Overview

What is Webull?

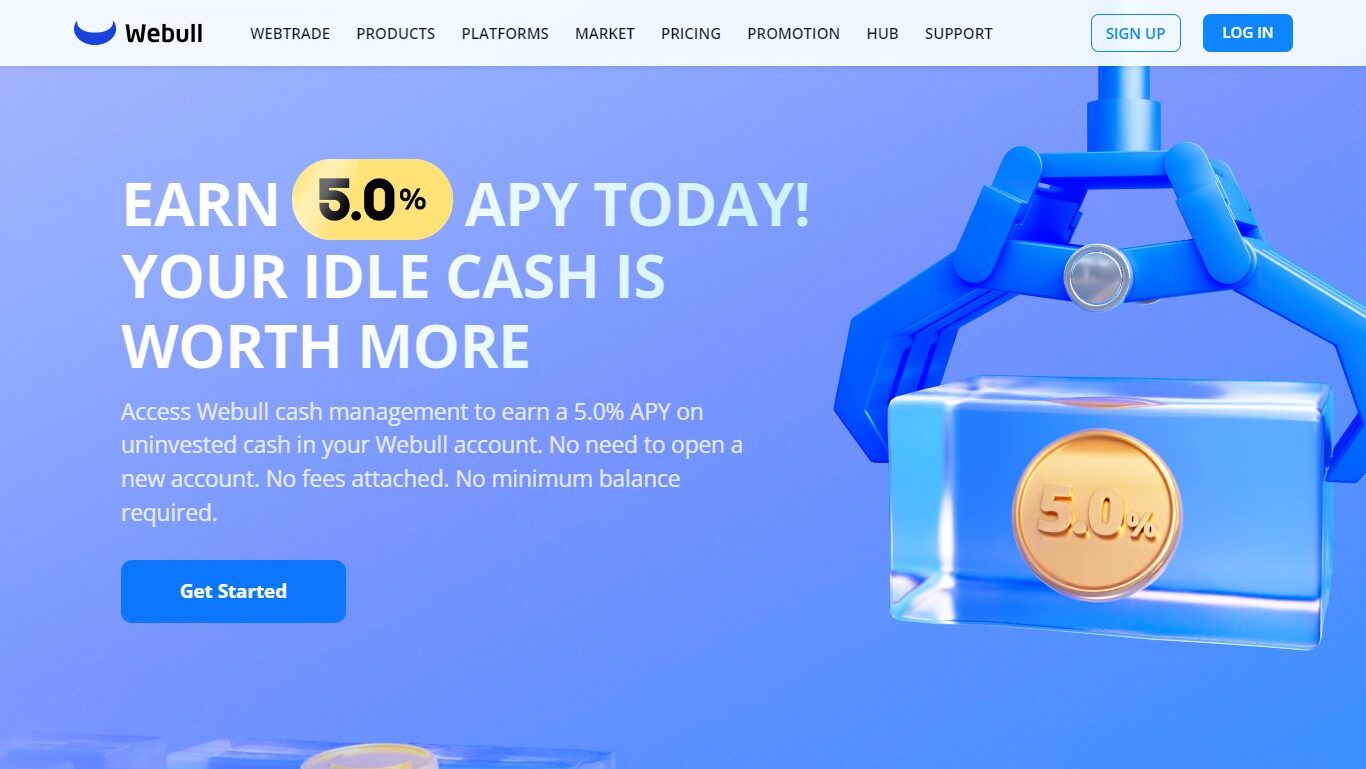

Webull is a financial services company that aims to democratize investing by offering a user-friendly platform with commission-free trading for a wide range of investment vehicles, including stocks, exchange-traded funds (ETFs), options, and even cryptocurrencies. This makes it appealing for new investors seeking an easy-to-use platform and seasoned investors looking for cost-effective trading options.

Why Use Webull?

Webull stands out from other brokers by providing several key features:

