What is Revolut?

Managing your finances across borders can be a hassle. Revolut goes beyond traditional bank accounts, offering a global financial app designed to streamline your money matters. From holding and exchanging multiple currencies to sending and receiving international payments, Revolut empowers you to take control of your finances with transparency and convenience, no matter where you are in the world.

Why Choose Revolut?

Seeking a convenient and transparent way to manage your finances globally? Here’s why Revolut stands out:

- Effortless Currency Exchange: Exchange currencies at interbank rates with no hidden fees, saving you money on transactions.

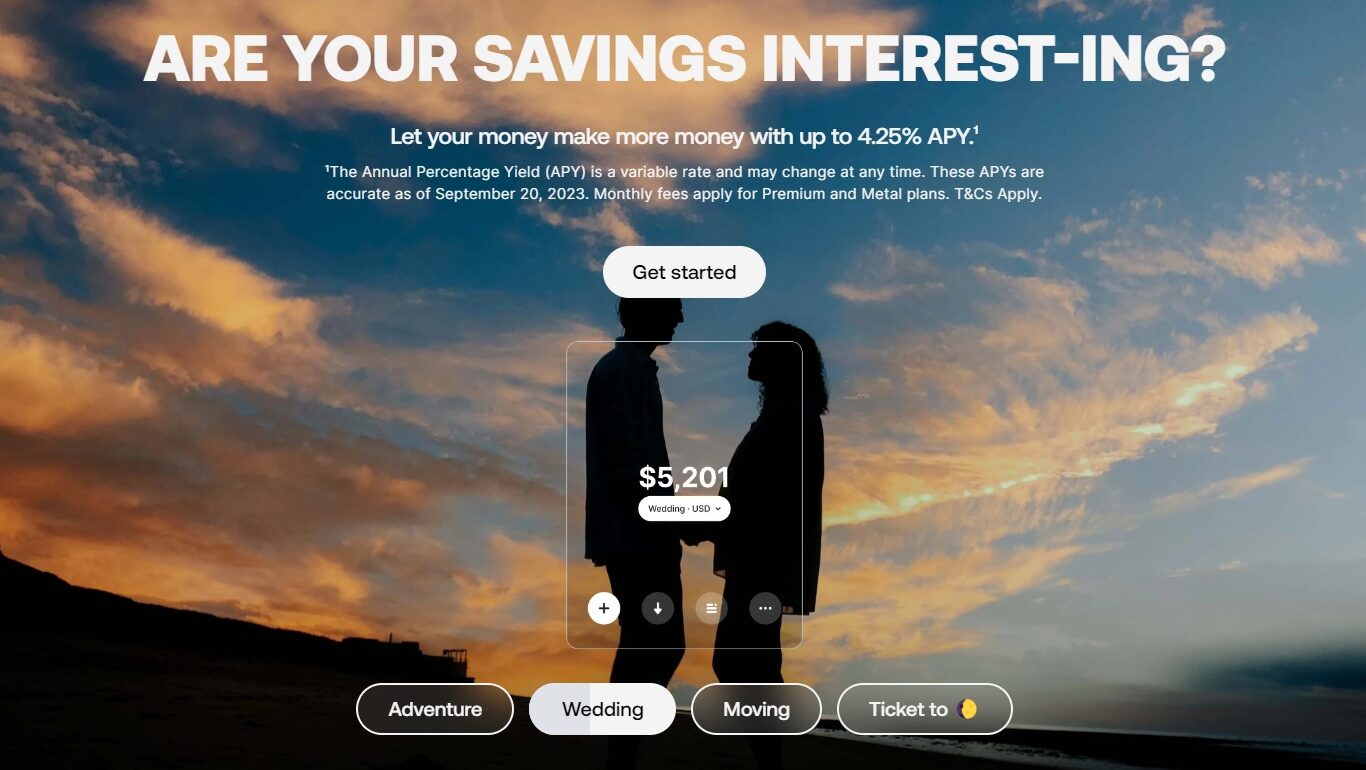

- Multi-Currency Accounts: Hold and manage multiple currencies within a single app, eliminating the need for multiple bank accounts.

- International Payments: Send and receive international payments quickly and securely, avoiding high bank fees.

- Debit Card for Global Spending: Use your Revolut debit card worldwide to pay and withdraw cash with minimal fees.

- Budgeting Tools: Track your spending and manage your budget effectively with built-in budgeting tools.

- Cryptocurrency Trading (Optional): Buy and sell cryptocurrencies directly within the app (subject to regulations).

- Stock Trading (Optional): Invest in stocks with fractional shares through a commission-free trading platform (subject to regulations).

Who is Revolut For?

Revolut caters to individuals and businesses seeking a global and convenient financial solution:

- Frequent Travelers: Manage your travel expenses seamlessly with multi-currency accounts and fee-friendly spending.

- Global Freelancers & Remote Workers: Receive and send international payments without hefty fees.

- Online Shoppers: Make international purchases with ease and avoid foreign transaction charges.

- Budget-Conscious Individuals: Track your spending and manage your finances effectively across currencies.

- Anyone Looking to Go Global: Revolut empowers you to bank and manage your money on a global scale.

Revolut goes beyond traditional banking, offering a comprehensive and user-friendly app designed to simplify your finances no matter where you are in the world. With its focus on transparency, convenience, and global features, Revolut is the perfect choice for individuals and businesses seeking a seamless and cost-effective way to manage their money internationally