Explore Modern Treasury

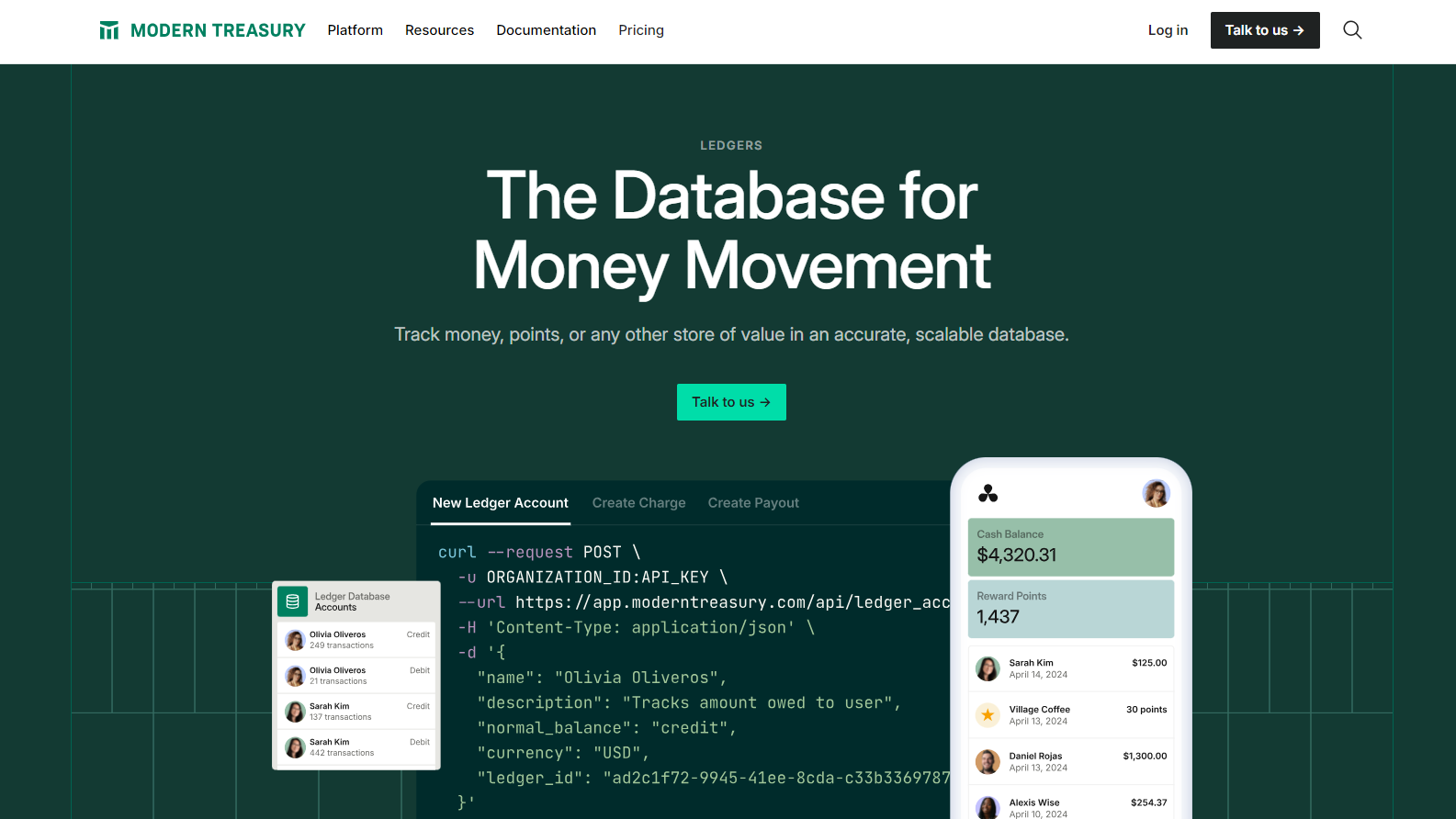

Streamline Finances with Modern Treasury – The Operating System for Money Movement

Modern Treasury is a cutting-edge treasury management solution that enables businesses to seamlessly manage and optimize money movement. With its innovative automation, real-time...

