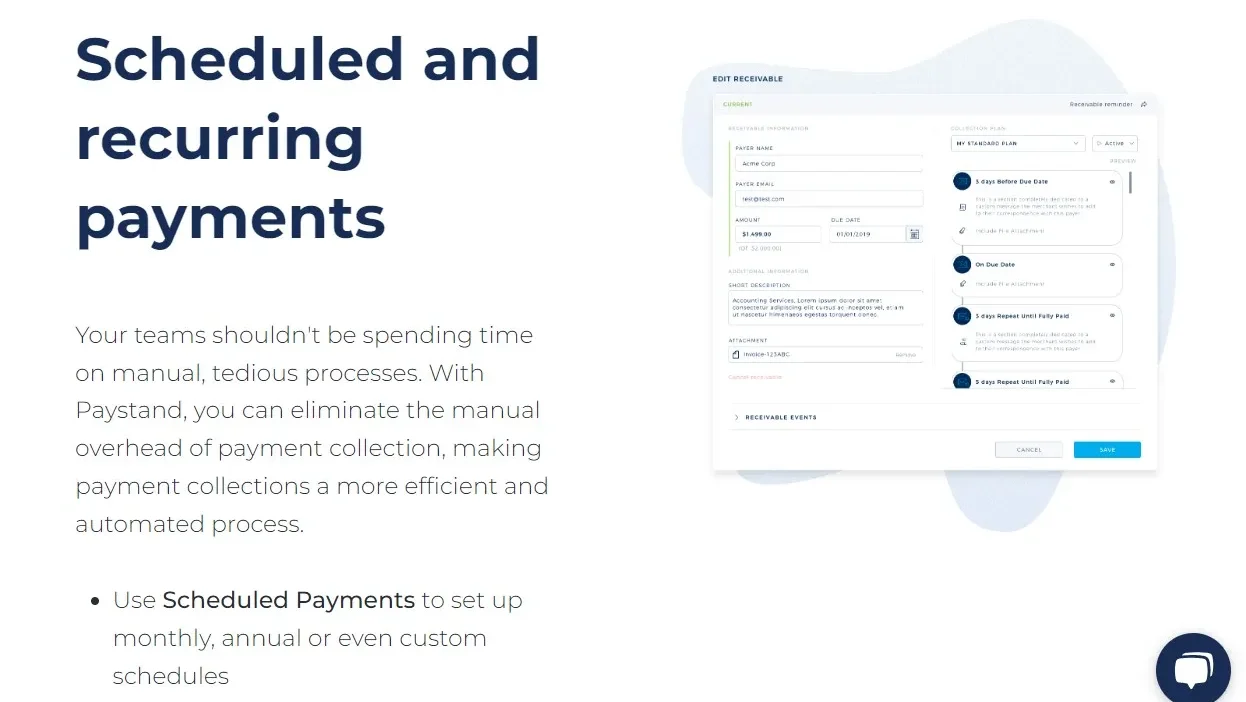

- Digitized Receivables: PayStand transforms traditional receivables processes by digitizing them, leading to increased efficiency and reduced manual effort. This digitization accelerates the payment cycle and enhances cash flow.

- Automated Processing: With advanced automation capabilities, PayStand streamlines payment processing, reducing errors and saving valuable time. Automation helps in eliminating the repetitive tasks associated with manual billing and payments.

- Reduced Time-to-Cash: By leveraging blockchain technology and modern payment infrastructures, PayStand significantly reduces the time it takes for businesses to receive payments, improving overall financial health and liquidity.

