Explore Stripe

Optimize Your Payment Processing with Stripe Payments – A Comprehensive Platform for Businesses

Stripe Payments, a leader in the Payment Processing Software category, provides businesses with a robust, all-in-one solution to accept credit cards, debit cards, and...

Optimize Your Payment Processing with Stripe Payments – A Comprehensive Platform for Businesses

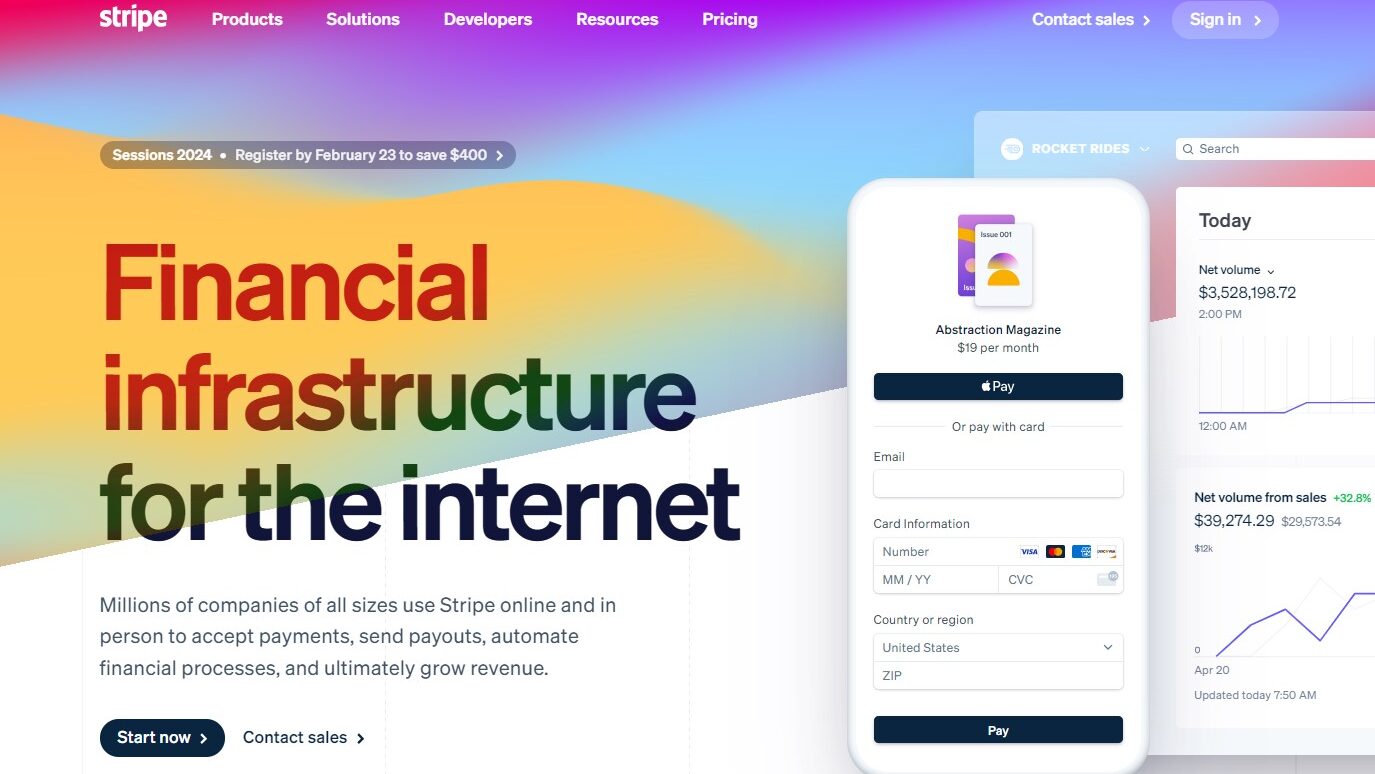

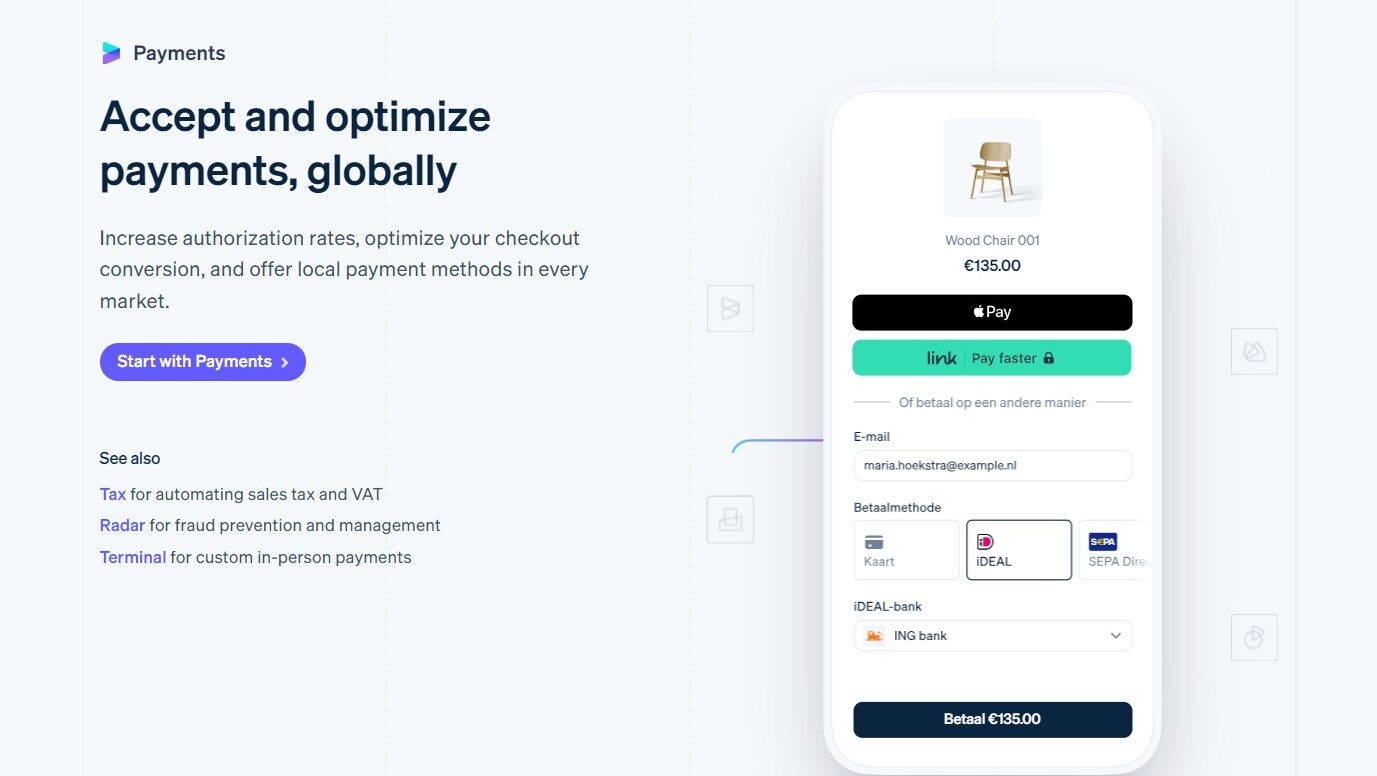

Stripe Payments, a leader in the Payment Processing Software category, provides businesses with a robust, all-in-one solution to accept credit cards, debit cards, and alternative payment methods globally. Designed for simplicity and scalability, its easy-to-use APIs, no-code features, and advanced tools empower businesses to process payments securely and efficiently while driving growth.

Why Use Stripe Payments?

Stripe Payments excels in delivering:

- Extensive Payment Options: Supports multiple payment methods, currencies, and digital wallets, ensuring businesses reach customers worldwide.

- Integration Flexibility: Easily merges with popular e-commerce platforms, accounting tools, and POS systems for seamless operation.

- Advanced Security: Employs robust encryption and fraud detection mechanisms to safeguard transactions and customer data.

- Detailed Reporting & Analytics: Offers insights into transaction trends and revenue, enabling data-driven decision-making.

- Customizable Checkout Experience: Businesses can personalize their checkout process to enhance brand identity and customer satisfaction.

Who is Stripe Payments For?

Stripe Payments caters to a wide range of users and industries, including:

- E-commerce Businesses: An optimal choice for online stores focused on fast, reliable, and global payment solutions.

- Small and Medium Businesses: Simplifies payment collection and management without requiring extensive IT resources.

- Technology Companies: Enables developers to build customized payment workflows using its innovative APIs.

