Explore Afterpay

Afterpay – The Future of Flexible Payment Solutions

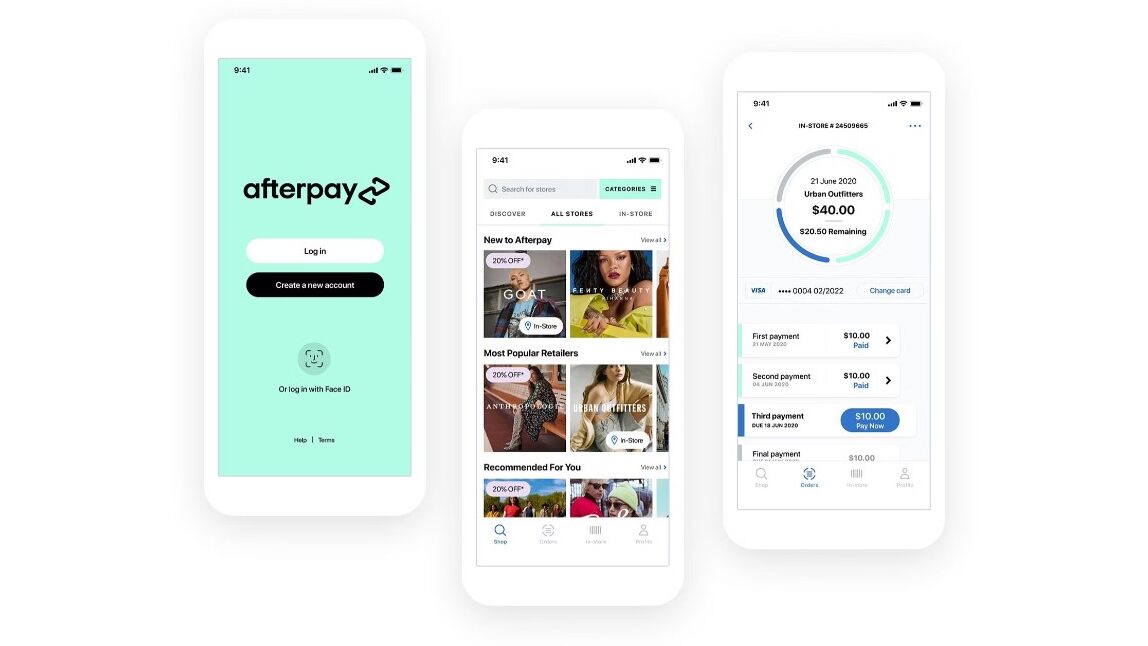

Afterpay is a leading solution in the Buy Now, Pay Later (BNPL) category, providing customers and businesses with a seamless and interest-free installment payment option. With Afterpay, users can shop for their...

Afterpay – The Future of Flexible Payment Solutions

Afterpay is a leading solution in the Buy Now, Pay Later (BNPL) category, providing customers and businesses with a seamless and interest-free installment payment option. With Afterpay, users can shop for their favorite items now and split their total payment into four installments over six weeks, all without incurring interest. Businesses that integrate Afterpay benefit from higher sales, increased customer loyalty, and greater average order value.

Why Use Afterpay?

Afterpay offers remarkable advantages for both consumers and businesses:

- Easy Payment Management: Customers can make purchases without upfront financial strain by paying across four equal installments.

- Risk-Free for Businesses: Afterpay assumes responsibility for chargebacks and fraud, ensuring merchants receive payment upfront without added risk.

