Overview

What is Wise Business?

Ditch the hidden fees and complexities of traditional international money transfers. Wise Business isn’t just another currency exchange service; it’s a transparent and efficient platform designed to empower businesses of all sizes to manage their global finances seamlessly. Ditch the inflated exchange rates, slow transfer times, and limited account features and focus on sending, receiving, holding, and managing multiple currencies with ease. Wise Business offers a suite of features that save you money on international transactions, streamline your global payments, and give you control over your finances in today’s interconnected world.

Why Choose Wise Business?

Struggling with hidden fees, slow transfers, limited currency options, and a lack of transparency in managing your international finances? Wise Business offers a compelling solution:

- Transparent Pricing: Wise Business uses the mid-market exchange rate, ensuring you get the same rate you see on Google. No hidden fees or markups.

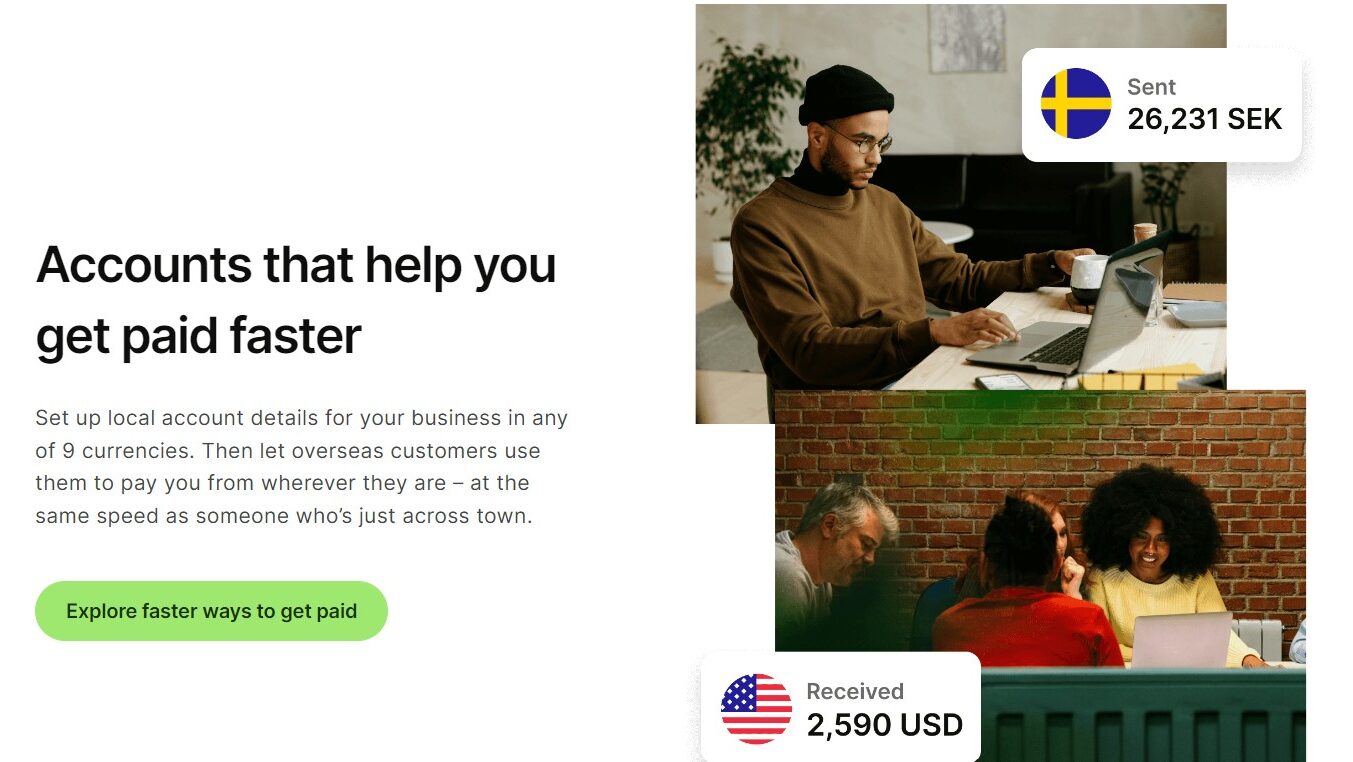

- Fast & Secure Transfers: Move your money quickly and securely between countries with Wise Business’s efficient transfer network.

- Hold & Manage Multiple Currencies: Maintain balances and easily convert between over 40 currencies with a single Wise Business account.

- Effortless International Payments: Pay your employees, freelancers, and suppliers globally with ease at a fraction of the cost of traditional banks.

