Explore Pulley

Optimize Equity Management with Pulley – The Ultimate Cap Table Platform

Pulley is a revolutionary platform under the Equity Management Software category, designed to simplify cap table management and equity decisions for startups. Empowering founders and employees with...

Optimize Equity Management with Pulley – The Ultimate Cap Table Platform

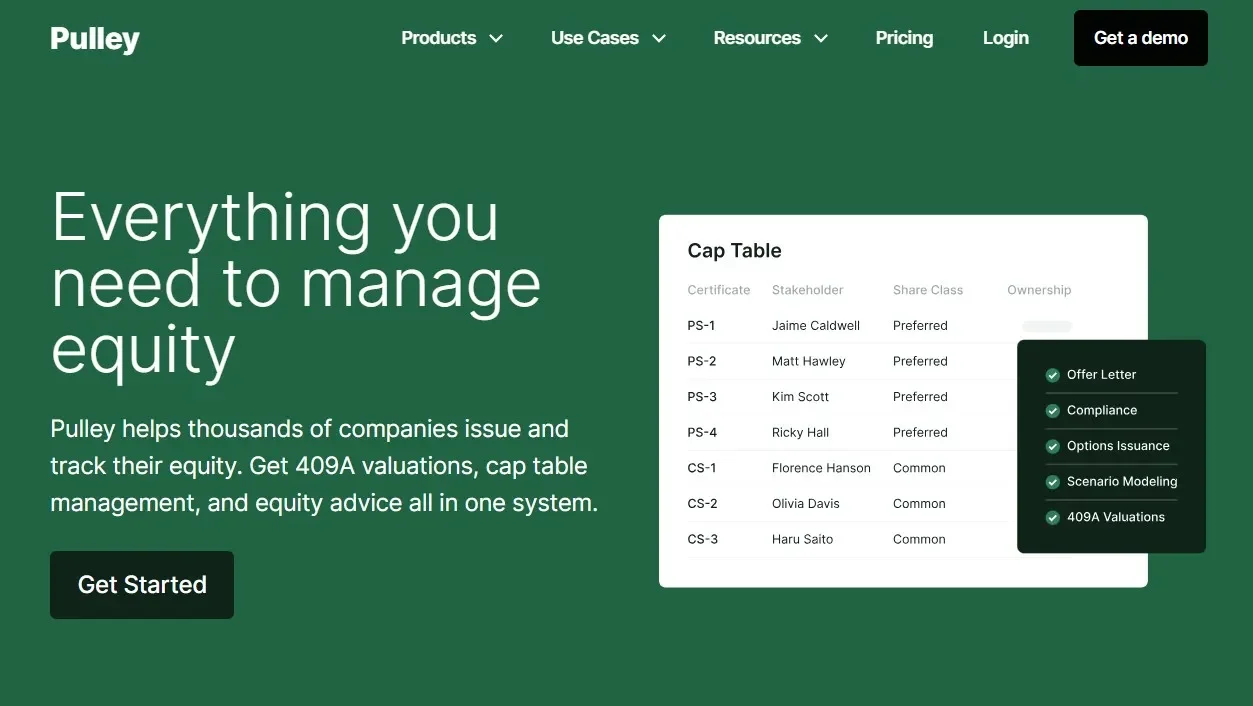

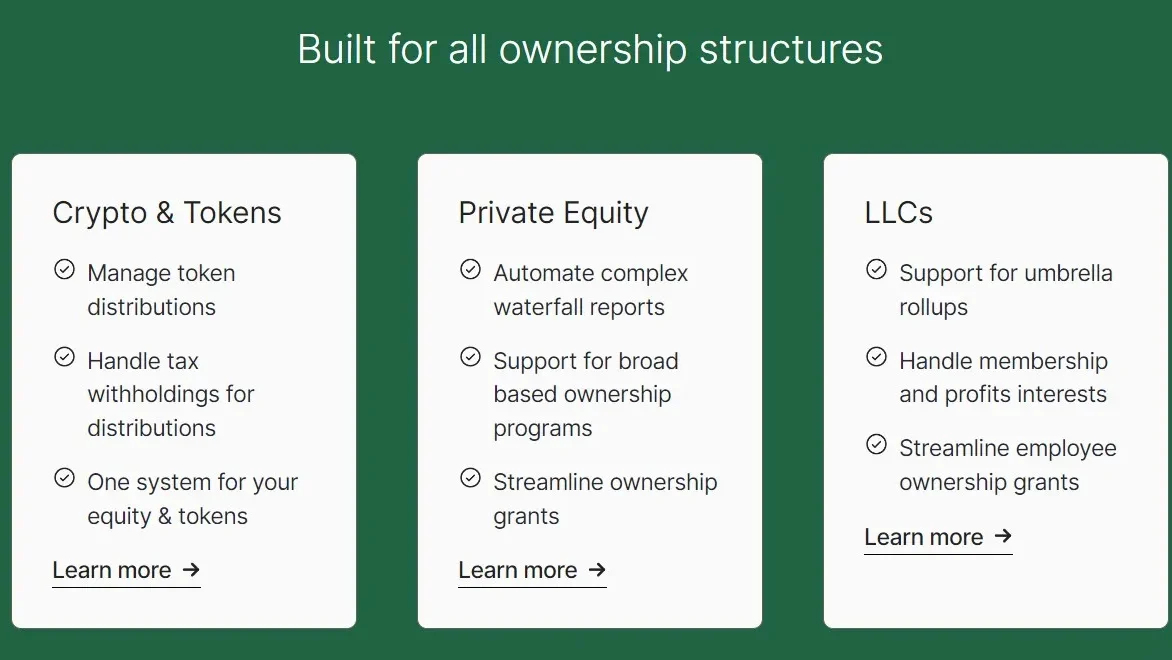

Pulley is a revolutionary platform under the Equity Management Software category, designed to simplify cap table management and equity decisions for startups. Empowering founders and employees with insightful tools, Pulley ensures effective ownership tracking, fundraising modeling, compliance, and transaction management. With its seamless integration capabilities and fast onboarding, it helps businesses focus on scaling without administrative roadblocks.