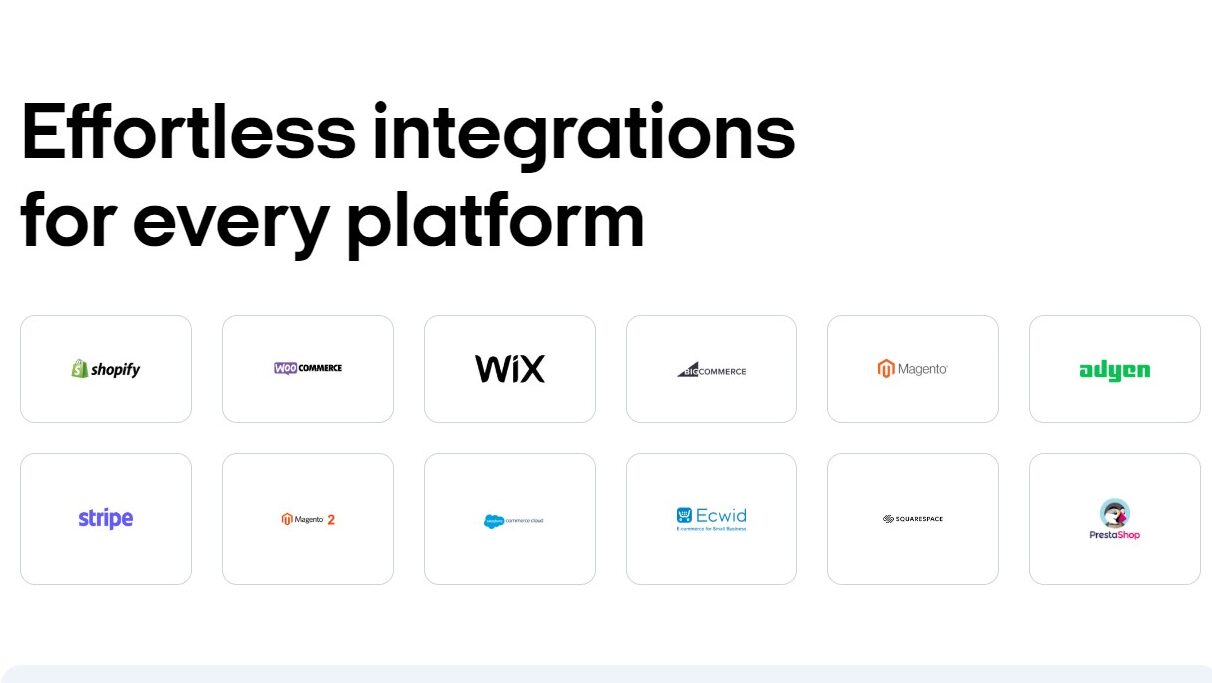

- Engagement With Loyal Shoppers: Businesses gain access to a global audience of over 19 million active shoppers while benefiting from daily referrals.

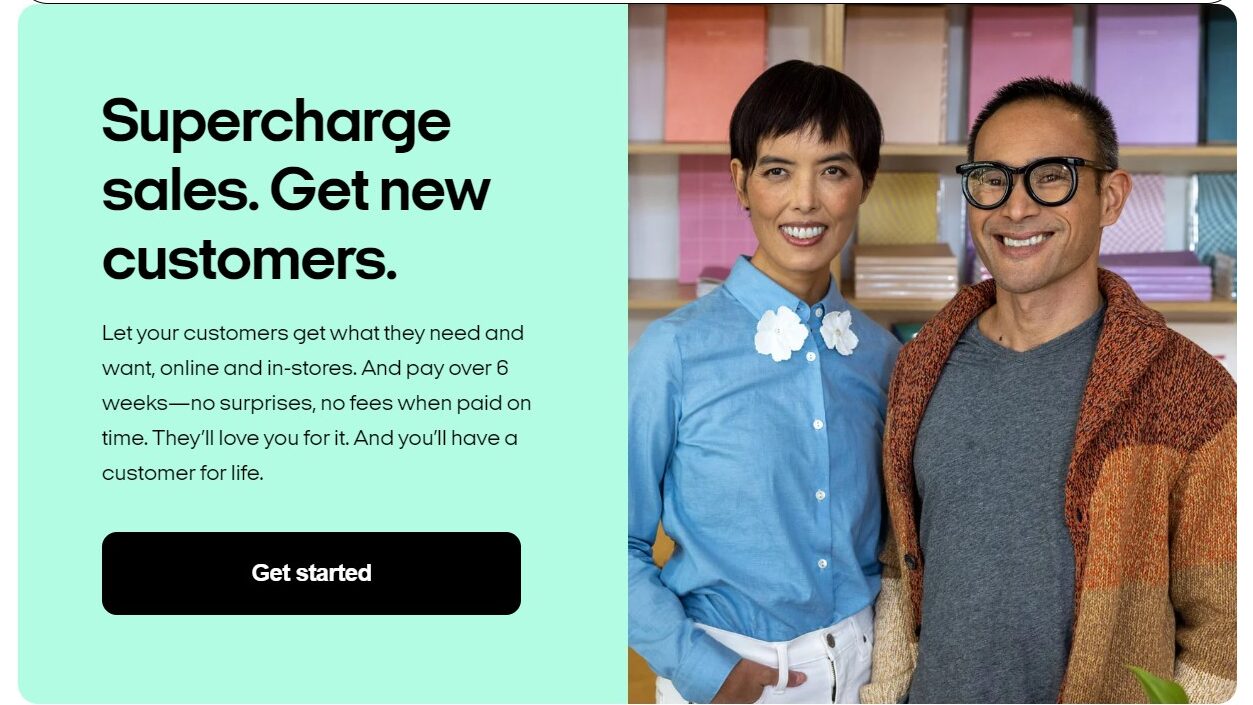

- E-commerce Integration: The service integrates seamlessly with online stores through APIs or platform plugins, offering a smooth user experience.

- Flexible and Transparent Terms: Afterpay provides clear payment schedules, email reminders, and user-friendly customer portals for tracking and managing payments.

Who is Afterpay For?

Afterpay is designed to meet the needs of diverse audiences:

- Consumers: Afterpay is perfect for individuals looking to make purchases in installments without interest while maintaining financial flexibility.

