Overview

What is the Chase Ink Business Unlimited Credit Card?

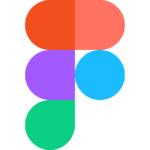

The Chase Ink Business Unlimited Credit Card is a no-annual-fee rewards card designed for small business owners who want to earn unlimited cash back rewards on everyday business purchases. Get flat-rate cash back on all purchases, simplifying your approach to maximizing returns on business spending with ease.

Why Use the Chase Ink Business Unlimited Credit Card?

Here are some of the key benefits of the Chase Ink Business Unlimited Credit Card:

- Unlimited 1.5% Cash Back: Earn unlimited 1.5% cash back on all purchases made for your business, with no category restrictions or spending caps. This straightforward rewards structure allows you to easily accumulate cash back without needing to track bonus categories.

- No Annual Fee: No annual fee, unlimited cash back rewards, perfect for budget-conscious businesses seeking rewards without extra costs.

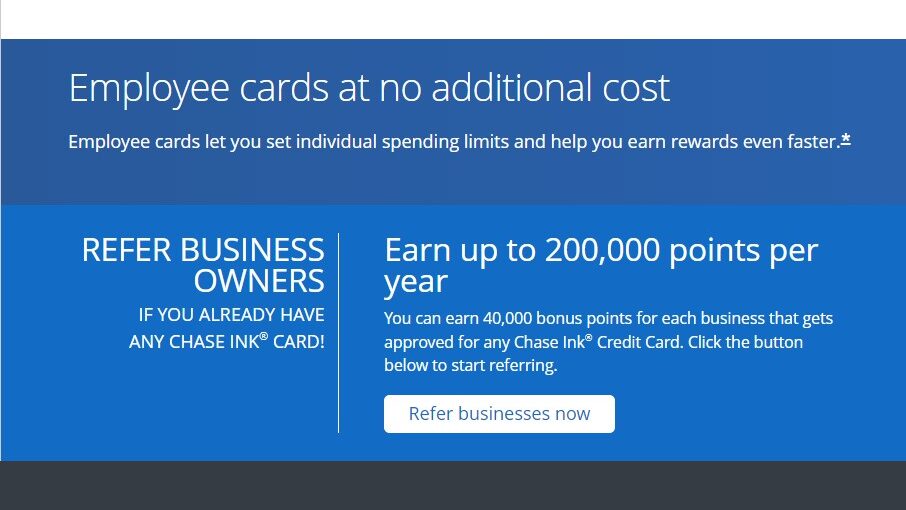

- Employee Cards: Authorize users at no extra cost, enabling rewards on employee spending and simplifying business expenses management.

- Business Insurance: Card benefits include cell phone coverage and purchase protection, offering some built-in insurance for common business needs.

Who is the Chase Ink Business Unlimited Credit Card Right For?

The Chase Ink Business Unlimited Credit Card is ideal for:

- Small Businesses with Straightforward Spending: This card is a good fit for businesses with consistent spending across various categories, as it offers a flat-rate cash back benefit on all purchases.

- Cost-Conscious Business Owners: No annual fee, unlimited cash back rewards, perfect for budget-conscious businesses seeking rewards without extra costs.

- New Business Owners: No annual fee, straightforward rewards program, ideal for new businesses managing expenses.

The Chase Ink Business Unlimited Credit Card offers a no-frills approach to earning cash back rewards on everyday business purchases. With its unlimited cash back rate, no annual fee, and built-in business insurance perks, the Chase Ink Business Unlimited Credit Card is a strong contender for small business owners looking for a straightforward and cost-effective way to maximize their return on business spending.