Streamline Finances with Modern Treasury – The Operating System for Money Movement

Modern Treasury is a cutting-edge treasury management solution that enables businesses to seamlessly manage and optimize money movement. With its innovative automation, real-time financial insights, and AI-driven functionalities, Modern Treasury transforms complex financial processes into efficient and scalable workflows.

Why Use Modern Treasury?

Modern Treasury is a leader in payment processing and treasury management, offering:

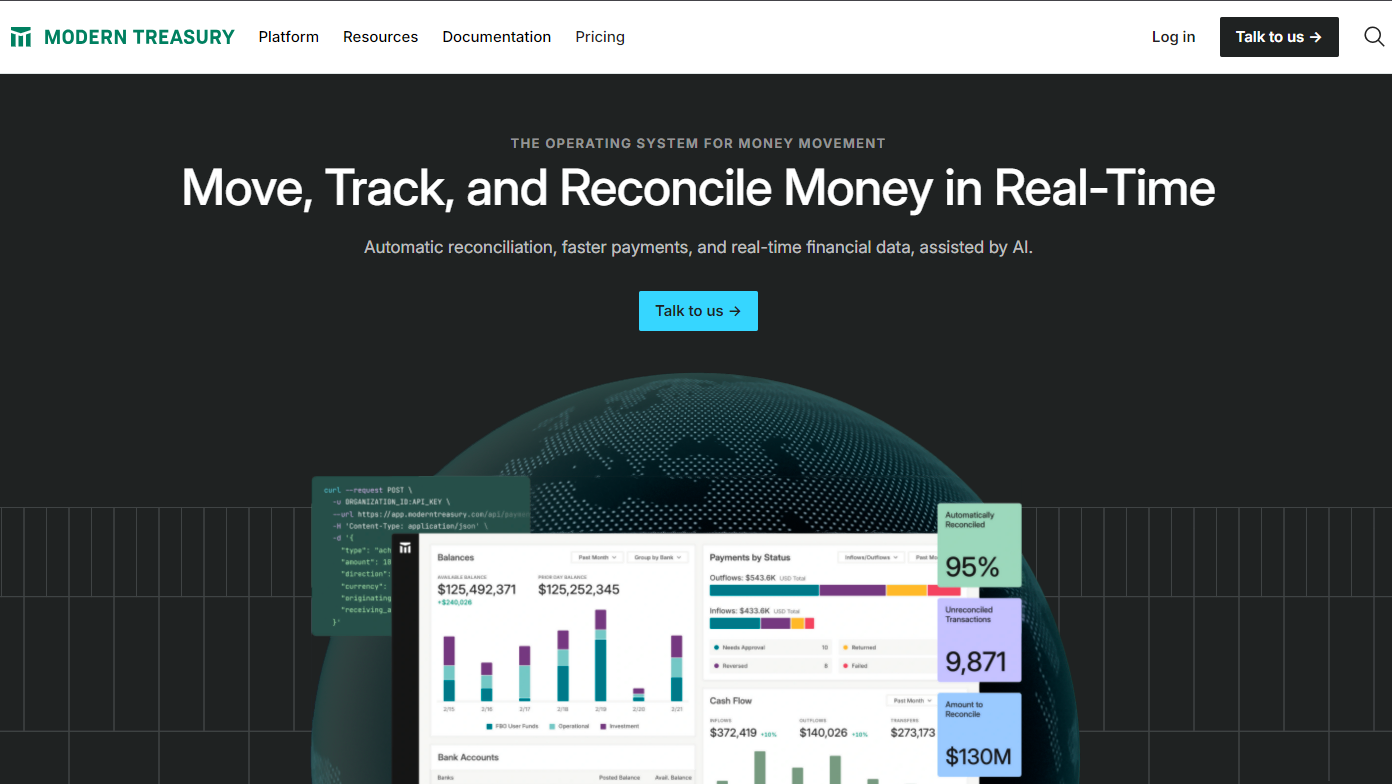

- Automatic Reconciliation: Automate payment and ledger reconciliations, reducing manual errors and freeing up resources.

- Faster Payments: Leverage ACH, wires, and returns in real-time to streamline money movement, ensuring timely transfers regardless of scale.

