Overview

What is Affirm for Business?

In today’s competitive retail landscape, offering convenient payment options is no longer a nicety – it’s a necessity. Affirm for Business isn’t just another payment processor; it’s a powerful sales tool that lets you offer flexible financing to your customers, increasing their buying power and driving conversions. With Affirm, your customers can split their purchases into manageable payments, without hidden fees or surprise interest. It is one of the top solutions in the Fintech and Banking industry.

Why Choose Affirm for Business?

Looking to boost sales and attract new customers by offering flexible payment solutions? Here’s why Affirm for Business stands out:

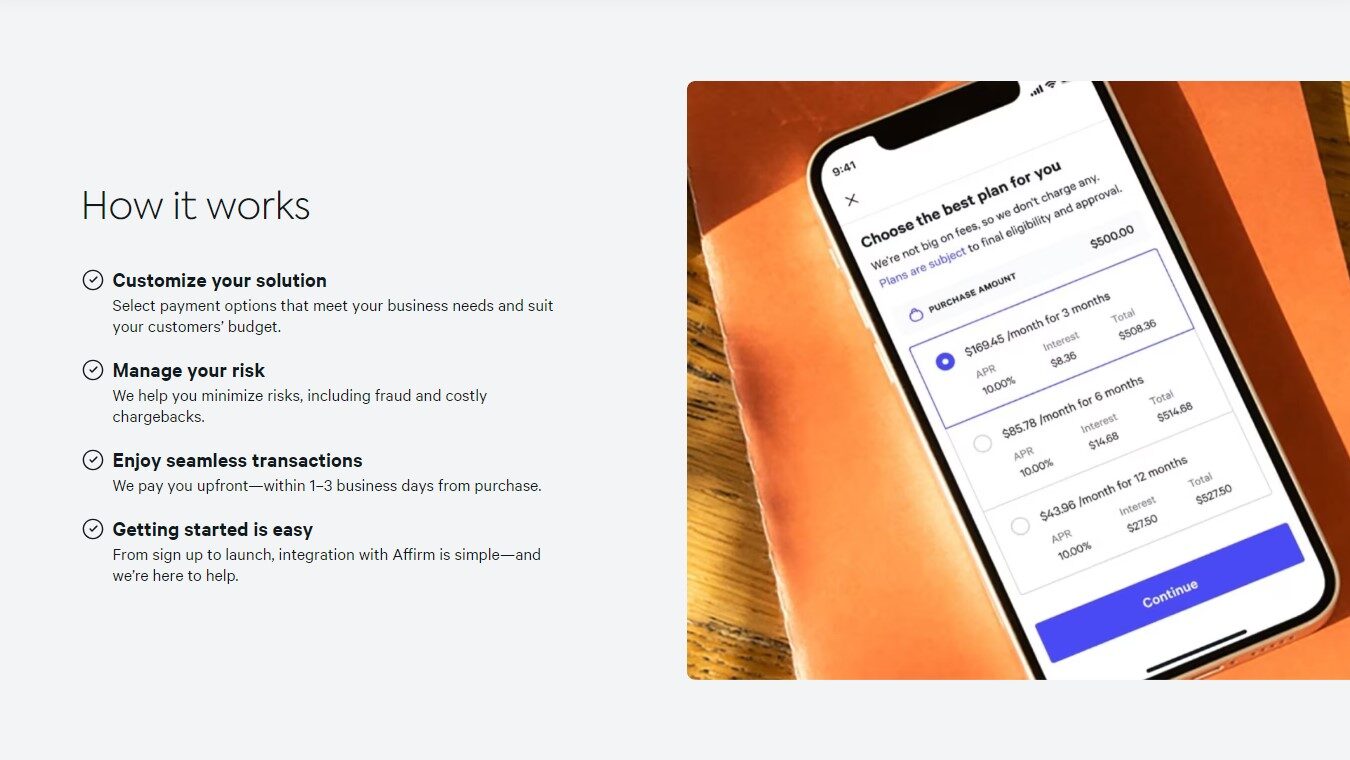

- Increased Sales & Conversions: Empower your customers to purchase higher-value items by splitting their payments into affordable installments.

- Improved Customer Satisfaction: Offer a transparent and convenient payment option that builds trust and loyalty with your customers.

- Fast and Easy Integration: The Affirm platform integrates seamlessly with your existing online store, making it easy to get started.

- No Risk for You: Affirm takes on the credit risk, so you get paid upfront for every sale.

- Targeted Marketing Tools: Utilize Affirm’s marketing tools to reach new customers interested in flexible financing options.

- Fraud Protection: Benefit from advanced fraud prevention measures to protect your business.

Who is Affirm For Business?

Affirm for Business empowers businesses of all sizes to unlock the power of flexible financing:

- Ecommerce Businesses: Increase conversions and average order value by offering buy now, pay later options.

- High-Ticket Retailers: Make expensive products more accessible to customers with flexible payment plans.

- Subscription Businesses: Simplify subscription sign-ups and encourage recurring revenue with manageable installments.

- Service Providers: Allow customers to finance larger service packages over time.

- Business-to-Business (B2B) Companies: Offer flexible financing options to your B2B customers.

Affirm for Business goes beyond traditional payment processing, providing a powerful tool to boost sales, improve customer satisfaction, and unlock new revenue opportunities. With its seamless integration, flexible payment options, and fraud protection, Affirm for Business is the perfect choice for businesses seeking to empower their customers and drive growth