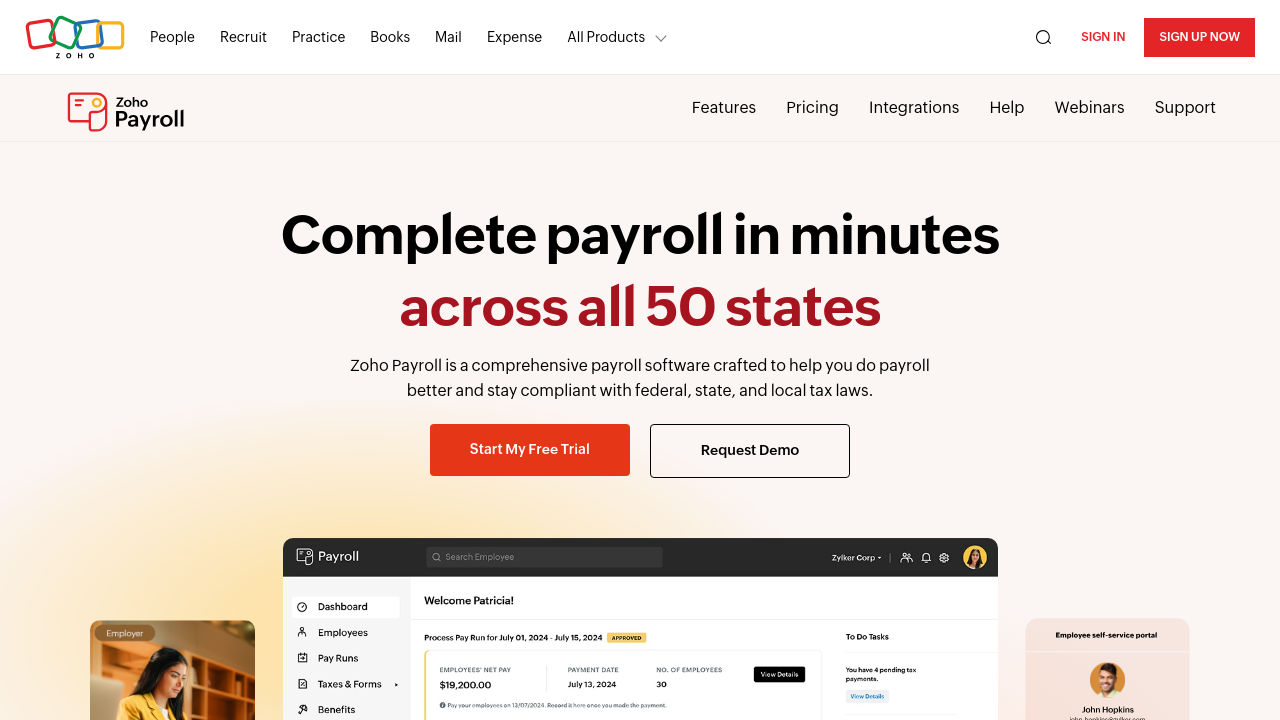

Zoho Payroll is a cloud‐based payroll software designed with simplicity, automation, and full compliance in mind. Ideal for businesses ranging from small startups to large enterprises, Zoho Payroll streamlines the entire payroll process while ensuring adherence to labour and statutory laws across India, UAE, USA, and Saudi Arabia.

Product Overview

Zoho Payroll automates salary computations, tax calculations, and deductions with ease. Its uniquely integrated payroll ecosystem enables seamless automation of accounting and expense management. The solution is equipped with a comprehensive employee self-service portal—accessible via both web and mobile—that empowers employees to view, manage, and securely store their pay stubs, tax documents, and related financial records.

Designed with user-friendly interfaces and robust features, Zoho Payroll helps organizations reduce manual work and minimize errors. The software simplifies compliance by automatically calculating statutory deductions and generating payslips and detailed reports necessary for filing returns. With direct deposit functionality enabled through partner banks, timely salary payments become a hassle-free process.

Key Features

- Automatic calculation of salaries, taxes, and deductions

- Compliance with region-specific regulations—be it Income Tax, EPF, and ESI in India; pension, gratuity, and WPS in the UAE; or federal, state, and local taxes in the USA

- Direct salary deposits through integrated banking partners

- A highly intuitive employee self-service portal accessible on both desktop and mobile devices

- Flexible salary structures that accommodate diverse compensation models

- User and role-based access control to safeguard sensitive payroll data

- Approval flows and seamless salary revisions ensuring efficient administrative processes

- Robust integrations with accounting, expense, and HR software for unified business management

The India edition of Zoho Payroll handles compliance with multiple taxes and statutory deductions, while the UAE edition automatically calculates gratuity and pension deductions based on regional mandates. The USA edition focuses on simplifying payroll across all states, generating detailed salary breakdowns, and automating tax remittances.

Why Choose Zoho Payroll?

Zoho Payroll not only modernizes and digitizes payroll processes but also supports your business growth with scalability and customization. Its dedicated support team offers migration and implementation assistance, ensuring a smooth transition from manual systems. The platform is built with performance and reliability in mind, making payroll management efficient and secure.

Discover exclusive deals on Zoho Payroll Deals. For more payroll solutions, explore our category of Payroll Software.

Alternatives