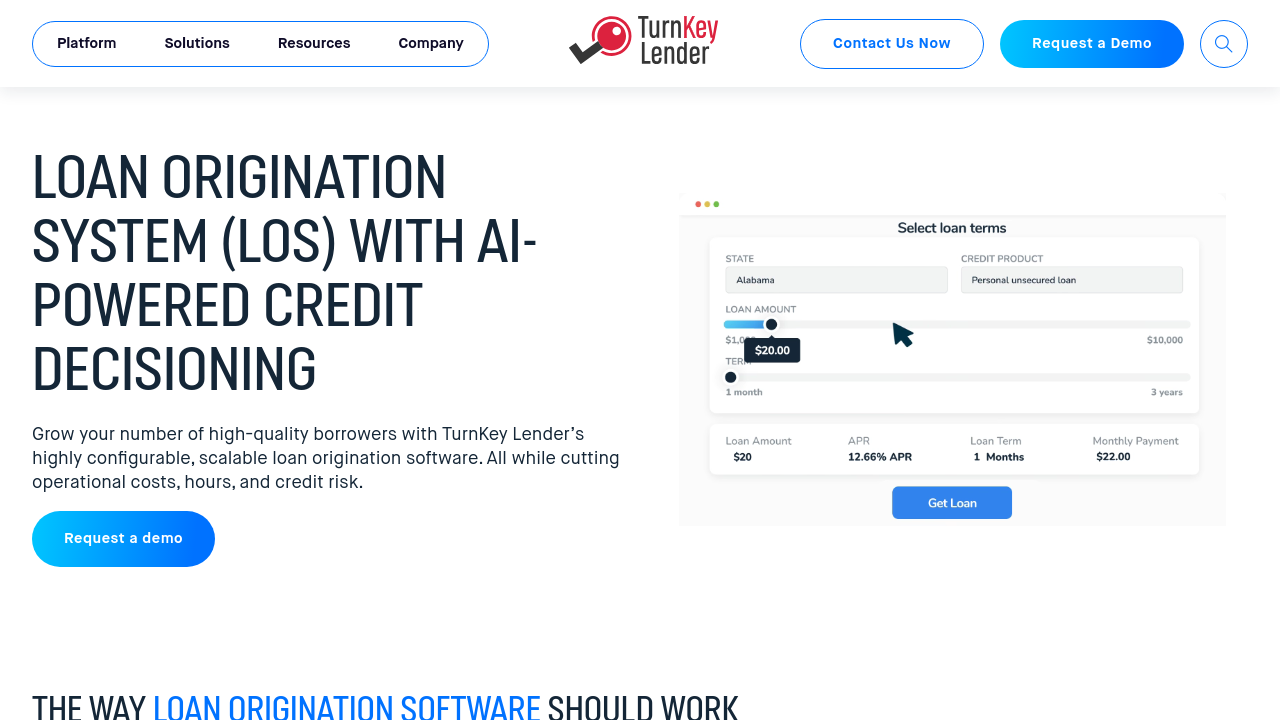

TurnKey Lender is a comprehensive, cloud-based platform designed to automate the entire lending process from origination through servicing and collections. Developed for a global market, this intelligent system supports traditional and alternative lending, SME financing, leasing, trade finance, in-house financing, and more. With its innovative AI-driven decision engine and deep neural networks, TurnKey Lender empowers financial institutions to make near-instant credit decisions while reducing portfolio risk and boosting profitability.

Serving customers in over 50 countries, TurnKey Lender stands out as a leader in Unified Lending Management (ULM). The platform not only streamlines the loan process with automated workflows and advanced fraud prevention tools but also provides extensive customization options including simple white-labeling, a modular end-to-end architecture, and pre-built integrations. Its secure, scalable, and intuitive interface makes it suitable for banks, digital lenders, multi-finance companies, and trade finance operators looking to optimize operations and enhance customer experience.

Key Features and Benefits

- Advanced AI-Powered Credit Scoring: The platform leverages proprietary AI to evaluate borrowers accurately, reducing unnecessary risk while supporting rapid decision-making.

- End-to-End Automation: From the loan origination process to underwriting and servicing, TurnKey Lender automates core functions to minimize manual intervention and enhance efficiency.

- Customizable and Modular Architecture: Adapt the system to your specific needs with customizable credit products, flexible data integrations, and simple white-label options.

- Global Reach with Multiple Language Support: The solution is designed with international operations in mind, supporting a broad range of languages to serve diverse user bases.

- Robust Integration Capabilities: Easily integrate with credit agencies, third-party software, and payment platforms to ensure seamless operations within your existing ecosystem.

TurnKey Lender’s innovative approach means that organizations can deploy a fully functional lending platform quickly, reducing time-to-market for new financial products and improving overall operational agility. Its customizable design and extensive configuration options enable businesses to meet evolving market demands without compromising on security or performance.

As a comprehensive solution in the Loan Origination and Servicing category, TurnKey Lender helps streamline administrative tasks, improve operational workflows, and enhance the customer journey with digital onboarding and automated notifications.

For a closer look at how TurnKey Lender can transform your lending processes, visit the product homepage. To explore exclusive offers, check out the deal page.

Alternative