Overview

What is PayPal?

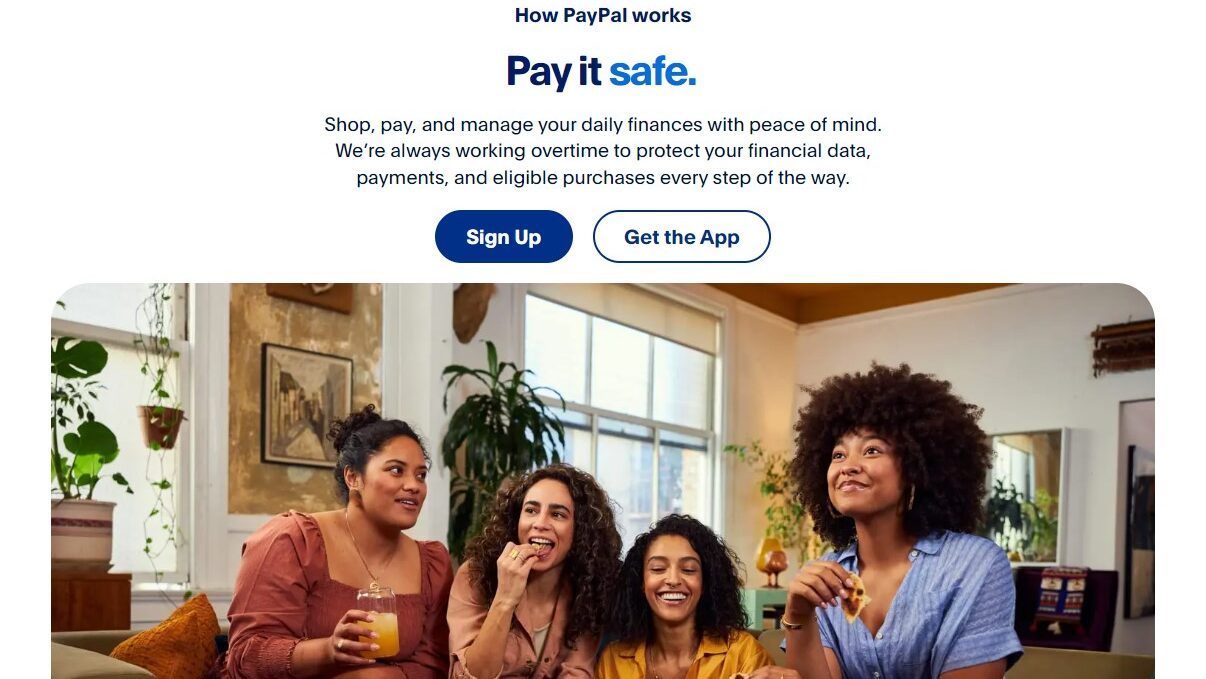

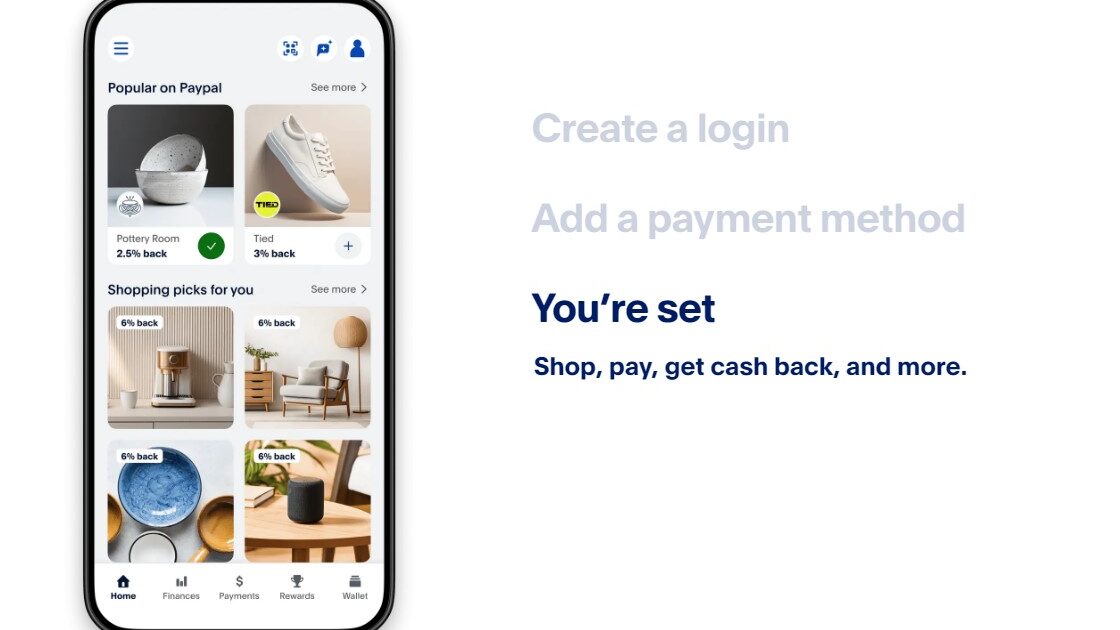

Forget the hassle of checks and money orders. PayPal isn’t just an online payment processor; it’s a digital wallet designed to streamline your online transactions with security and convenience. From sending and receiving money globally to shopping online securely, PayPal empowers you to manage your finances digitally with peace of mind.

Why Choose PayPal?

Looking for a secure and convenient way to send and receive money online? Here’s why PayPal stands out:

- Easy Money Transfers: Send and receive payments quickly and securely between friends, family, and businesses worldwide.

- Global Acceptance: Shop online at millions of PayPal-accepting merchants around the world.

- Enhanced Buyer and Seller Protection: Enjoy added security for both buyers and sellers with purchase protection and seller protection programs.

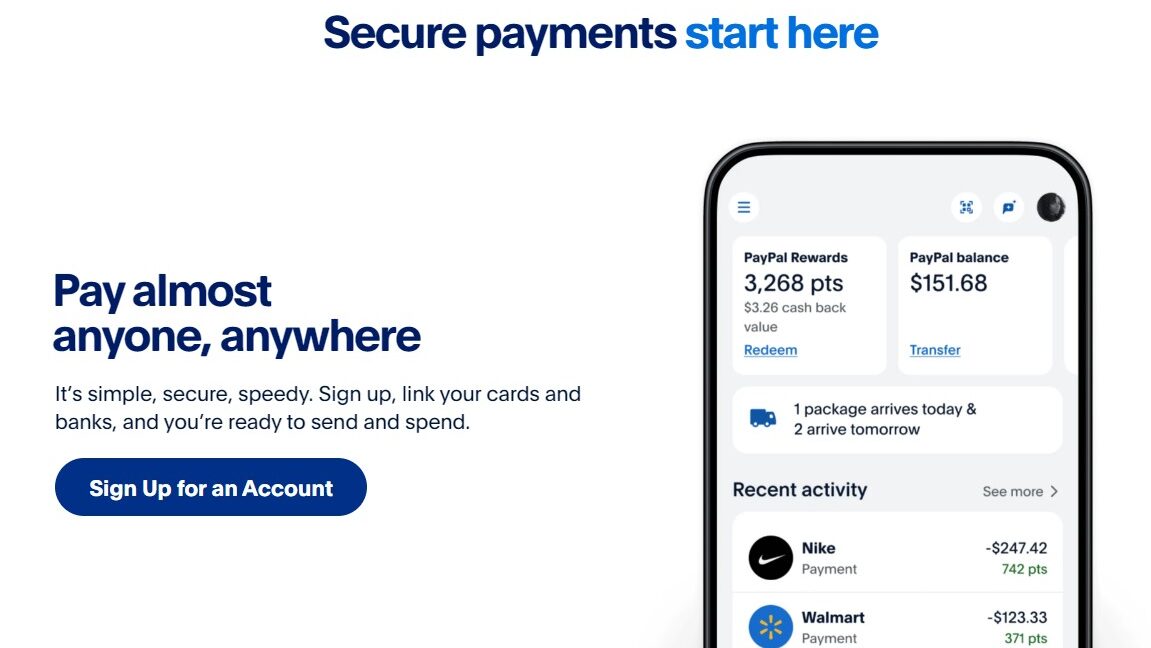

- Mobile Payment Convenience: Use the PayPal mobile app to send and receive money on the go.

- Multiple Funding Options: Link your bank account, debit card, or credit card to your PayPal account for easy transactions.

Who is PayPal For?

PayPal caters to individuals and businesses seeking a secure and versatile online payment solution:

- Online Shoppers: Make secure purchases at millions of online stores that accept PayPal.

- Freelancers and Contractors: Get paid quickly and easily by clients around the world.

- People Sending Money Abroad: Send money internationally to friends and family with competitive exchange rates.

- Small Businesses: Accept online payments securely and expand your customer base globally.

- Anyone Looking for a Digital Wallet: PayPal offers a convenient and secure way to manage your online finances.

PayPal goes beyond a simple payment method, offering a secure and versatile platform designed to simplify your online transactions. With its focus on convenience, global reach, and buyer/seller protection, PayPal is the perfect choice for individuals and businesses seeking a seamless and secure way to manage their online finances.