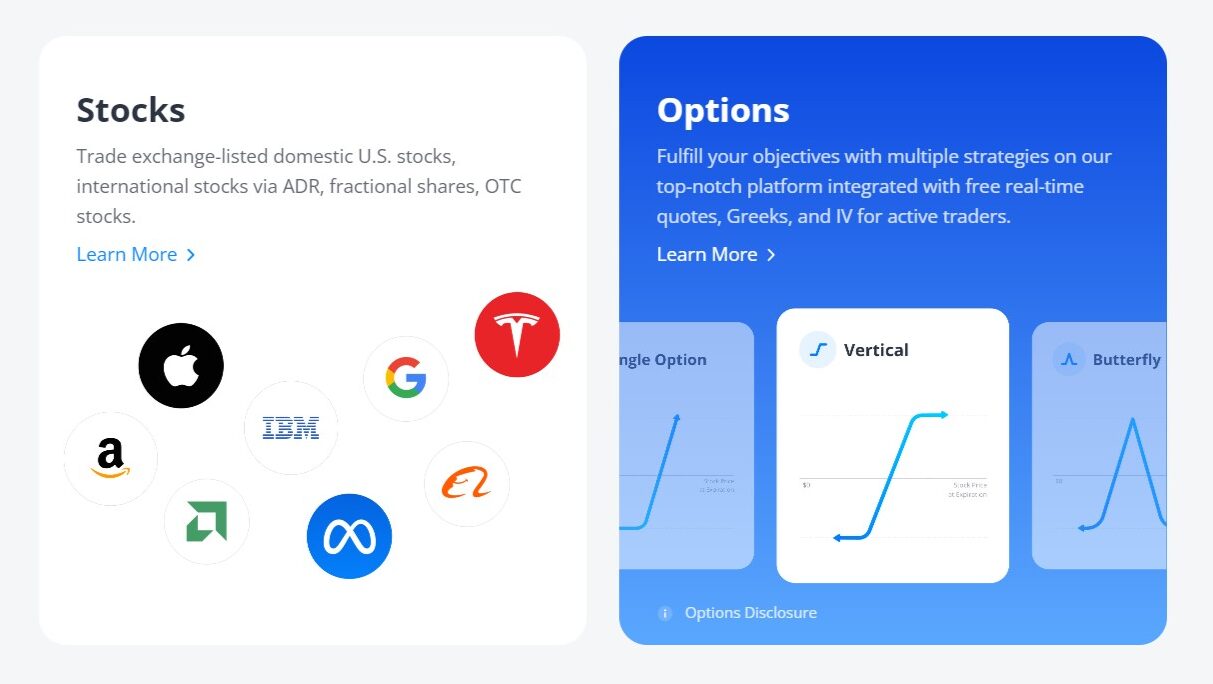

- Commission-Free Trading: Unlike traditional brokers that charge per-trade fees, Webull allows users to buy and sell stocks, ETFs, and listed options without commissions.

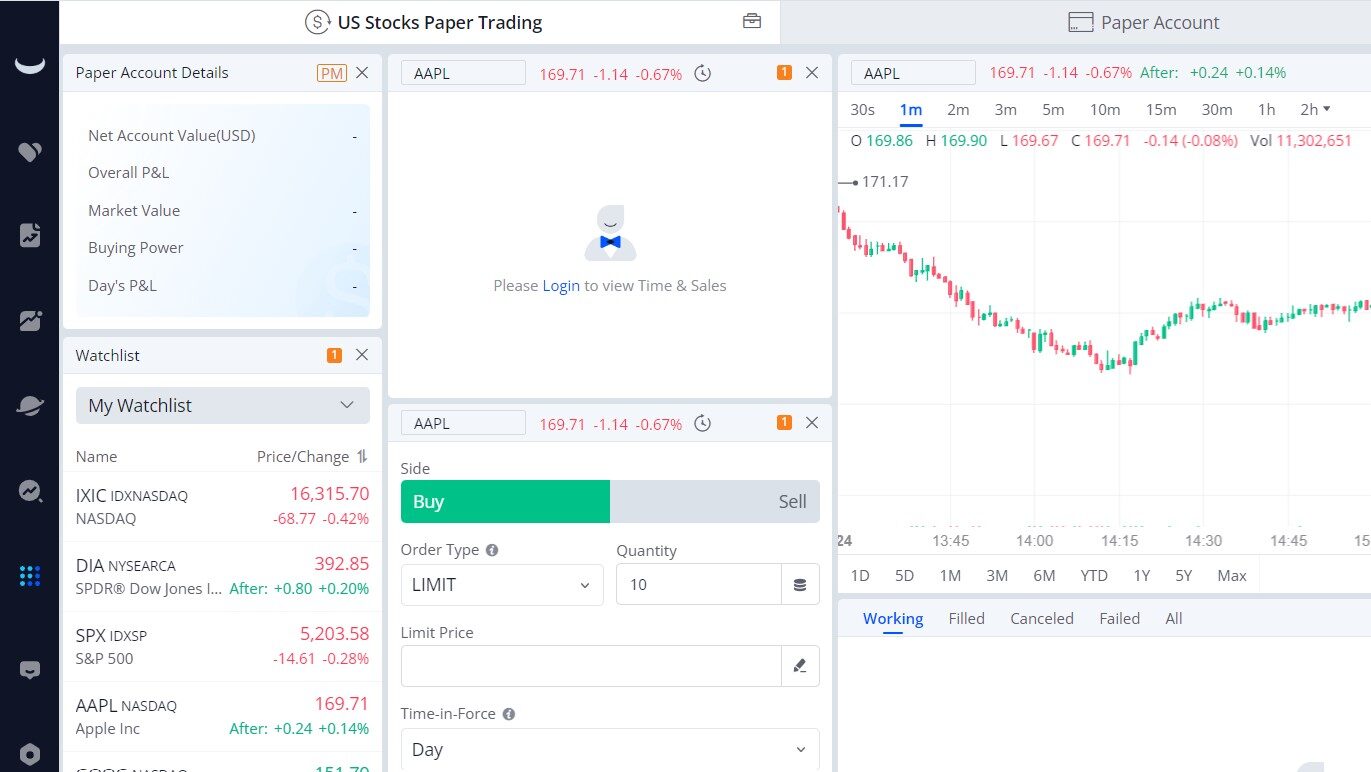

- Advanced Platform & Tools: Webull provides robust desktop and mobile apps with technical analysis tools, charting features, and market data for informed investing.

- Fractional Shares: Webull enables investing in fractional shares, facilitating market participation for beginners or those with limited capital.

- Margin Trading: For experienced investors, Webull provides margin accounts to leverage their buying power.

- Paper Trading: Webull offers simulated trading to practice investing before using real funds, providing a risk-free environment for learning.

Who is Webull For?

Webull caters to a wide range of investors, including:

- Beginners: With its user-friendly interface, educational resources, and fractional shares, Webull is a good option for new investors looking to get started.

- Active Traders: The advanced platform, charting tools, and commission-free trading make Webull attractive for active traders who frequently buy and sell securities.

- Long-Term Investors: Webull also caters to long-term investors seeking a user-friendly platform for buying and holding stocks and ETFs for the long haul.

Webull offers commission-free trading, a powerful platform, and educational resources. This makes it a strong contender for investors of all experience levels.