Overview

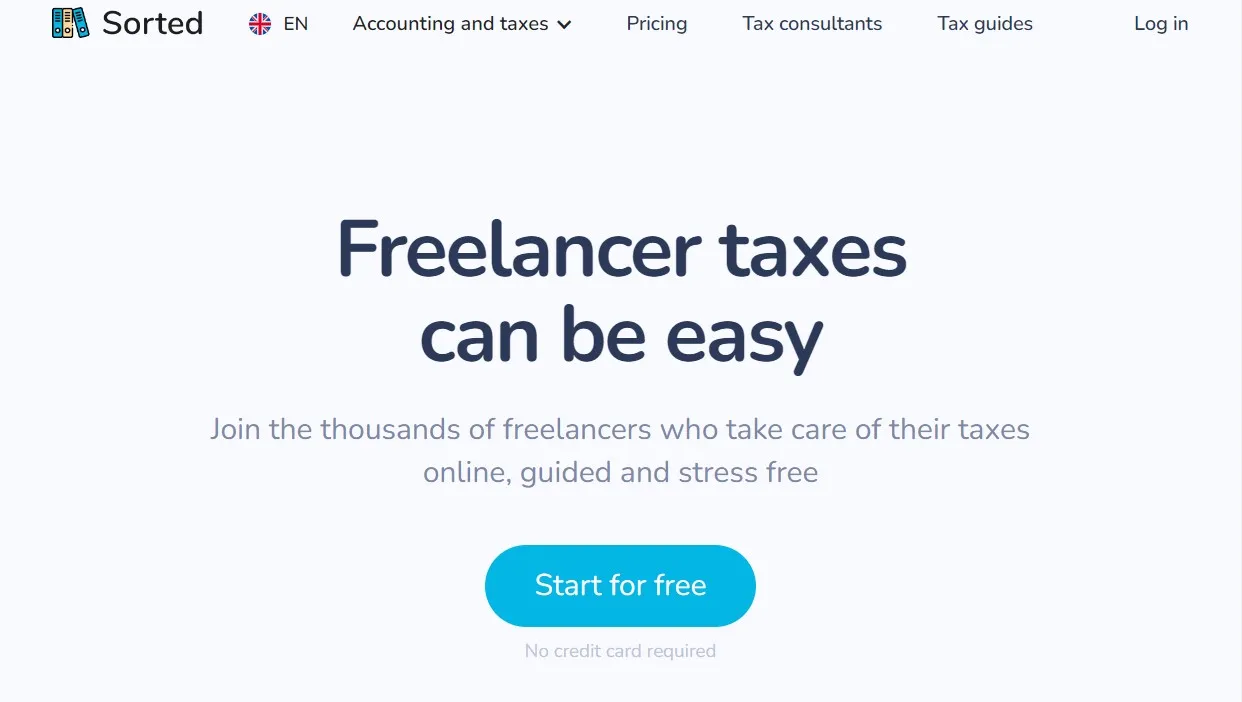

What is Sorted?

Sorted is a comprehensive bookkeeping and tax reporting tool designed specifically for self-employed individuals. It simplifies financial management by offering features that streamline the processes of tracking expenses, invoicing clients, and preparing tax reports. Sorted aims to take the hassle out of bookkeeping, allowing users to focus more on their business and less on paperwork.

Why Use Sorted?

In the realm of bookkeeping and tax reporting tools for the self-employed, Sorted stands out by:

- Automated Bookkeeping: Sorted automates many of the bookkeeping tasks, such as tracking expenses and categorizing transactions. This reduces the manual effort required and minimizes the risk of errors.

- Easy Invoicing: With Sorted, creating and sending invoices to clients is quick and straightforward. It also helps in tracking the status of invoices and managing payments efficiently.

