Overview

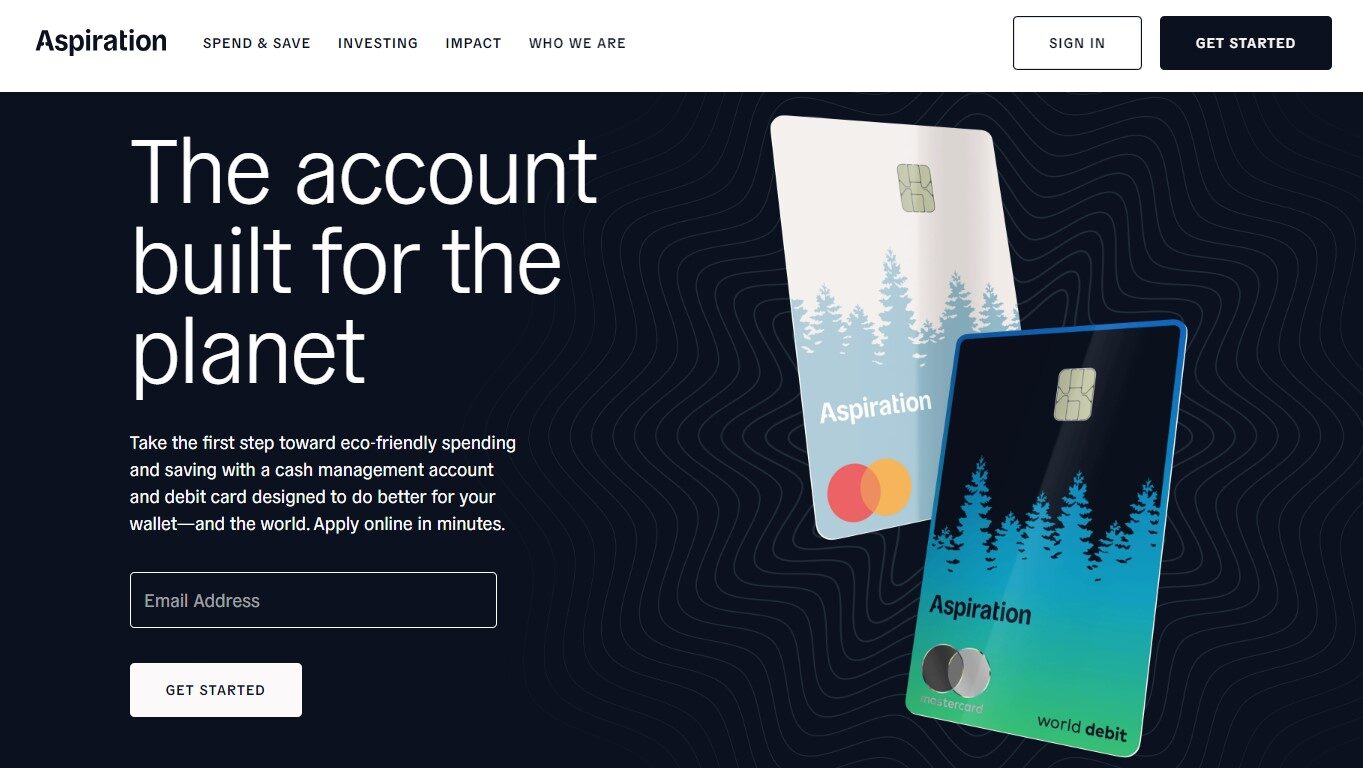

What is Aspiration?

Looking for a banking experience that aligns with your values? Aspiration isn’t just another bank; it’s a sustainable and socially conscious financial platform designed to help you manage your money while making a positive impact. With features that encourage saving, reward eco-conscious spending, and offset your carbon footprint, Aspiration empowers you to be financially healthy and environmentally responsible.

Why Choose Aspiration?

Seeking a sustainable and rewarding banking solution that aligns with your values? Here’s why Aspiration stands out:

