Overview

What is MoneyLion?

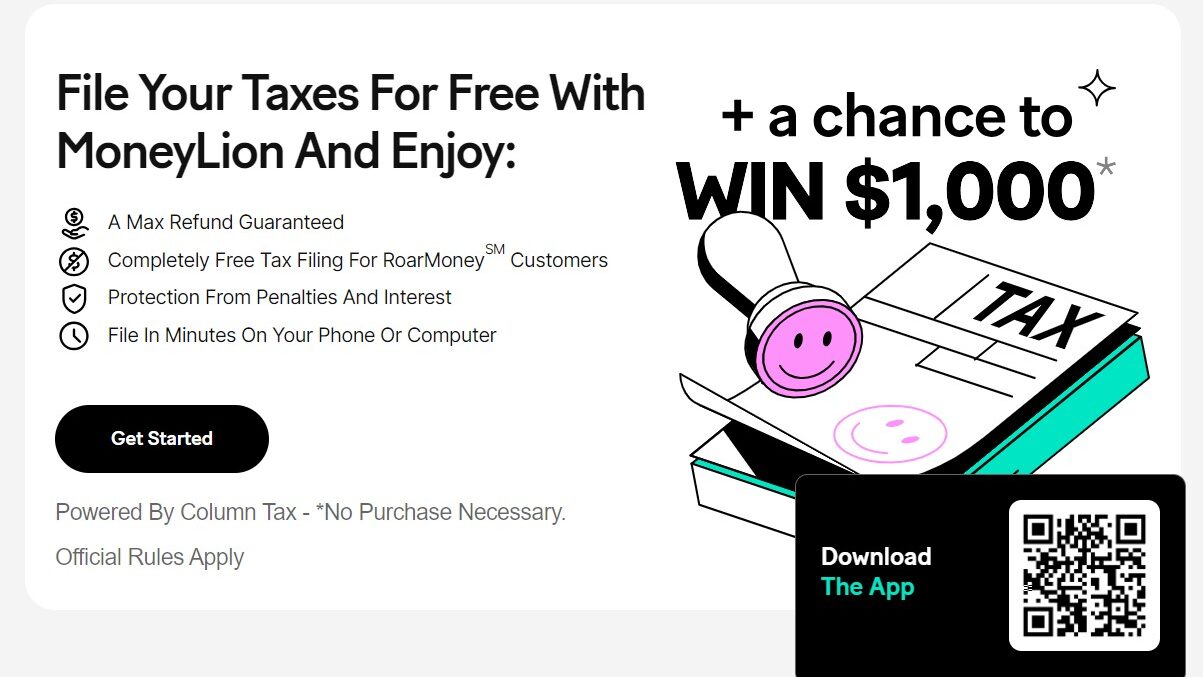

Looking for a mobile banking solution that goes beyond the basics? MoneyLion isn’t just a bank account; it’s a comprehensive financial app designed to empower you with mobile-first convenience, flexible features, and tools to help you grow your money. From managing your everyday banking to building credit and investing, MoneyLion provides a suite of features to help you take control of your financial future.

Why Choose MoneyLion?

Seeking a convenient and empowering way to manage your finances? Here’s why MoneyLion stands out:

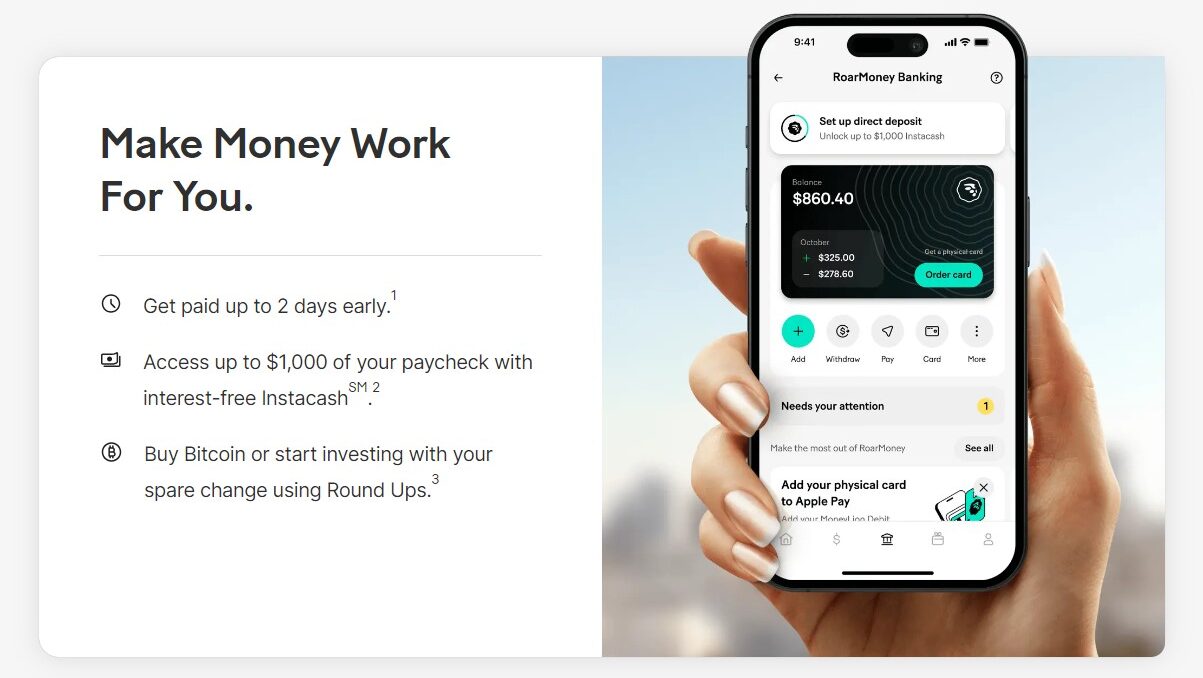

- Mobile-First Banking: Manage your finances seamlessly through the user-friendly MoneyLion mobile app.

- Get Paid Early (Direct Deposit): Receive your paycheck up to 2 days early.

- No Monthly Fees: Enjoy fee-free banking with no minimum balance requirements.

- Cashback Rewards: Earn cash back rewards on debit card purchases with select merchants.

- Instacash℠ (Advance): Access up to $1,000 to cover unexpected expenses, avoiding overdraft fees (subject to eligibility and verification).

- Credit Builder Plus (Optional): Build or improve your credit score with a secured credit card option.

- Managed Investing (Optional): Start investing with as little as $1 and grow your wealth over time.

Who is MoneyLion For?

MoneyLion caters to individuals seeking a modern and feature-rich banking experience:

- Young Professionals: Manage your finances on the go with the convenient mobile app and get paid up to 2 days early.

- Budget-Conscious Individuals: Benefit from fee-free banking and avoid overdraft fees with Instacash℠.

- People Building Credit: Start or improve your credit score with Credit Builder Plus.

- Tech-Savvy Users: Embrace the convenience of mobile-centric banking with a suite of financial tools.

- Anyone Looking to Grow Their Money: Earn cashback rewards, access Instacash℠ advances, and explore investing options.

MoneyLion goes beyond traditional banking, offering a user-friendly and feature-rich platform designed to empower you to take charge of your finances. With its focus on convenience, fee-free banking, reward programs, and financial tools, MoneyLion is the perfect choice for individuals seeking an all-in-one solution to manage their money and build a brighter financial future.