Overview

What is Zelle?

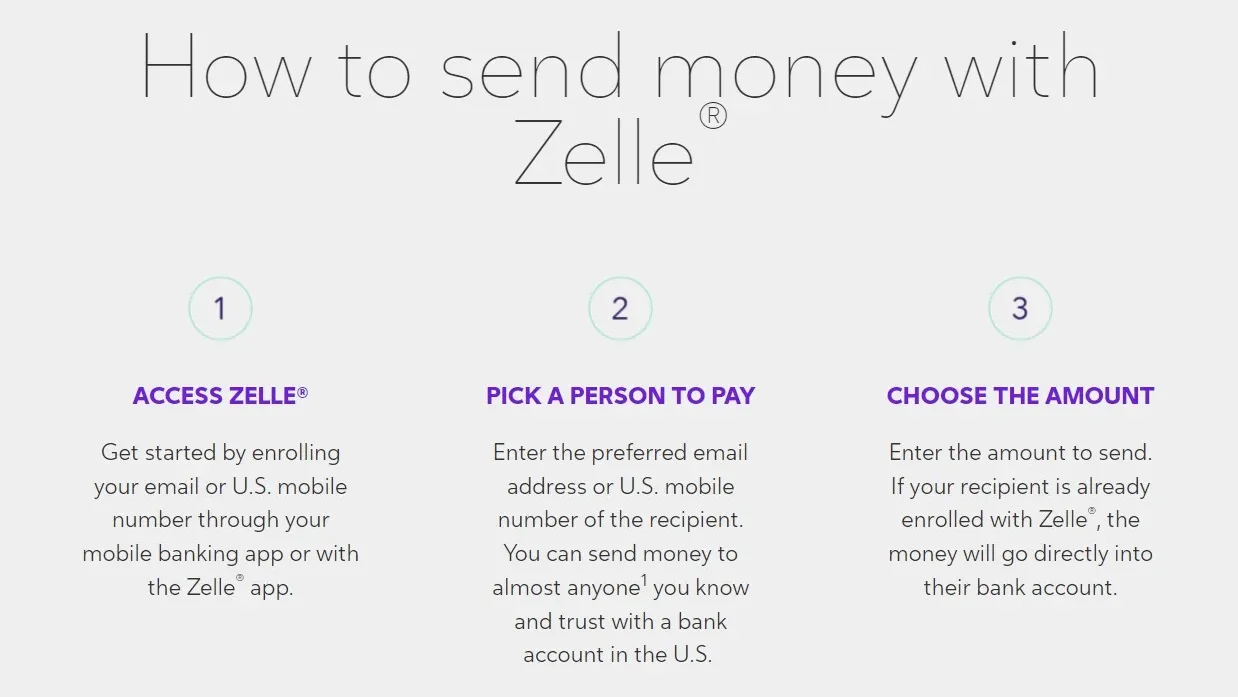

Zelle is a convenient and secure way to send money directly between almost any bank accounts in the United States. With Zelle, users can transfer funds quickly, typically within minutes, without the need for cash or checks. Whether you’re splitting bills, repaying friends, or sending money to family members, Zelle offers a fast and easy solution for money transfers.

Why Use Zelle?

Zelle stands out as a preferred money transfer service due to the following reasons:

- Speedy Transactions: Zelle enables users to send money swiftly, with most transfers processed within minutes. This rapid transaction speed makes it ideal for urgent payments or splitting expenses on the go.

- Convenience: With Zelle, users can send money directly from their bank accounts through their bank’s mobile app or online banking platform. This eliminates the need for physical cash or paper checks, streamlining the payment process.

- Security: Zelle prioritizes security and privacy, ensuring that users can transfer funds with peace of mind. The platform employs advanced encryption and authentication measures to safeguard financial transactions.

- Wide Accessibility: Zelle is widely supported by major banks and financial institutions across the U.S., making it accessible to a broad user base. Users can easily enroll in Zelle through their bank’s existing digital banking services.

Who is Zelle For?

Zelle caters to a diverse range of users who value convenience, speed, and security in their money transfers:

- Individuals: Whether you need to split bills with roommates, repay a friend for lunch, or send money to a family member, Zelle offers a hassle-free solution for personal money transfers.

- Small Businesses: Small businesses can use Zelle to make quick payments to vendors, contractors, or employees. The fast transaction speed and ease of use make it a convenient option for business payments.

- Families: Zelle is ideal for families looking to transfer funds between family members for various purposes, such as gifting, shared expenses, or emergency financial support.

- Freelancers: Freelancers and independent contractors can use Zelle to receive payments from clients promptly, eliminating delays associated with traditional payment methods.

In summary, Zelle offers a seamless and efficient way to send money between bank accounts in the U.S., making it a preferred choice for individuals, small businesses, families, and freelancers seeking a convenient and secure money transfer solution.