Overview

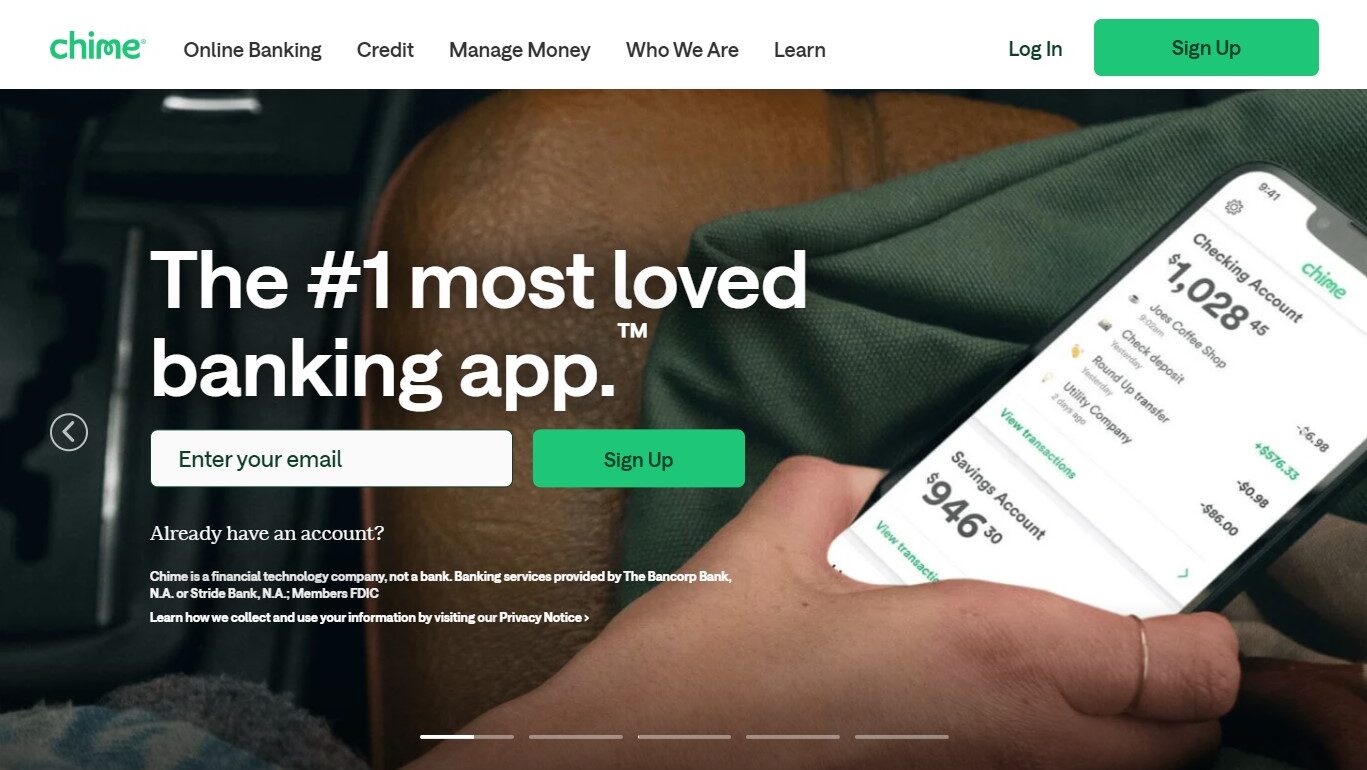

What is Chime?

In today’s digital age, managing your finances shouldn’t be a hassle. Chime isn’t your traditional bank; it’s a modern financial platform designed to empower you with transparency, convenience, and fee-free banking. With a mobile-centric approach and a focus on building your financial health, Chime provides the tools you need to manage your money with confidence and achieve your financial goals.

Why Choose Chime?

Seeking a transparent and convenient banking solution that helps you take control of your finances? Here’s why Chime stands out:

- No Monthly Fees: Enjoy fee-free banking, with no minimum balance requirements.

- Mobile Banking: Manage your finances seamlessly through the user-friendly Chime mobile app.

- Get Paid Early: Receive your paycheck up to 2 days early with direct deposit.

- SpotMe: Avoid overdraft fees with SpotMe, a fee-free overdraft service that advances small amounts to cover debits.

- Security & Reliability: Trust Chime’s commitment to bank-level security to protect your financial information.

- Building Credit: Establish or improve your credit score with Chime’s optional Credit Builder tool.

Who is Chime For?

Chime caters to individuals seeking a modern and accessible banking experience:

- Young Professionals: Manage your finances on the go with the convenient mobile app.

- Budget-Conscious Individuals: Benefit from fee-free banking and avoid unnecessary charges.

- People Building Credit: Start or improve your credit score with the Credit Builder tool.

- Anyone Seeking Transparency: Enjoy clear and understandable account information with no hidden fees.

- Tech-Savvy Users: Embrace the convenience of mobile-centric banking.

Chime goes beyond traditional banking, offering a transparent and user-friendly platform designed to empower you to manage your money. With its focus on convenience, fee-free banking, and financial tools, Chime is the perfect choice for individuals seeking to take control of their finances and build a brighter financial future.