Overview

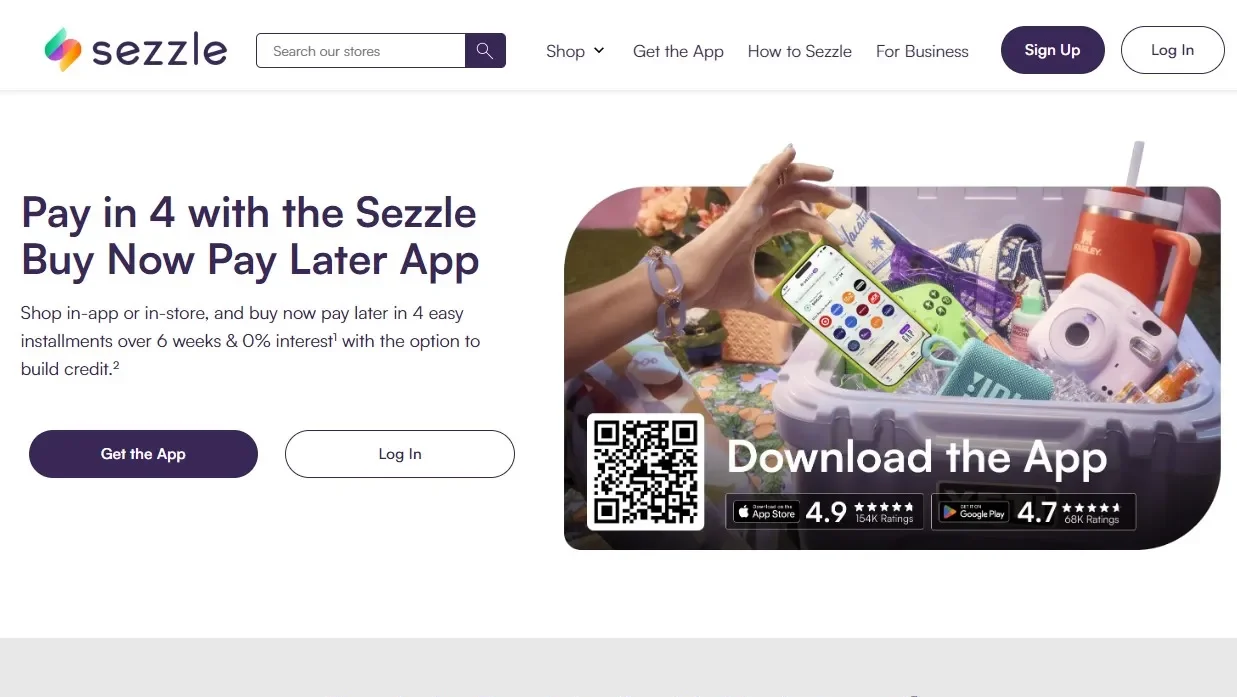

What is Sezzle?

Sezzle is a Buy Now Pay Later app that allows users to shop in-app or in-store and pay for their purchases in 4 easy installments over 6 weeks with 0% interest¹. Additionally, Sezzle offers the option to build credit² while enjoying the convenience of spreading out payments.

Why Use Sezzle?

Sezzle stands out in the Buy Now Pay Later space by:

