Overview

What is Betterment?

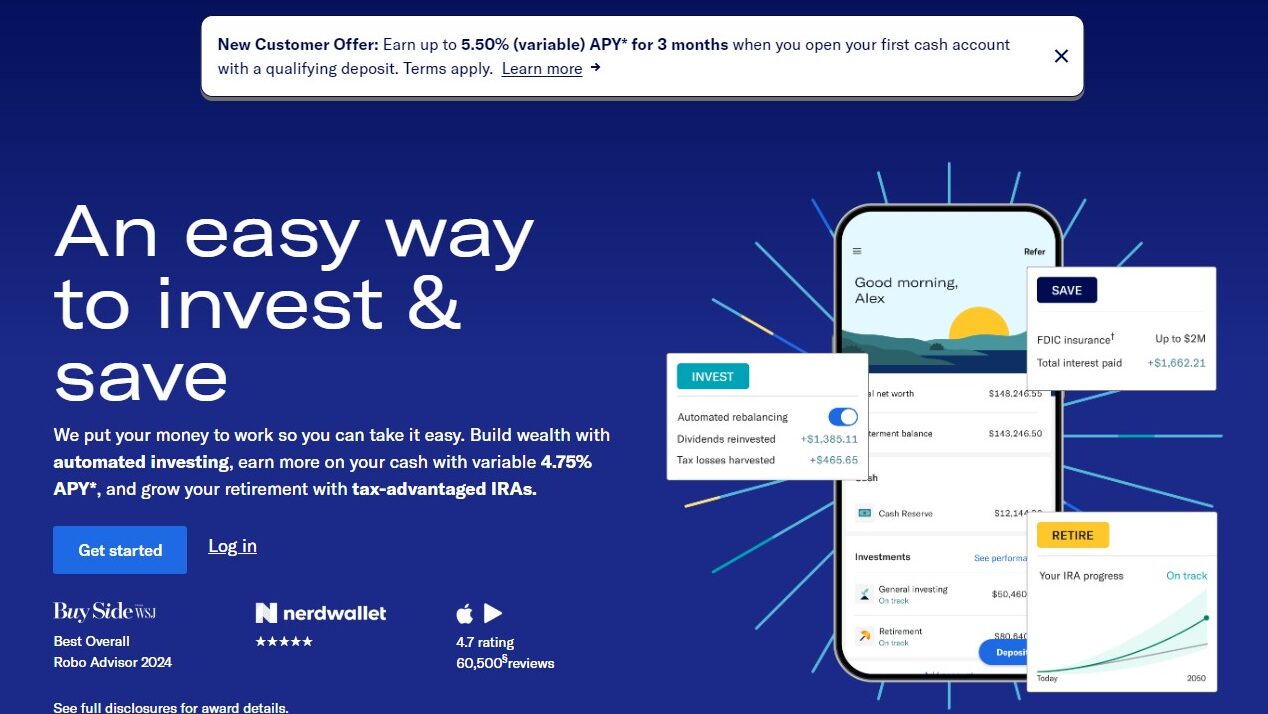

Betterment is a leading digital investment advisor (robo-advisor) offering a user-friendly and automated wealth management platform. Betterment utilizes automated investing strategies and a team of investment professionals to help individuals achieve their financial goals.

Why Use Betterment?

Betterment stands out from traditional investment advisors by offering several key features:

- Automated Investing: Betterment utilizes a robo-advisor approach to create and manage a diversified investment portfolio tailored to your individual risk tolerance and financial goals. This allows for a hands-off approach to investing, freeing you from the burden of actively picking stocks or managing your portfolio.

- Low Fees: Betterment charges a low annual management fee, significantly lower than traditional financial advisors.

- Tax-Optimization: Betterment offers tax-optimized investment strategies to help you minimize your tax burden and maximize your returns.

- Human Expertise: While automated, Betterment also provides access to a team of certified financial planners (CFPs) for personalized advice and guidance.

- Easy-to-Use Platform: Betterment boasts a user-friendly web and mobile app that makes it simple to monitor your investments, adjust your portfolio allocation, and make additional deposits.

Who is Betterment For?

Betterment caters to a wide range of investors, including:

- Beginners: With its automated investment approach, low minimum investment, and educational resources, Betterment is a perfect platform for those new to investing.

- Busy Professionals: Betterment allows individuals to invest and manage their wealth effortlessly, making it ideal for those who don’t have the time or expertise to actively manage their portfolios.

- Long-Term Investors: Betterment is a suitable option for long-term investors seeking a low-cost and automated approach to build wealth and reach their financial goals over time.

Betterment provides a user-friendly and automated wealth management platform that makes investing accessible and affordable for everyone. With its automated investment strategies, low fees, and access to financial expertise, Betterment empowers users to invest with confidence and grow their wealth over the long term.