Overview

What is Stripe?

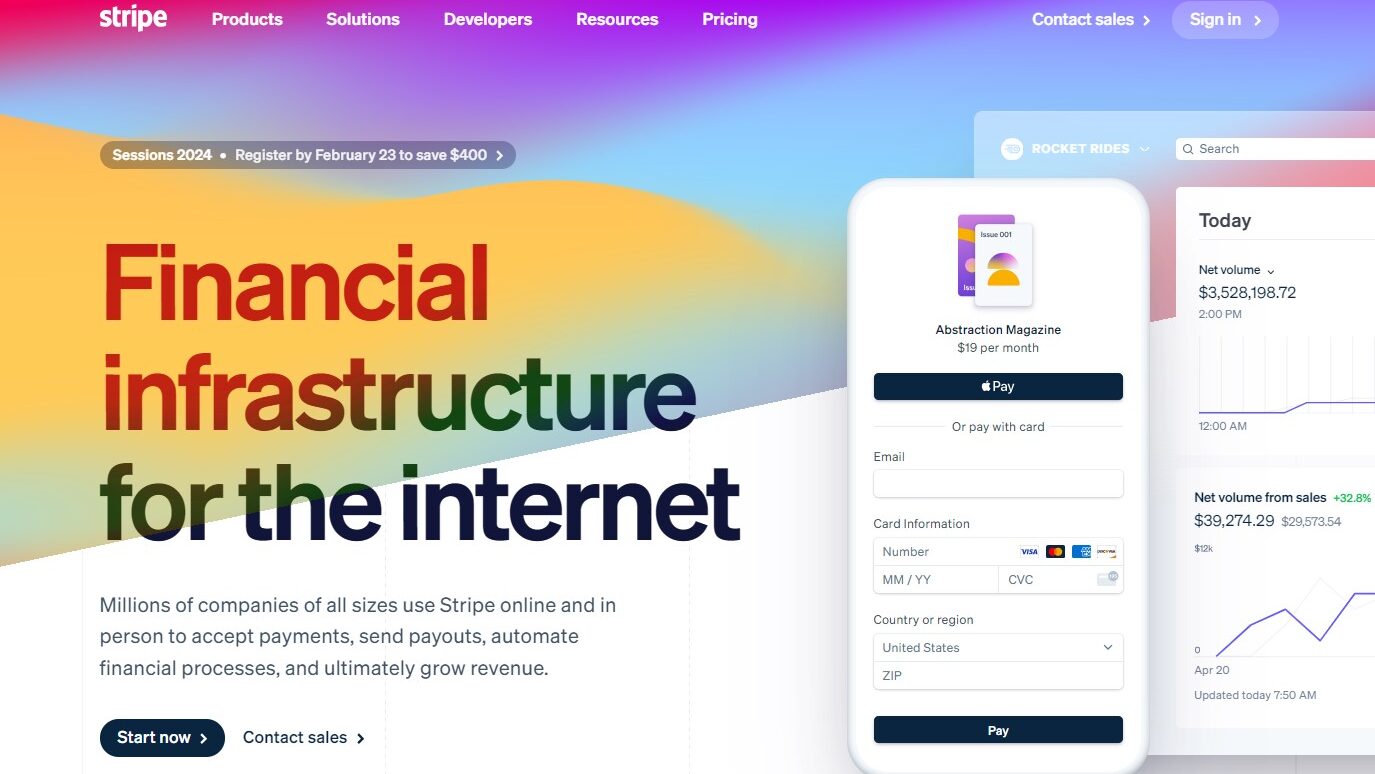

Forget the complexities of managing multiple payment processors and fragmented financial tools. Stripe isn’t just a payment gateway; it’s a comprehensive financial ecosystem that empowers businesses of all sizes to accept payments, manage subscriptions, issue payouts, and simplify financial operations. Ditch the limitations of traditional payment solutions and cumbersome integrations – Stripe provides a unified and scalable platform, allowing you to focus on what matters most: growing your business.