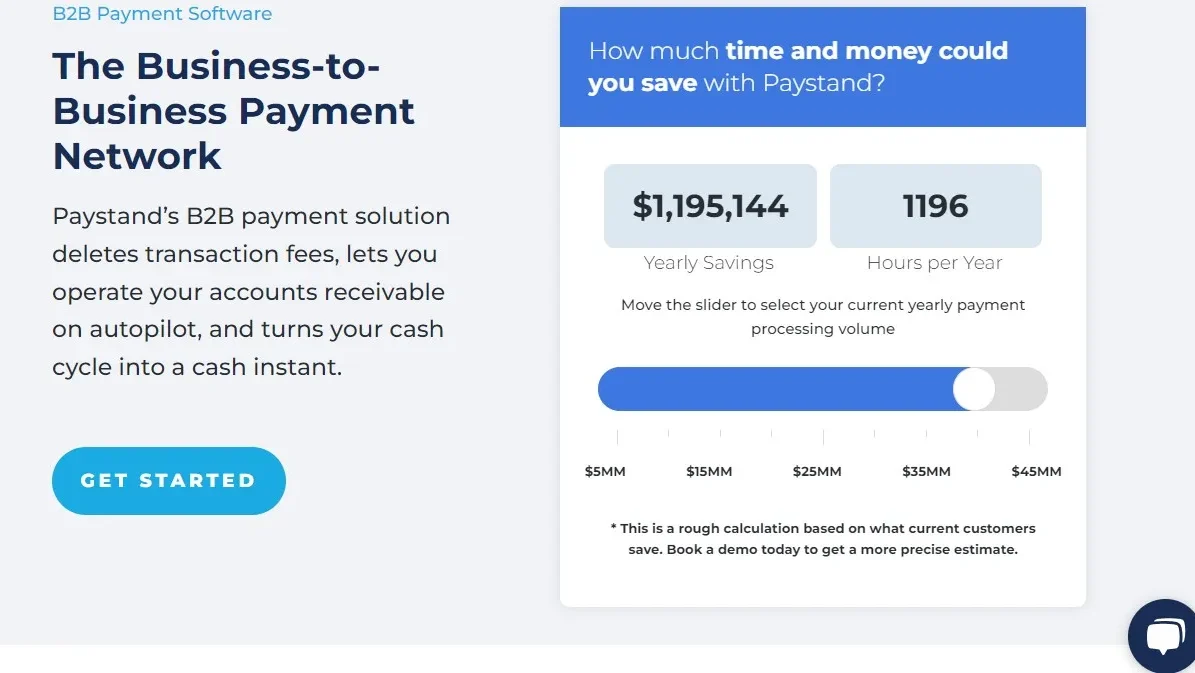

- Lower Transaction Costs: PayStand’s innovative approach to payments helps lower transaction fees, making it a cost-effective solution for businesses. This reduction in costs can lead to substantial savings over time.

- Integration Flexibility: PayStand’s platform is highly flexible, allowing seamless integration with websites, invoices, ERP billing systems, and mobile applications. This ensures that businesses can incorporate digital payments into their existing workflows with ease.

- Venture-Backed and Recognized: As a venture-backed company, PayStand benefits from significant investment and support. It has been consistently recognized as a leading solution in the B2B payment space, highlighting its reliability and effectiveness.

Who is PayStand For?

PayStand caters to a diverse range of enterprises and industries:

- Manufacturers and Distributors: These businesses can leverage PayStand to streamline their payment processes, reduce costs, and improve cash flow management, allowing them to focus on their core operations.

- Software Platforms: Software companies can integrate PayStand into their platforms to offer seamless billing and payment solutions to their users, enhancing the overall user experience and value proposition.

- Service Providers: Service-based businesses benefit from PayStand’s automated and efficient billing processes, enabling them to manage their receivables more effectively and ensure timely payments.

- ERP System Users: Enterprises using ERP systems can integrate PayStand to enhance their financial operations, ensuring a smooth and efficient billing and payment workflow.

In summary, PayStand is a transformative B2B billing and payment platform that harnesses the power of modern Internet, Blockchain, and SaaS technologies to enhance efficiency, reduce costs, and drive new revenue opportunities. Whether you’re a manufacturer, distributor, software platform, or service provider, PayStand offers the tools needed to modernize your payment processes and improve financial outcomes.