ePayPolicy is a robust digital payment solution designed specifically for commercial insurance agencies and brokers. Trusted by over 7,500 insurance companies, ePayPolicy streamlines the payment process by offering a secure platform for ACH and credit card transactions, as well as daily check collection and an extensive payables network. This solution not only accelerates the payment cycle, but also simplifies accounting processes, enabling agencies to bind policies faster and enhance customer satisfaction.

Positioned within the Digital Payment Systems category, ePayPolicy brings together a comprehensive suite of features that are essential for modern insurance payment processing. By integrating with 18 popular management systems such as Vertafore, Applied, and NowCerts, the platform ensures seamless connectivity with your existing workflow. This integration minimizes manual data entry, reduces errors, and ultimately saves time for both internal teams and clients.

Why Use ePayPolicy?

- Simplicity and Security: ePayPolicy offers a user-friendly interface that simplifies payment collection, ensuring that each transaction is processed with top-level security. This ease of use benefits both staff and clients.

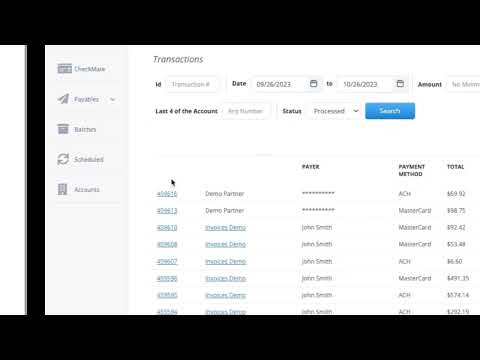

- Fast Processing: Digital payments are completed quickly, allowing for immediate deposit into bank accounts and speeding up the overall payment cycle. This capability is critical for agencies that need to secure funds before binding policies.

- Comprehensive Integrations: With native integrations into leading management systems, the platform supports efficient data synchronization that reduces manual workload and improves operational efficiency.

- Flexible Payment Options: Whether collecting funds via ACH, credit card, or even paper checks, ePayPolicy offers diverse mechanisms that meet the varying needs of your clients.

ePayPolicy is ideal for insurance agents, office managers, and financial administrators looking to streamline collections and enhance customer service. The platform’s design focuses on reducing the friction associated with traditional payment methods while ensuring compliance and security. Furthermore, its ability to generate secure payment links and deliver receipts automatically contributes significantly to an overall better customer experience.

Explore exclusive deals to get started and transform your payment operations today. For those interested in comparing solutions, excellent alternatives include PayPal, Square Point of Sale, and Applied Epic. Each brings unique features that cater to different aspects of payment processing and can offer complementary advantages alongside ePayPolicy.

By choosing ePayPolicy, insurance agencies can modernize their payment systems while ensuring reliability, security, and a streamlined workflow—ultimately resulting in improved operational efficiency and enhanced customer satisfaction.