Overview

What is PayPal Business?

Managing a business involves a multitude of tasks, and simplifying your finances shouldn’t be one of them. PayPal Business goes beyond traditional payment processing, offering a suite of integrated solutions designed to streamline your operations and boost your sales. Ditch the complexities of managing multiple accounts and fragmented financial tools. PayPal Business offers a centralized platform, secure online transactions, and integrated marketing tools– all designed to empower your business to thrive.

Why Choose PayPal Business?

Running a successful business requires efficient financial management and a reliable payment processing solution. Here’s why PayPal Business stands out:

- All-In-One Business Account: Consolidate your business finances with a single account for sending and receiving payments, managing invoices, and accessing valuable financial tools.

- Secure Online Transactions: Process payments safely and securely with industry-leading fraud protection, giving you peace of mind and protecting your customers’ information.

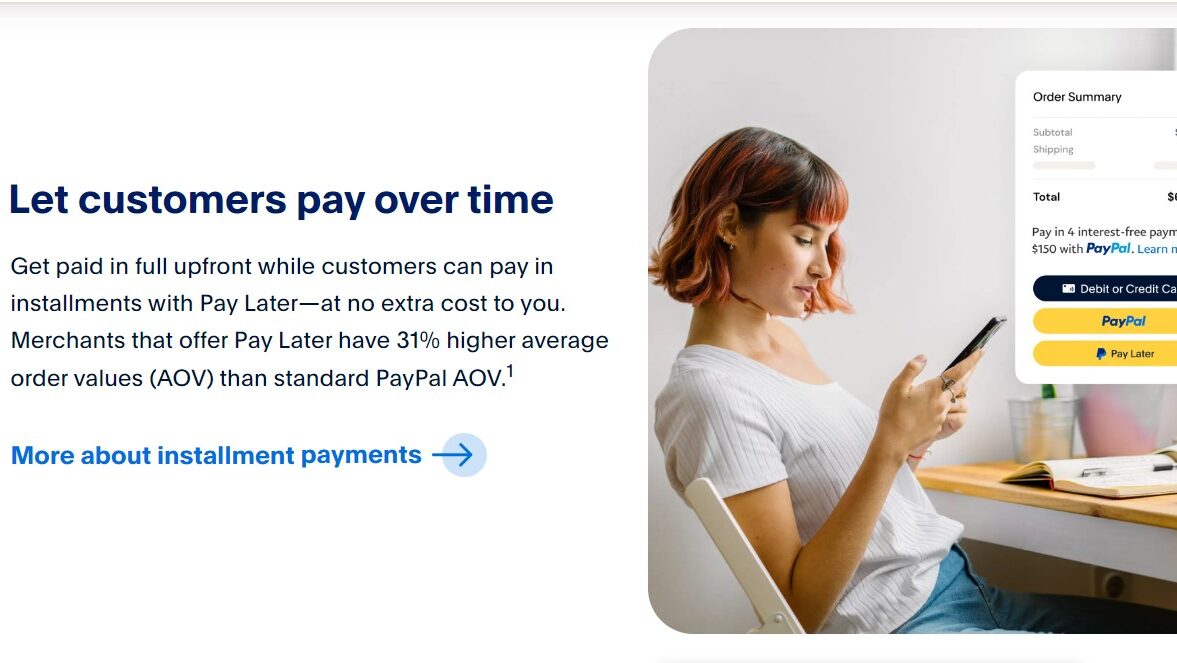

- Fast and Easy Payments: Get paid quickly and effortlessly through invoices, online payment buttons, or mobile payments, keeping your cash flow moving.

- Integrated Marketing Tools: Leverage built-in marketing tools to create and send invoices, manage customer relationships, and run targeted marketing campaigns.

- Global Reach: Accept payments from customers all over the world, expanding your customer base and boosting your sales potential.

- Mobile Payment Acceptance: Take payments on the go with mobile card readers, providing flexibility and convenience for your customers.

- Detailed Transaction Tracking: Gain valuable insights into your finances with detailed transaction tracking and reporting, helping you make informed business decisions.

Who is PayPal Business For?

PayPal Business caters to businesses of all sizes, from freelancers and startups to established companies:

- Freelancers & Solopreneurs: Send and receive payments with ease, manage invoices, and track your finances all in one place.

- Small and Medium Businesses: Simplify your financial processes, securely accept payments online and in person, and leverage marketing tools to reach new customers.

- E-commerce Businesses: Offer a variety of payment options to your online store, manage customer relationships, and take your business global.

- Service-Based Businesses: Send invoices quickly, accept secure payments, and manage your finances efficiently.

PayPal Business goes beyond a simple payment processor, offering a comprehensive suite of solutions designed to streamline your operations, secure your transactions, and empower your business for growth. With its centralized platform, secure transactions, and integrated tools, PayPal Business is the perfect choice for businesses seeking to simplify finances, boost sales, and thrive in today’s digital marketplace.