Overview

What is Wells Fargo?

In today’s dynamic financial landscape, you deserve a banking partner that understands your needs. Wells Fargo goes beyond traditional banking, offering a suite of personalized financial solutions designed to help you manage your money, grow your savings, and plan for the future. With a focus on digital convenience and expert guidance, Wells Fargo empowers you to take control of your finances with confidence.

Why Choose Wells Fargo?

Seeking a reliable and innovative banking partner to support your financial goals? Here’s why Wells Fargo stands out:

- Personalized Solutions: Benefit from a wide range of banking products and services, tailored to your individual financial needs and goals.

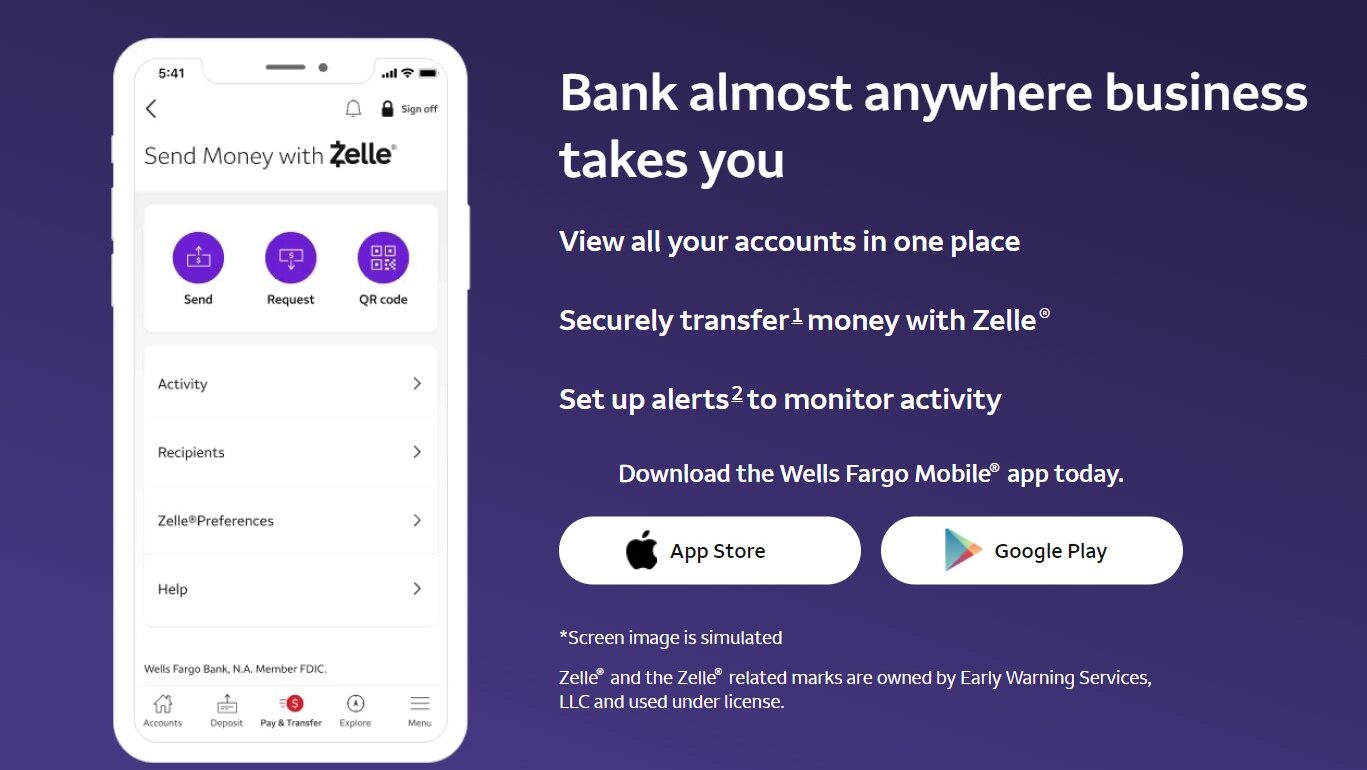

- Digital Banking Convenience: Manage your accounts seamlessly through online banking, mobile banking, and a network of ATMs.

- Financial Guidance: Access financial resources and expert advice to help you make informed financial decisions.