Why Use Pulley?

Pulley streamlines equity management through its innovative features:

- Comprehensive Cap Table Management: Pulley allows users to manage multiple share classes, options, and associated documents electronically. It enhances accuracy and transparency for stakeholders.

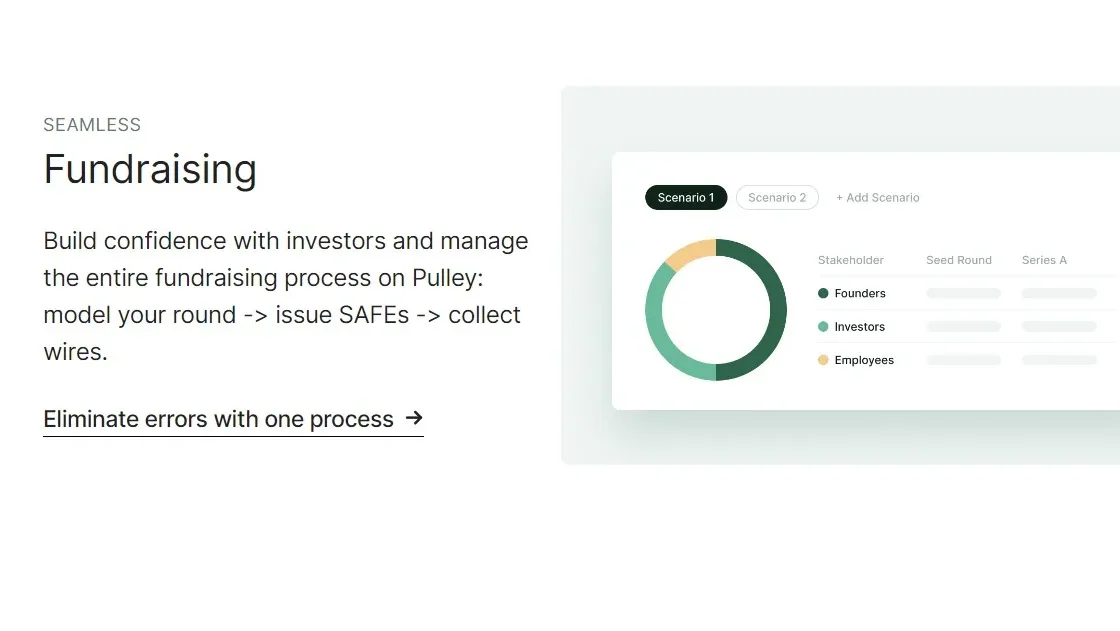

- Fundraising and Equity Modeling: The platform’s fundraise modeler lets users project dilution, model complex scenarios, and analyze potential outcomes efficiently.

- Employee and Candidate Insights: Features like an employee dashboard simplify vesting and taxes, while the offer letter generator effectively communicates equity value to candidates.

