Overview

What is the American Express Blue Business Cash Card?

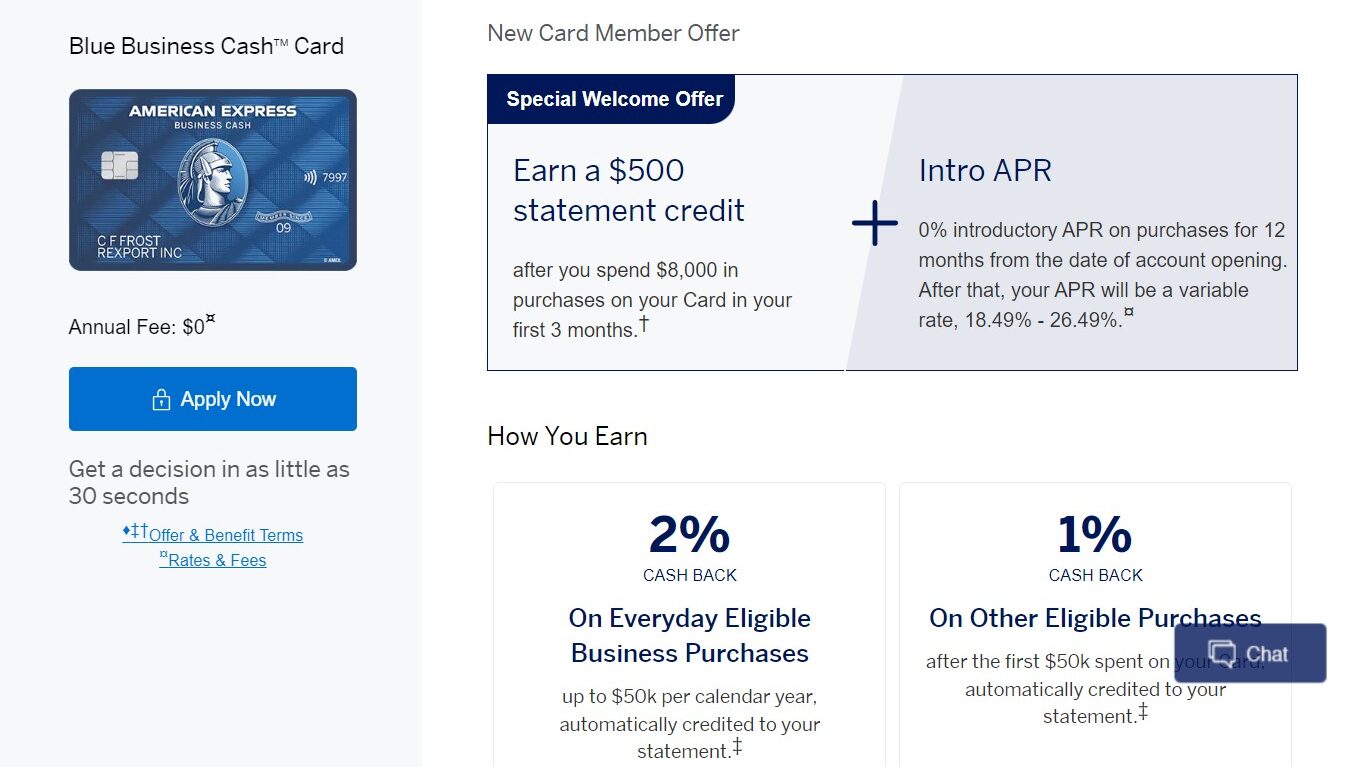

The American Express Blue Business Cash Card is a credit card designed for small business owners who prioritize earning cash back rewards on everyday business purchases. It offers a straight-forward rewards program with a high cash back rate on purchases, with no annual fee, making it a compelling option for cost-conscious business owners.

Why Use the American Express Blue Business Cash Card?

Here are some of the key benefits of the American Express Blue Business Cash Card:

- High Cash Back Rate: Earn 2% cash back on all eligible purchases on up to $50,000 spent in a calendar year, then 1%. This flat-rate rewards program simplifies earning rewards without needing to track bonus categories.

- No Annual Fee: The card doesn’t have an annual fee, distinguishing it from other cash back rewards cards for businesses.

- Expanded Buying Power: American Express offers increased spending power if needed, providing flexibility for unexpected business expenses. Exceed your credit limit temporarily, but clear any charges above it monthly to evade extra fees.

- Pay Over Time Option: Enjoy flexibility by having the option to carry a balance and make minimum monthly payments. Keep in mind that interest charges will apply on any unpaid balance.

- Global Acceptance: Merchants globally accept American Express, providing convenience for traveling business owners and international purchasers.

Who is the American Express Blue Business Cash Card Right For?

The American Express Blue Business Cash Card is ideal for:

- Small Businesses with Straightforward Spending: This card is a good fit for businesses with consistent spending across various categories, as it offers a flat-rate cash back benefit.

- Cost-Conscious Business Owners: This fee-free card emphasizes cash back rewards, ideal for budget-conscious businesses seeking rewards without annual fees.

- New Business Owners: Blue Business Cash Card has a straightforward rewards program and no annual fee, ideal for new businesses.

The American Express Blue Business Cash Card offers a no-frills approach to earning cash back rewards on everyday business purchases. With its high cash back rate, no annual fee, and globally recognized acceptance, the Blue Business Cash Card is a strong contender for small business owners looking for a straightforward and cost-effective way to maximize their return on business spending.