- Branch Network & Customer Support: Enjoy the security and personalized service of a nationwide network of branches and dedicated customer support representatives.

- Security & Reliability: Trust Wells Fargo’s commitment to security and data protection, ensuring your financial information remains safe.

Who is Wells Fargo For?

Wells Fargo caters to individuals and families seeking a comprehensive and supportive banking experience:

- Individuals & Families: Manage everyday banking needs, from checking and savings accounts to online bill pay and money transfers.

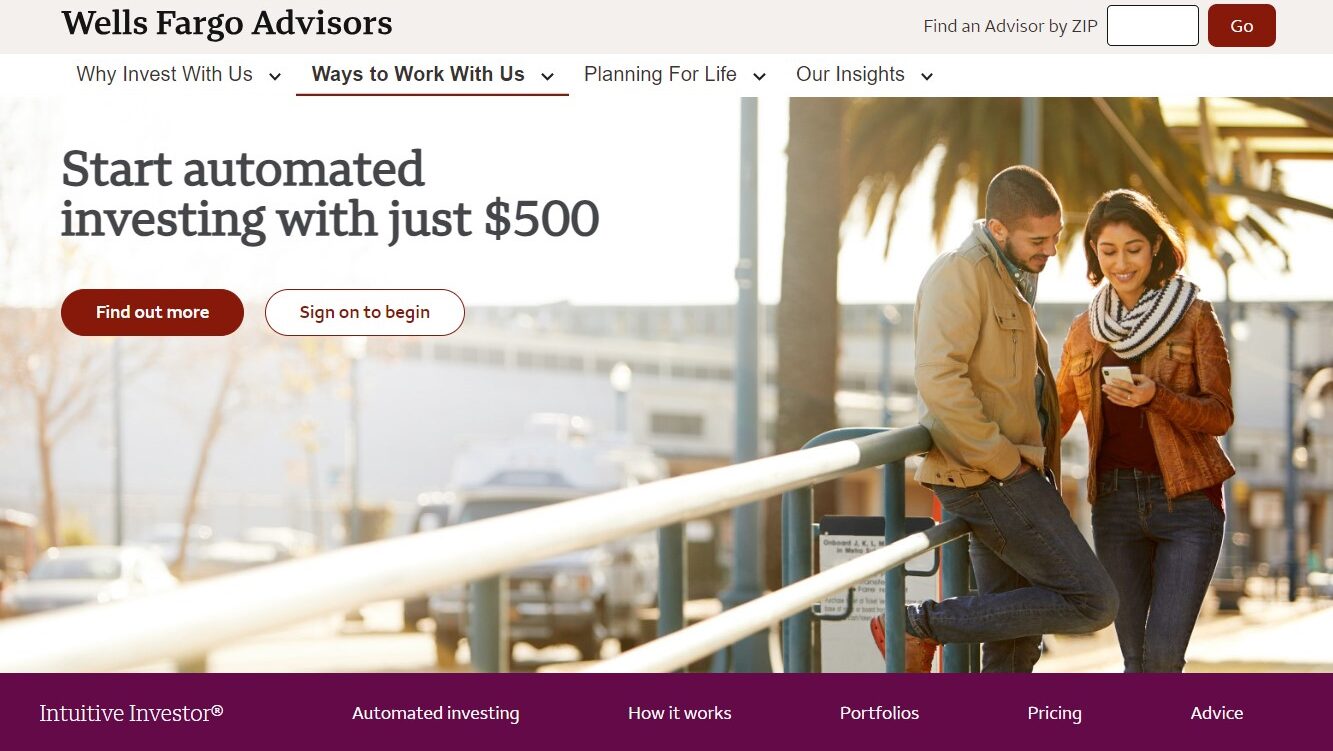

- Savers & Investors: Explore savings accounts, certificates of deposit (CDs), and investment products to help you grow your wealth.

- Homeowners & Borrowers: Access mortgage loans, home equity lines of credit, and other financing options to achieve your homeownership goals.

- Small Business Owners: Benefit from business banking solutions, including checking accounts, lines of credit, and merchant services.

- Tech-Savvy Users: Enjoy the convenience of digital banking tools to manage your finances on the go.

Wells Fargo goes beyond a traditional bank, offering a personalized approach to financial management. With a combination of digital convenience, expert guidance, and a wide range of products and services, Wells Fargo empowers you to achieve your financial goals with confidence.