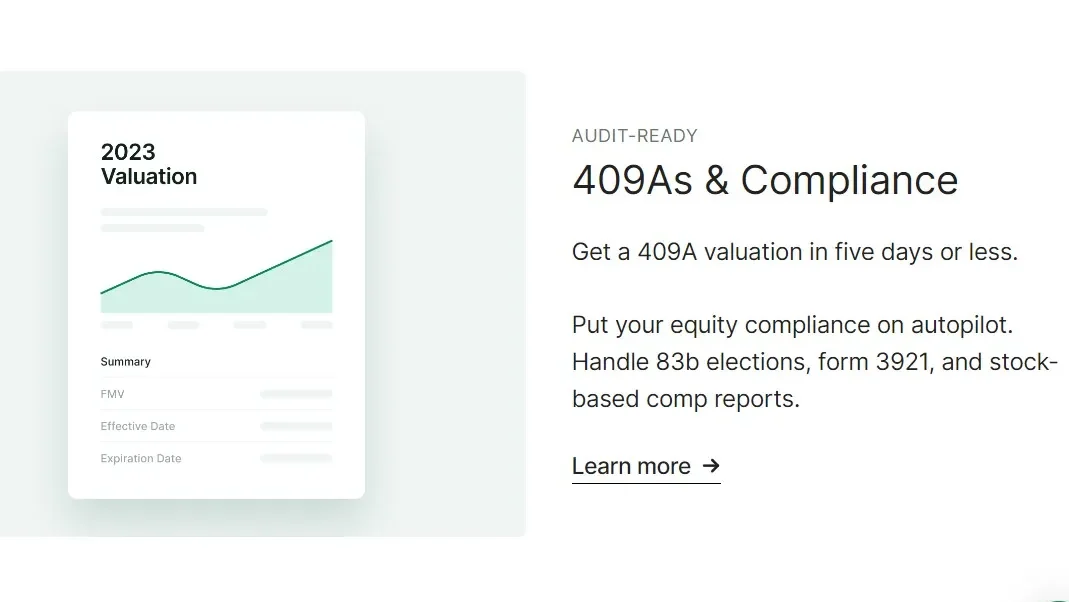

- Compliance Automation: Pulley offers rapid 409A valuations and automates tax form generations, including Form 3921 and 83(b) elections, ensuring startups stay compliant with minimal effort.

- Integration and Workflow Optimization: Integrate Pulley with your HRIS for seamless updates, enhanced document tracking, and unified workflows.

Who is Pulley For?

Pulley serves a broad spectrum of users:

- Startups: Emerging businesses seeking scalable cap table solutions find Pulley’s “Startup” and “Growth” plans ideal for managing early and mid-stage equity needs.

- Established Companies: Fast-growing organizations benefit from features like priority onboarding, ASC 718 reporting, and waterfall modeling under Pulley’s “Custom” plan.

- Founders and Investors: Pulley caters to decision-makers by providing precise equity data and actionable insights to guide fundraising and ownership tracking decisions.

- Employees and Candidates: Employees are kept motivated through transparency in equity allocation and vesting, ensuring clarity on long-term incentives.

In conclusion, Pulley redefines equity management by delivering comprehensive, user-friendly tools tailored to every growth stage of a startup. Whether you’re crafting your first cap table, managing fundraising strategies, or ensuring compliance, Pulley is an invaluable partner for businesses striving to build strong equity foundations. With scalable plans, quick onboarding, and remarkable support, Pulley ensures your cap table management remains effortless and impactful.

Pulley Satisfaction and Score

Pulley Score and Review

See Pulley pros cons, the conclusions and the subscribed score

See how Pulley works on Video

Pulley Pricing and Features

Pulley Product Experience

Steps to Cancel Pulley Subscription

Pulley Pricing

Simplifying Equity Management: Concluding Your Use of Pulley

As your needs for cap table management evolve or you explore alternative solutions, Pulley offers a streamlined process to conclude your engagement with their comprehensive platform. To ensure a seamless transition and efficient equity tracking, please visit this page.

Most frequent question about Pulley

Pulley is a comprehensive cap table management platform tailored for startups and founders. It streamlines equity management by offering an all-in-one system for 409A valuations, cap table management, and equity advice. With Pulley, startups can efficiently issue and track their equity, ensuring compliance and transparency throughout their growth journey.

Pulley facilitates 409A valuations, a crucial process for startups to determine the fair market value of their common stock. Through its platform, Pulley connects companies with experienced valuation experts who perform thorough assessments based on industry standards and regulatory requirements. This ensures startups receive accurate valuations that comply with IRS guidelines, helping them make informed decisions regarding equity compensation and fundraising.

Pulley offers robust features for cap table management, allowing startups to easily track and manage their equity ownership structure. With Pulley, users can input and update shareholder information, issue new equity grants, manage option exercises and terminations, and track ownership dilution over time. Additionally, Pulley provides real-time visibility into the company’s capitalization table, empowering founders and stakeholders with actionable insights for strategic decision-making.

Pulley offers equity advice to startups through its platform and expert support services. Whether startups are navigating complex equity-related matters or seeking guidance on equity compensation strategies, Pulley’s team of experienced professionals provides personalized advice tailored to their specific needs. From understanding the implications of equity grants to optimizing equity structures for growth, Pulley equips startups with the knowledge and expertise to effectively manage their equity.

Yes, Pulley caters to startups of all sizes, from early-stage ventures to rapidly growing companies. Whether a startup is just beginning its journey or has already raised multiple rounds of funding, Pulley offers scalable solutions to meet their evolving equity management needs. With its user-friendly interface, comprehensive features, and expert support, Pulley empowers startups to efficiently manage their equity from inception to exit.

Try these alternatives of Pulley

Wells Fargo offers personalized banking solutions, digital convenience, expert guidance, and nationwide support. Tailored to individuals, families, homeowners, small businesses, and investors, it empowers financial control and growth with security and reliability.