What is Braintree?

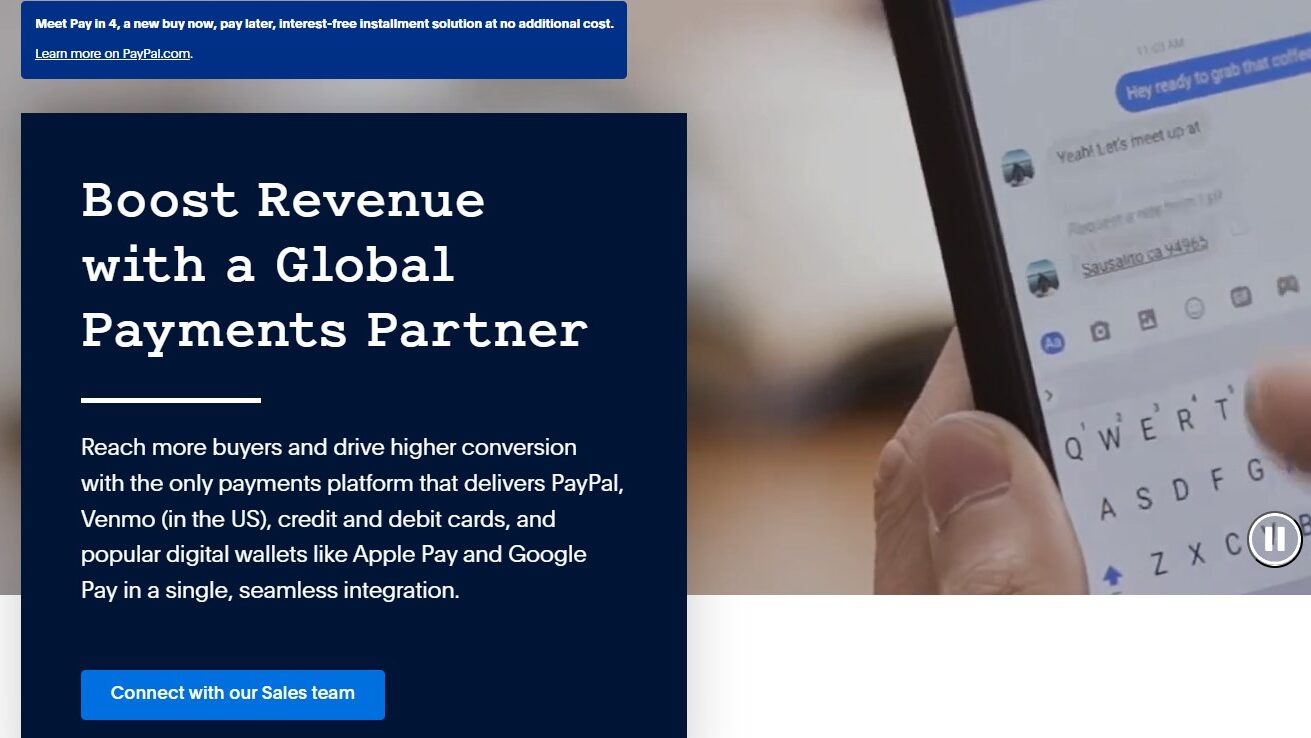

Navigating the complexities of online payment processing can be a headache. Braintree cuts through the clutter, offering a comprehensive and secure payment solution designed to streamline your business operations. Accept a wide range of payment methods, including credit cards, debit cards, PayPal, Venmo (US only), and more, all through a single integration. With its robust fraud prevention tools and intuitive dashboard, Braintree empowers you to focus on growing your business, not managing your payments.

Why Choose Braintree?

Seeking a reliable and secure payment processing solution that simplifies online transactions? Here’s why Braintree stands out:

- All-in-One Platform: Accept a variety of payment methods through a single integration, streamlining your checkout process.

- Global Reach: Process payments from customers around the world, supporting a wide range of currencies.