- Retailers and Merchants: Businesses can attract new customers, enhance sales conversion rates, and build lasting brand loyalty with Afterpay’s installment payment offerings.

- E-commerce Platforms: Online vendors seeking hassle-free payment integration and risk-free transaction handling benefit greatly from Afterpay’s solutions.

Why it Stands Out

Afterpay’s value extends beyond flexible installment options. It supports various languages, provides daily settlement reports, and ensures customers enjoy a great shopping experience. By prioritizing transparency, simplicity, and security, Afterpay empowers both consumers and businesses alike, transforming the online and in-store checkout experience.

In conclusion, Afterpay revolutionizes shopping with its interest-free BNPL model, offering flexibility for customers and growth opportunities for businesses. Whether you’re a shopper seeking financial ease or a merchant aiming to maximize sales, Afterpay delivers a reliable, user-friendly payment solution that reshapes the modern retail landscape.

Afterpay Satisfaction and Score

Afterpay Score and Review

See Afterpay pros cons, the conclusions and the subscribed score

See how Afterpay works on Video

Afterpay Pricing and Features

Afterpay Product Experience

Steps to Cancel Afterpay Subscription

Afterpay Pricing

Simplifying Your In-Store Payment Options: Concluding Your Afterpay Account

As your business evolves and you explore alternative in-store payment processing solutions for your customers, Afterpay offers a clear and efficient process to terminate your account. To ensure a smooth transition and avoid unintended charges, kindly visit this page.

Most frequent question about Afterpay

Afterpay offers several potential advantages for retailers:

- Increased Sales: By allowing customers to spread out payments, Afterpay can potentially increase your average order value and encourage impulse purchases. Customers might be more likely to buy higher-priced items if they can pay over time.

- Attract New Customers: The convenience of BNPL can attract new customers who prefer flexible payment options. Afterpay’s existing user base might also be more inclined to shop at your store if you offer their preferred payment method.

- Improved Conversion Rates: A streamlined checkout process with Afterpay can potentially reduce cart abandonment and lead to higher conversion rates at checkout.

- Reduced Risk: Afterpay assumes the risk of non-payment from customers. You receive your upfront payment regardless of whether the customer completes their installments.

These benefits can contribute to increased sales, a wider customer base, and a smoother checkout experience for your retail business.

While Afterpay doesn’t typically charge upfront fees for retailers to join their program, there are a few things to consider:

- Transaction Fees: Afterpay might charge a transaction fee on each sale facilitated through their BNPL service. This fee is usually a percentage of the total purchase amount.

- Chargeback Protection: Afterpay might offer chargeback protection for fraudulent transactions, but there might be associated fees or limitations on this service.

Understanding the potential transaction fees and any associated costs for chargeback protection is crucial when evaluating the overall impact of Afterpay on your retail business.

Yes, Afterpay understands the importance of marketing for retailers using their platform:

- Marketing Materials: Afterpay might provide access to marketing materials like co-branded signage, social media templates, or email marketing content. These resources can help you promote the availability of Afterpay as a payment option in your store.

- Customer Insights: Afterpay might offer some insights into customer behavior related to BNPL purchases. This data can potentially inform your marketing strategies and target specific customer segments effectively.

- Promotional Opportunities: In collaboration with Afterpay, you might have the option to create limited-time promotions or exclusive offers for Afterpay users, potentially attracting new customers or boosting sales during specific periods.

Utilizing Afterpay’s marketing resources can maximize the benefits of their BNPL service for your retail business.

Afterpay manages customer service for their BNPL service:

- Dedicated Customer Support: Afterpay has a dedicated customer support team to handle customer inquiries regarding their payment plans, missed payments, or account issues.

- Reduced Burden on Your Staff: This frees up your retail staff to focus on in-store customer service and product sales, rather than dealing with payment-related inquiries.

- Clear Communication: Afterpay communicates directly with customers regarding their BNPL plans, ensuring transparency and a consistent customer experience.

While you won’t be directly involved in handling customer service related to Afterpay, understanding their process can be helpful for managing customer expectations.

Afterpay can be used for both in-store and online purchases:

- In-Store Purchases: Look for the Afterpay logo at participating retailers. During checkout, you can choose Afterpay as your payment method and complete the transaction using the Afterpay app on your smartphone.

- Online Shopping: Many online stores offer Afterpay as a payment option at checkout. Simply select Afterpay during checkout and log in to your Afterpay account to complete the purchase.

The availability of Afterpay at a particular store might vary, so it’s recommended to check the retailer’s website or look for Afterpay signage at checkout for in-store purchases.

Try these alternatives of Afterpay

Stripe, a comprehensive financial ecosystem, simplifies payment acceptance, subscription management, and global scalability. With developer tools, fraud prevention, and a unified dashboard, it's ideal for e-commerce, subscriptions, marketplaces, freelancers, and growing businesses seeking streamlined financial operations.