- Automated Payments & Collections: Schedule recurring international payments and simplify your global cash flow management.

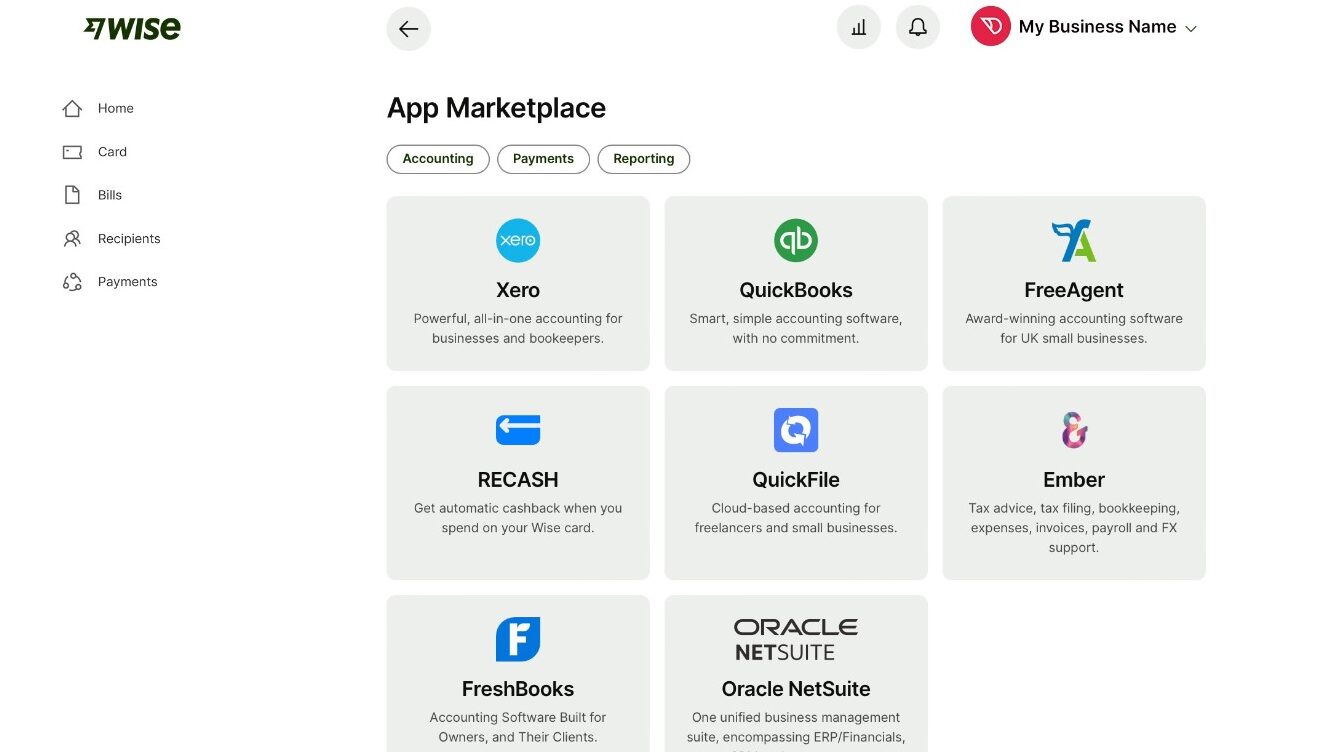

- Bulk Payments & Integrations: Easily manage multiple payments at once and integrate Wise Business with your accounting software for seamless workflows.

- Business-Grade Security & Compliance: Wise Business prioritizes security with industry-leading safeguards and regulatory compliance.

Who is Wise Business For?

Wise Business empowers businesses of all sizes and industries to go global:

- Freelancers & Solopreneurs: Get paid easily from international clients and manage your global income efficiently.

- Ecommerce Businesses: Sell your products worldwide, accept payments in multiple currencies, and manage international shipping costs effectively.

- Agencies & Marketing Firms: Pay international contractors and freelancers without breaking the bank.

- Import & Export Businesses: Streamline your international payments and manage foreign exchange fluctuations with ease.

- Startups & Growing Businesses: Scale your global operations with a cost-effective and user-friendly international money management solution.

- Established Enterprises: Consolidate your global finances and streamline international payments across multiple subsidiaries.

Wise Business stands out as a game-changer in the international money transfer landscape. Its commitment to transparent pricing, fast and secure transfers, multi-currency management, effortless international payments, automation capabilities, secure platform, and broad range of features makes it an attractive choice for businesses seeking to ditch traditional financial limitations, save money on global transactions, and unlock new growth opportunities in the global marketplace.