Why Choose Stripe?

Struggling with clunky payment systems, high fees, and complex financial management tasks? Stripe offers a compelling solution:

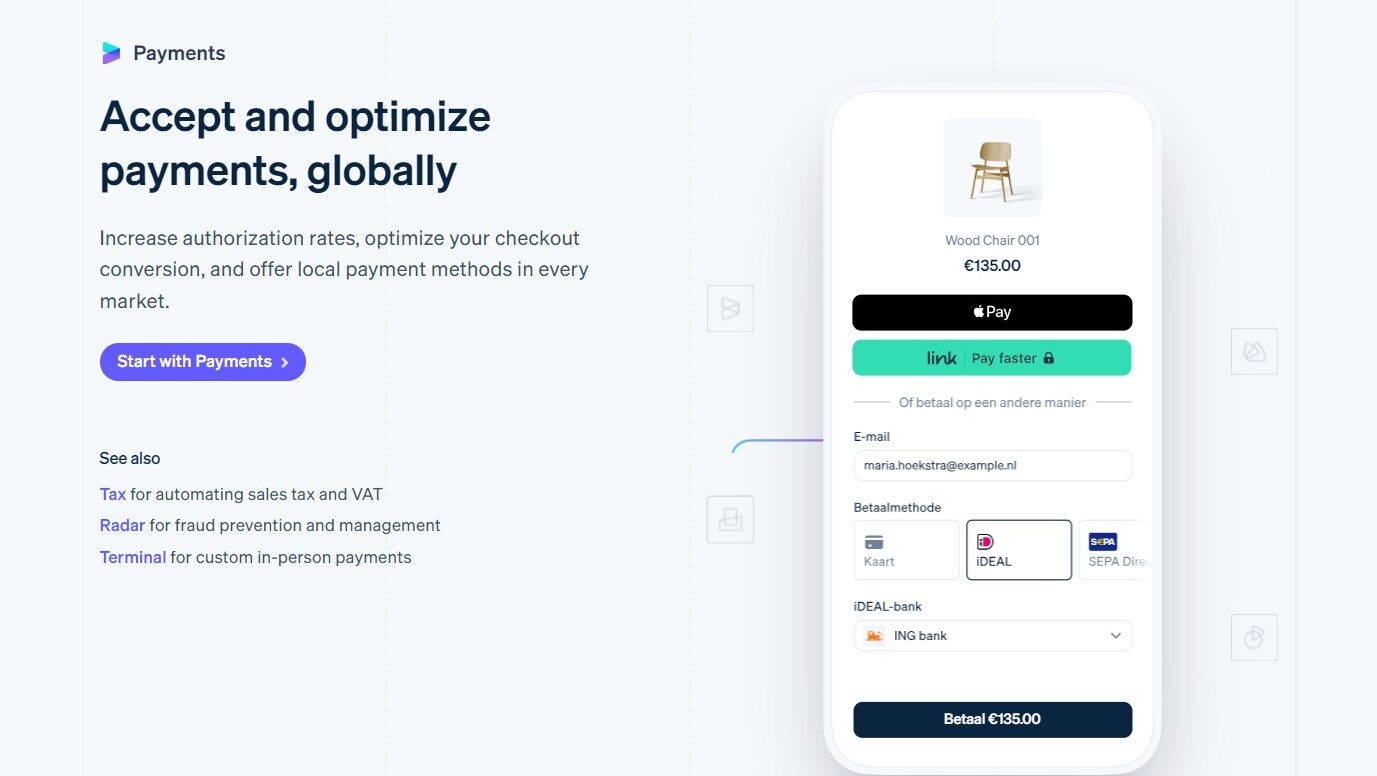

- Seamless payment acceptance: Accept all major credit cards, debit cards, and Apple Pay in a variety of currencies, with instant settlements and transparent pricing.