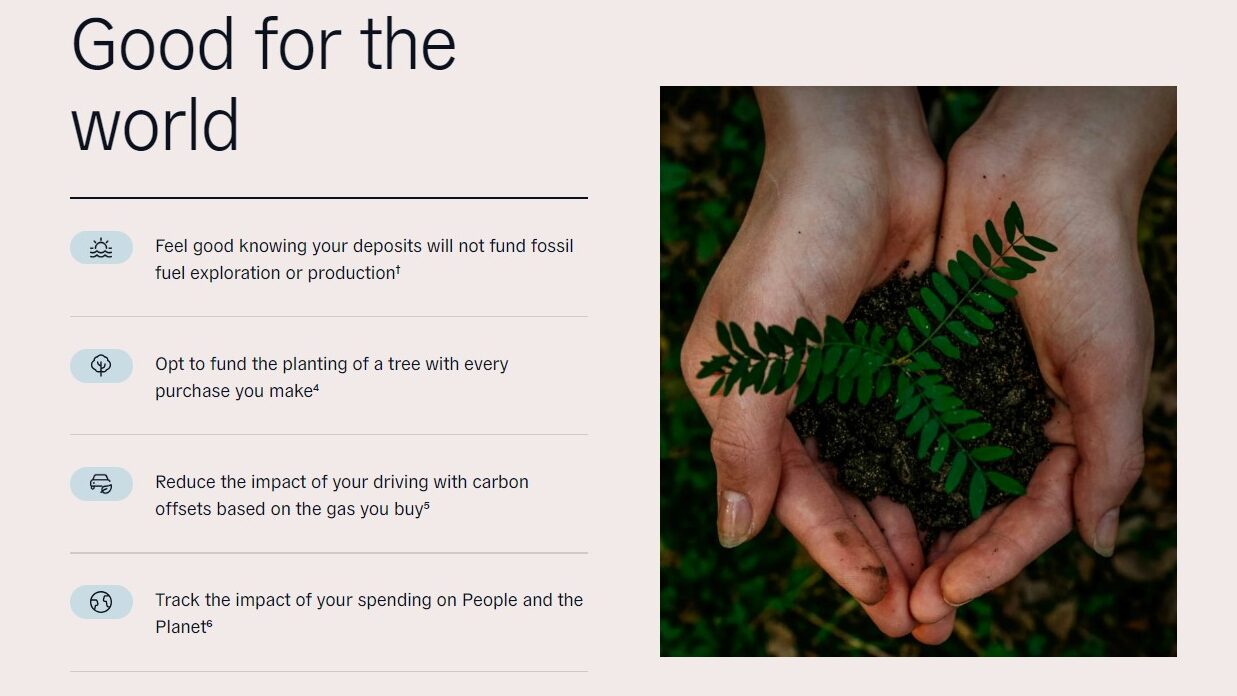

- Sustainable Banking: Plant trees and offset your carbon footprint with every swipe of your Aspiration debit card.

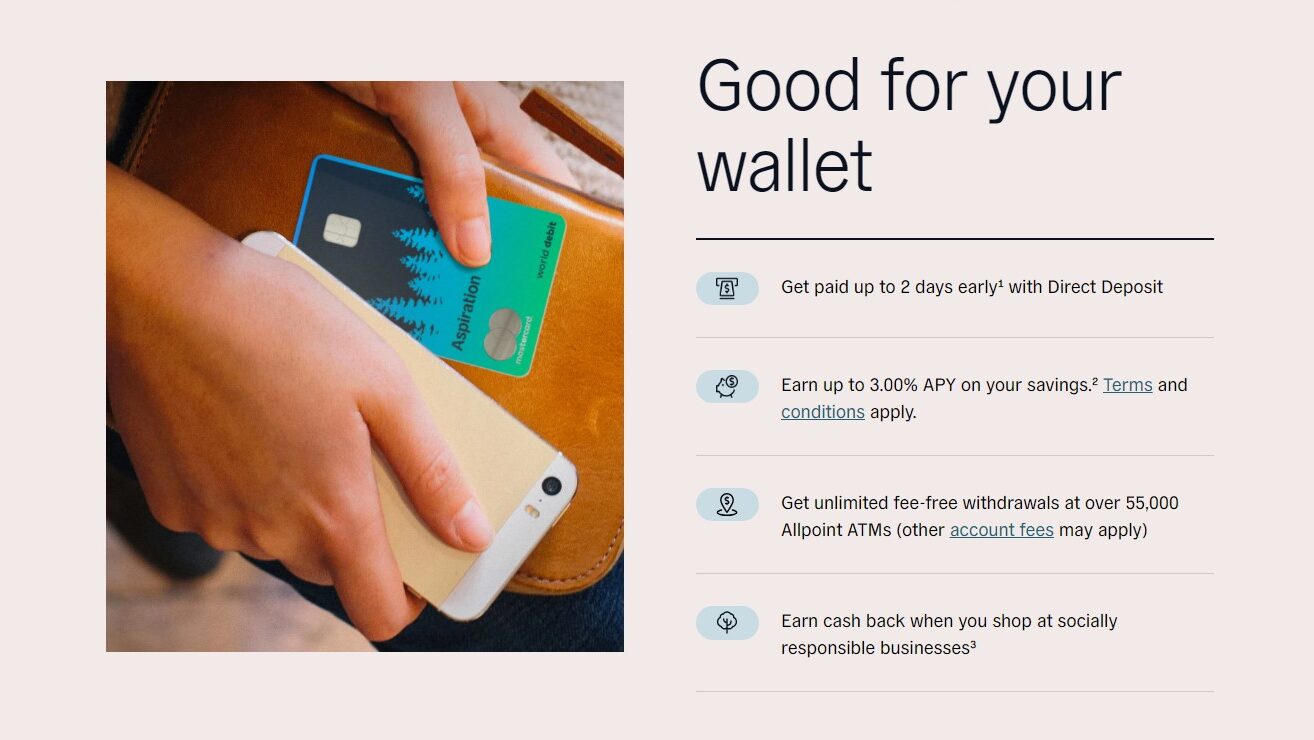

- High-Yield Savings: Earn a competitive interest rate on your savings to grow your money.

- Cash Back Rewards: Earn cash back rewards supporting sustainable businesses with your everyday purchases.

- Low or No Fees: Enjoy a transparent fee structure with minimal or no monthly fees.

- Mobile-First Banking: Manage your finances seamlessly through the user-friendly Aspiration mobile app.

- Socially Responsible Investing (Optional): Invest your money in companies committed to positive social and environmental impact (with Aspiration Invest, a separate service).

Who is Aspiration For?

Aspiration caters to individuals who want their banking experience to reflect their values:

- Eco-Conscious Consumers: Support sustainability efforts and offset your carbon footprint through your banking choices.

- Socially Responsible Investors: Align your investments with your values (with Aspiration Invest).

- Savers and Budgeters: Benefit from competitive interest rates and fee-transparency.

- Tech-Savvy Users: Embrace the convenience of mobile-centric banking.

- Anyone Who Wants to Make a Difference: Aspiration allows you to bank with a purpose and contribute to a positive future.

Aspiration goes beyond traditional banking, offering a sustainable and rewarding platform designed to empower you to manage your money while making a positive social and environmental impact. With its focus on sustainable practices, financial well-being, and rewarding eco-conscious choices, Aspiration is the perfect choice for individuals seeking to bank responsibly and build a brighter future.