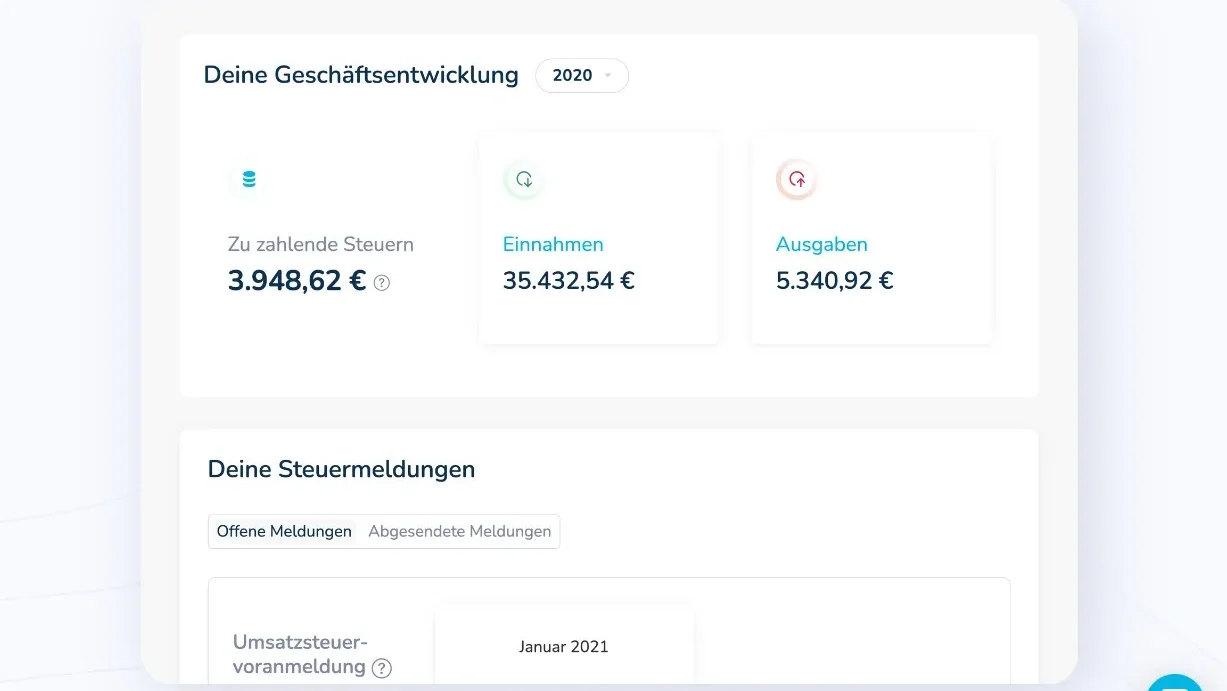

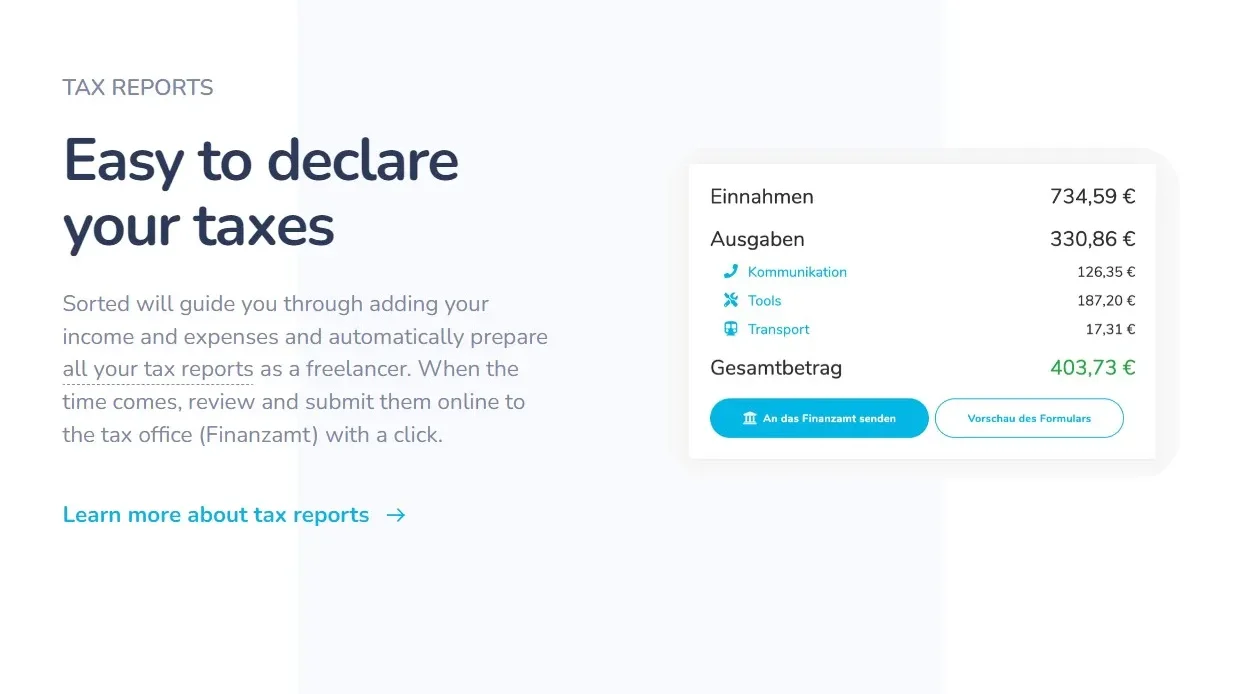

- Tax Reporting: Sorted simplifies tax reporting by providing features that help in preparing and submitting tax returns accurately and on time. It ensures compliance with tax regulations and reduces the stress associated with tax season.

- Financial Insights: Sorted offers financial insights and reports, allowing users to get a clear picture of their financial health. This helps in making informed business decisions and planning for the future.

Who is Sorted For?

Sorted caters to a diverse range of self-employed individuals, including:

- Freelancers: Freelancers can use Sorted to manage their finances efficiently, track project expenses, and ensure timely invoicing and payment collection.

- Consultants: Consultants benefit from Sorted’s ability to handle multiple clients and projects, providing a clear view of income and expenses related to each engagement.

- Small Business Owners: Small business owners can rely on Sorted for comprehensive bookkeeping and tax reporting, enabling them to focus more on growing their business rather than managing finances.

- Independent Contractors: Independent contractors can use Sorted to keep their financial records organized, track job-related expenses, and simplify their tax reporting process.

In conclusion, Sorted is an invaluable tool for self-employed individuals looking to streamline their bookkeeping and tax reporting. Whether you’re a freelancer, consultant, small business owner, or independent contractor, Sorted provides the features and insights needed to manage your finances effectively and stay compliant with tax regulations.