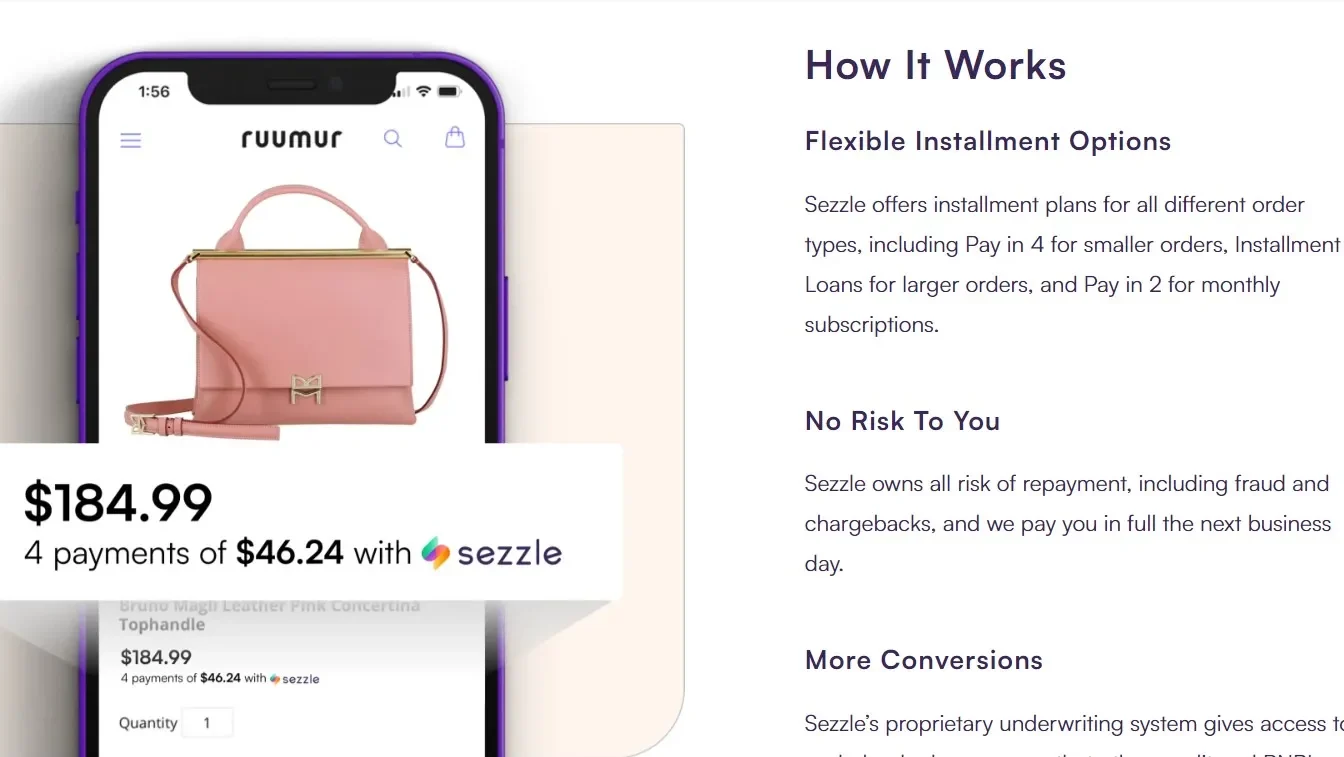

- Convenient Payment Options: With Sezzle, users can split their payments into 4 installments, making it easier to manage their budget and cash flow.

- Interest-Free Payments: Sezzle offers 0% interest¹ on purchases, allowing users to pay for their items over time without incurring additional costs.

- Build Credit: Users have the opportunity to build credit² by using Sezzle responsibly, which can be beneficial for improving their credit score over time.

- Flexibility in Shopping: Whether shopping in-app or in-store, Sezzle provides a flexible payment option that caters to a variety of purchasing preferences.

Who is Sezzle For?

Sezzle is ideal for a wide range of users, including:

- Online Shoppers: Individuals who prefer to shop online can benefit from Sezzle’s installment payment option, making it easier to afford larger purchases.

- Budget-Conscious Consumers: Those looking to manage their finances more effectively can use Sezzle to spread out payments without incurring interest¹.

- Credit Builders: Users interested in building or improving their credit² can leverage Sezzle as a tool to establish a positive credit history.

- Convenience Seekers: For individuals seeking a convenient and flexible payment solution, Sezzle offers a user-friendly experience for making purchases.

In summary, Sezzle provides a convenient and flexible Buy Now Pay Later option for users looking to manage their finances, build credit, and enjoy interest-free payments on their purchases. Whether you’re an online shopper, budget-conscious consumer, credit builder, or convenience seeker, Sezzle offers a valuable solution for spreading out payments and making shopping more accessible.