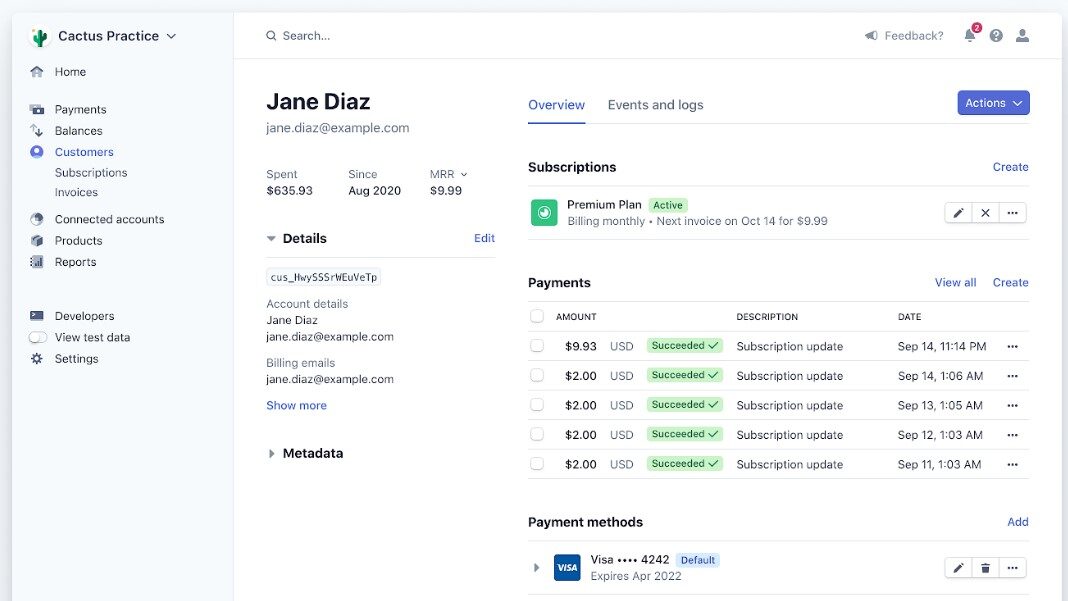

- Service-Based Businesses: Supports efficient invoicing and subscription management with recurring billing features.

In conclusion, Stripe Payments is a versatile and secure payment platform tailored for businesses of all sizes seeking global reach and growth. With scalable features and a user-friendly interface, Stripe Payments is an excellent choice for businesses aiming to simplify transactions and deliver superior customer experiences. Whether you’re launching a new venture or scaling an existing one, Stripe Payments offers everything you need to optimize your payment processing.

Stripe Satisfaction and Score

Stripe Score and Review

See Stripe pros cons, the conclusions and the subscribed score

See how Stripe works on Video

Stripe Pricing and Features

Stripe Product Experience

Steps to Cancel Stripe Subscription

Stripe Pricing

Steps to End Your Stripe Subscription.

Concluding your Stripe subscription is a straightforward process and can be achieved with ease. For detailed instructions, please visit this page.

Most frequent question about Stripe

Stripe goes far beyond processing credit card payments. Imagine setting up subscriptions, managing recurring billing, and facilitating secure in-person payments with just a few clicks. Leverage integrated fraud prevention tools to protect your business and its customers. Issue virtual and physical debit cards for your team, streamlining expenses and financial management. Stripe offers a versatile suite of tools designed to handle all your payment processing needs, from startups to established companies.

Stripe scales with your business. Start with simple payment processing and seamlessly add features like invoicing, subscriptions, and financing solutions as your needs evolve. Choose from various pricing plans tailored to different transaction volumes and business models. Whether you’re a solopreneur or a large enterprise, Stripe offers the flexibility and scalability to support your growth journey.

Stripe goes beyond simply processing transactions. Imagine automatically reconciling payments with your accounting software, saving you time and ensuring financial accuracy. Utilize data insights from Stripe to track sales trends and optimize your pricing strategy. Access Stripe Atlas, a suite of tools designed to help startups incorporate and launch their businesses quickly and efficiently. Stripe empowers you to streamline various business operations, beyond just the core payment processing function.

Stripe understands the importance of dispute resolution and fraud prevention. Their automated tools help identify and flag potentially fraudulent transactions, minimizing chargebacks and safeguarding your business. Leverage built-in dispute resolution tools to handle customer disputes efficiently and securely. Additionally, Stripe offers comprehensive documentation and resources to educate you on best practices for preventing and managing disputes.

Stripe embraces various payment methods. Accept popular e-wallets like Apple Pay and Google Pay, catering to modern consumer preferences. Explore alternative payment options like buy-now-pay-later solutions or international payment networks, expanding your reach and catering to diverse customer needs. While not every alternative payment method might be available in every region, Stripe continuously strives to offer a comprehensive and evolving range of options.