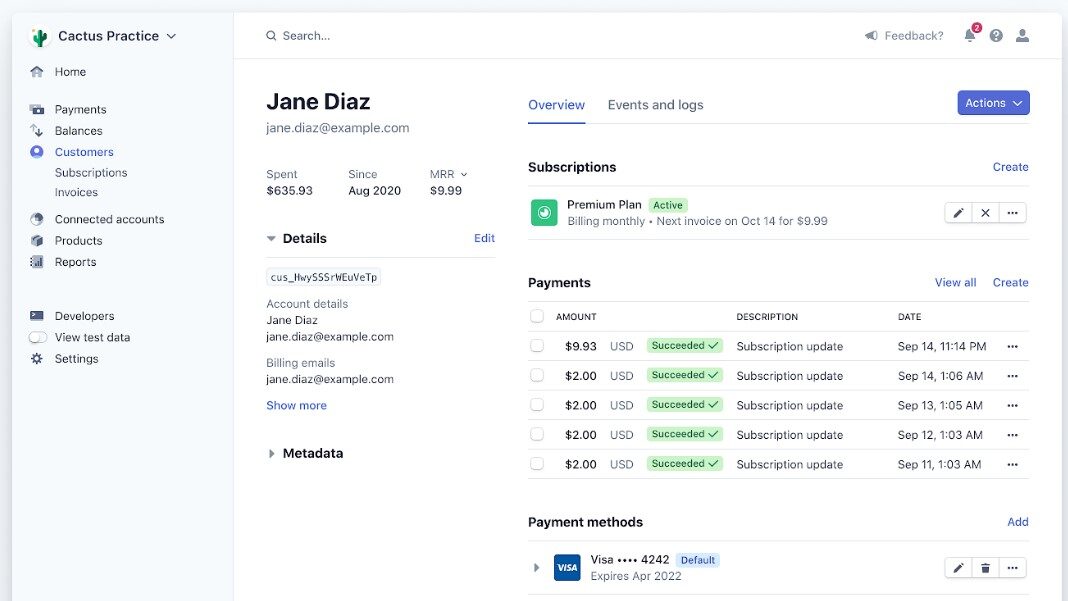

- Frictionless subscription management: Create and manage subscription plans with ease, automate recurring billing, and reduce churn with flexible payment options.

- Global reach and scalability: Expand your business internationally with built-in support for multiple currencies and global regulations, scaling effortlessly as your customer base grows.

- Powerful developer tools: Integrate Stripe seamlessly into your existing website or app with robust APIs and SDKs, empowering developers to build custom payment experiences.

- Fraud prevention and security: Benefit from industry-leading fraud detection and security measures, protecting your business and your customers’ financial information.

- Unified financial dashboard: Gain real-time insights into your transactions, fees, and payouts with a centralized dashboard, simplifying financial management and reporting.

Who is Stripe For?

Stripe empowers businesses across various industries and sizes:

- E-commerce businesses: Sell products and services online with a secure and user-friendly checkout experience, boosting conversion rates and revenue.

- Subscription businesses: Create and manage recurring memberships, SaaS products, and other subscription models with ease, driving predictable revenue growth.

- Marketplaces and platforms: Facilitate seamless transactions between buyers and sellers on your platform, ensuring a smooth and secure payment experience for all.

- Freelancers and solopreneurs: Accept payments from clients globally, manage invoices, and get paid quickly and securely, simplifying your financial operations.

- Startups and growing businesses: Scale your payment infrastructure effortlessly with a solution that adapts to your evolving needs, supporting your growth journey.

Stripe stands out as a flexible and adaptable platform that transcends the limitations of traditional payment processors. Its commitment to seamless transactions, global reach, powerful tools, and robust security makes it an attractive choice for businesses of all sizes seeking to streamline their financial operations, accept payments globally, and unlock new growth opportunities. Whether you’re a seasoned entrepreneur or a budding startup, Stripe empowers you to take control of your finances and focus on what you do best: building a thriving business.