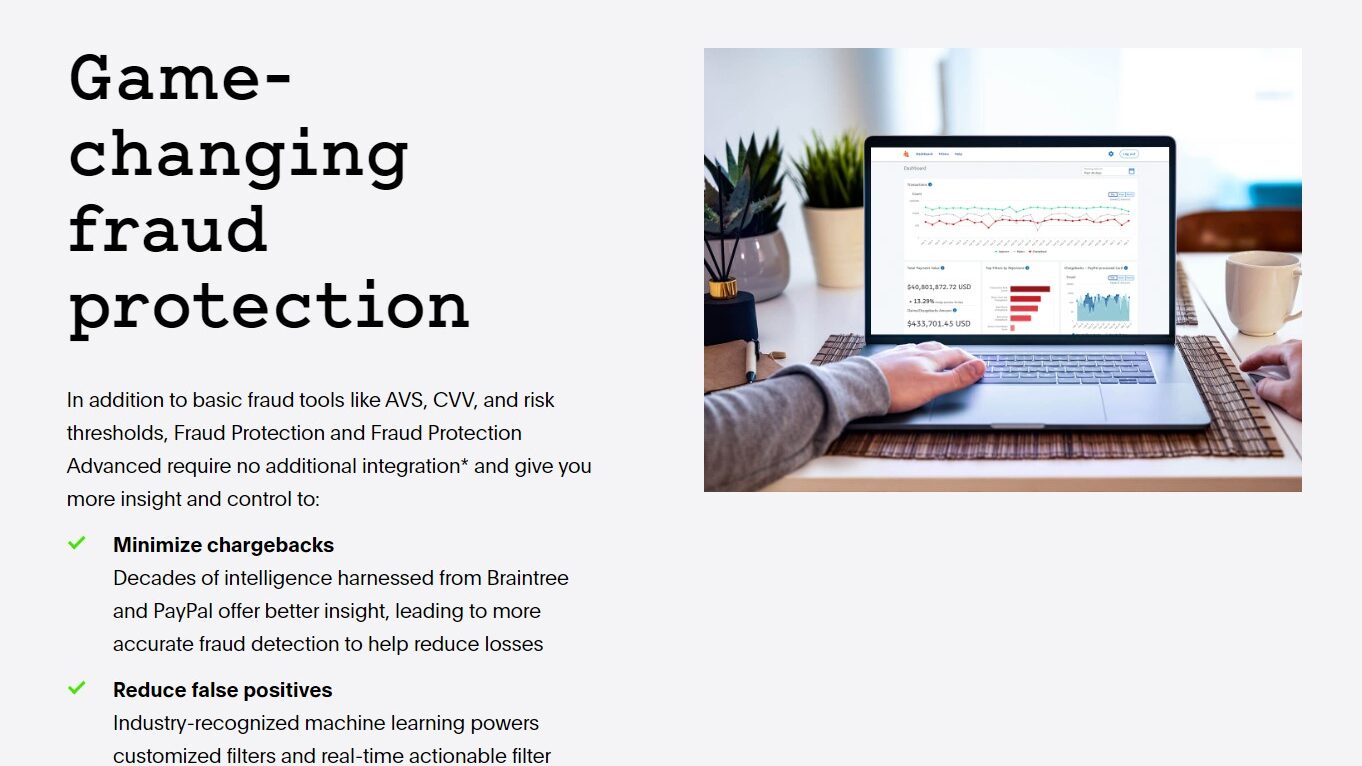

- Advanced Fraud Protection: Benefit from industry-leading fraud prevention tools to safeguard your business.

- Seamless Integrations: Braintree easily integrates with major ecommerce platforms and payment gateways.

- Detailed Reporting: Gain valuable insights into your transaction data with Braintree’s intuitive dashboard.

- Scalable Solutions: Whether you’re a startup or an established business, Braintree offers flexible solutions to accommodate your growth.

Who is Braintree For?

Braintree caters to businesses of all sizes seeking a streamlined and secure payment processing solution:

- Ecommerce Businesses: Accept online payments quickly and securely to boost sales and improve customer experience.

- Subscription Businesses: Simplify recurring billing and manage subscriptions with ease.

- Marketplaces & On-Demand Services: Enable seamless transactions within your marketplace or on-demand platform.

- Mobile App Developers: Integrate secure in-app payments to monetize your mobile app.

- Freelancers & Agencies: Accept payments professionally and efficiently from your clients.

Braintree goes beyond basic payment processing, offering a powerful and secure platform designed to simplify your business operations. With its comprehensive features, global reach, and robust security, Braintree empowers businesses to accept payments with confidence and focus on growth.