Overview

What is Chase for Business?

Managing a business involves a multitude of tasks, and simplifying your finances shouldn’t be one of them. Chase for Business goes beyond traditional banking, offering a suite of comprehensive solutions designed to empower your company’s growth. Ditch the inefficiencies of managing multiple accounts and fragmented financial tools. Chase for Business offers a centralized platform, innovative digital tools, and dedicated business specialists to streamline your operations and help your business thrive.

Why Choose Chase for Business Banking?

Running a business demands efficient financial management. Here’s why Chase for Business stands out:

- All-In-One Banking Solutions: Consolidate your business finances with a checking account, savings account, credit card, and merchant services – all under one roof.

- Streamlined Online Banking: Manage your finances anytime, anywhere with easy-to-use online banking tools that provide real-time insights and simplify transactions.

- Mobile Banking App: Enjoy the flexibility and convenience of managing your business finances on the go with the Chase Business mobile app.

- Dedicated Business Specialists: Benefit from the guidance and support of knowledgeable business specialists who understand your unique needs and goals.

- Financial Management Tools: Leverage online tools and resources to gain insights into your cash flow, make informed decisions, and optimize your business finances.

- Security and Reliability: Chase offers robust security measures to protect your business finances and ensure peace of mind.

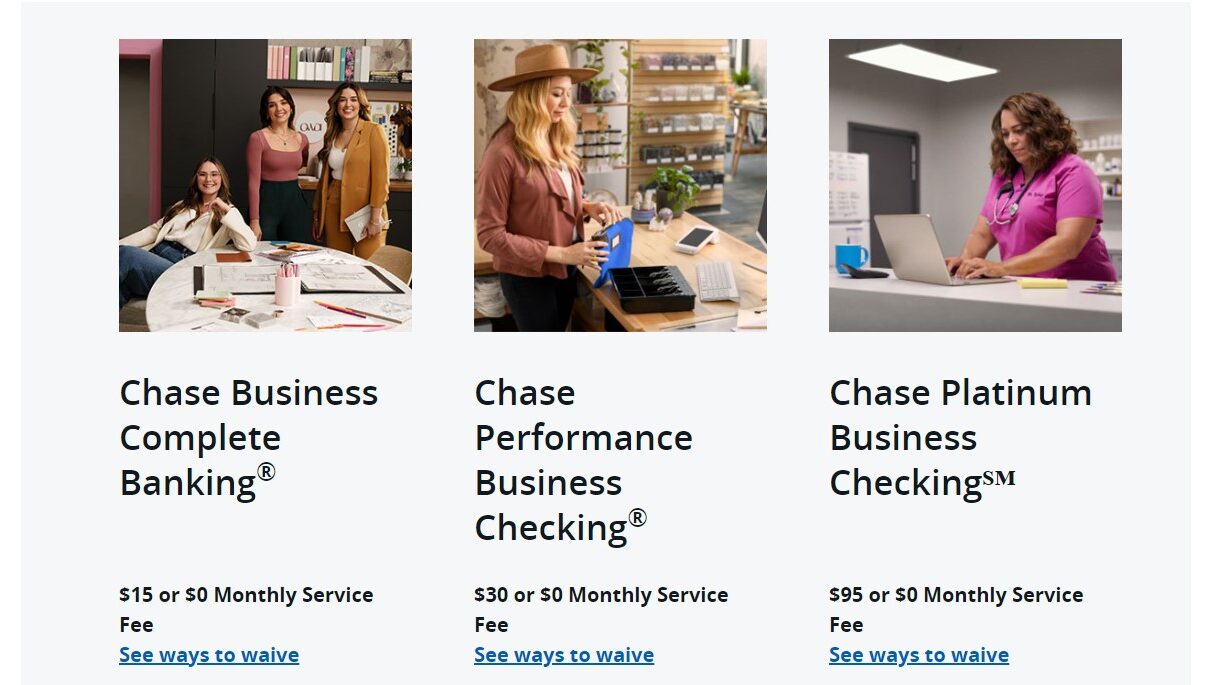

- Scalable Solutions: As your business grows, Chase for Business adapts to your evolving needs with a variety of account options and services.

Who is Chase for Business Banking For?

Chase for Business caters to entrepreneurs and business owners of all sizes:

- Start-Ups and Early-Stage Businesses: Get the tools and support you need to establish a strong financial foundation for your new venture.

- Growing Businesses: Benefit from scalable solutions that adapt to your increasing financial complexity.

- Established Businesses: Enjoy the convenience and security of managing all your business finances in one place.

- Businesses in All Industries: Chase for Business offers solutions tailored to a wide range of industries, from retail and hospitality to professional services.

Chase for Business stands out as a trusted partner for business banking solutions. Its commitment to comprehensive solutions, a centralized banking platform, innovative digital tools, dedicated business specialists, and security makes it the perfect choice for businesses seeking to streamline operations, gain financial clarity, and propel their ventures forward.