- AI-Assisted Financial Insights: Access real-time data that provides clear visibility into transactions and cash flow trends for informed decision-making.

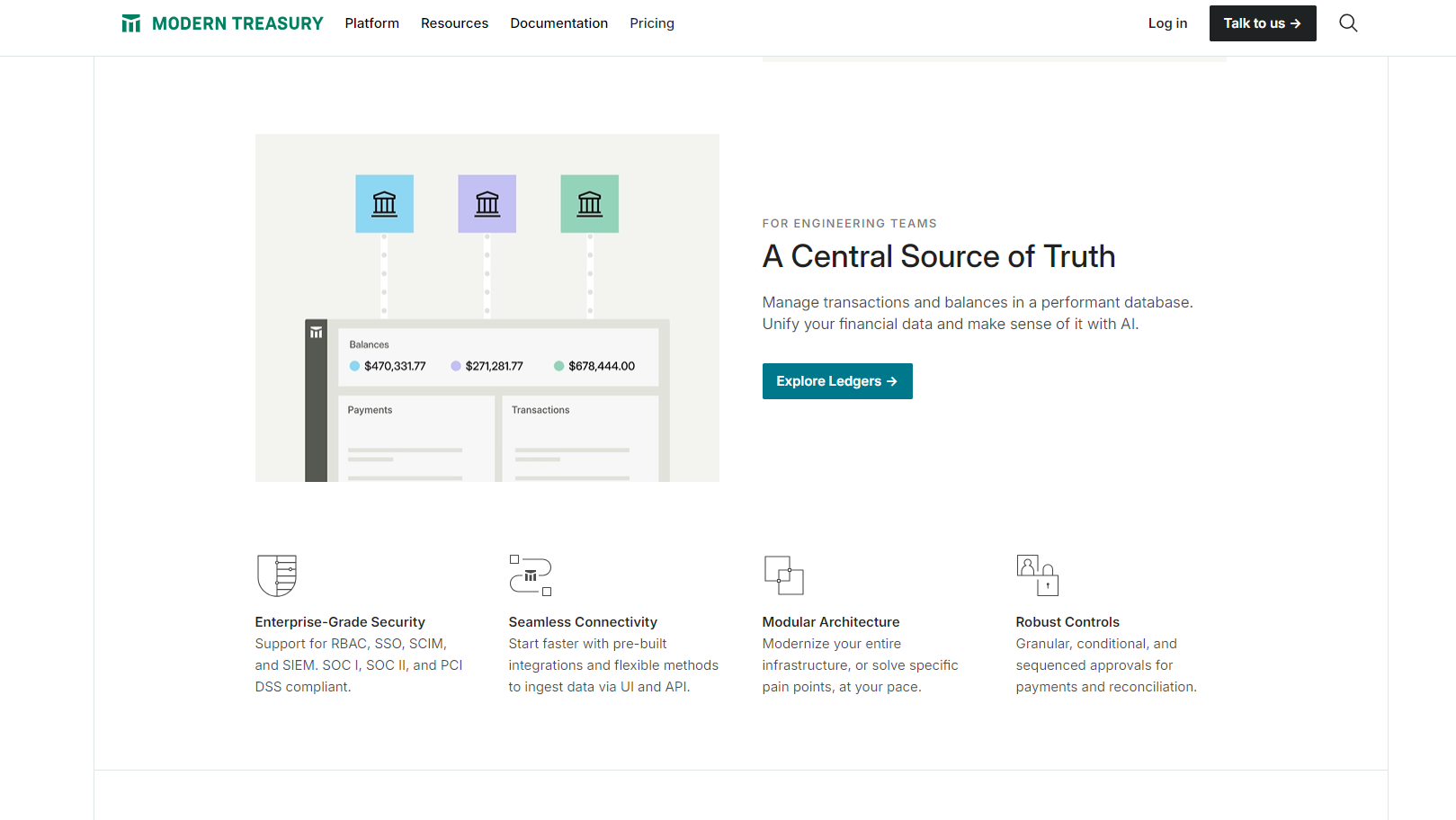

- Scalable APIs: Robust APIs simplify integrations with banks and financial systems, enabling businesses to implement and customize solutions effortlessly.

- Seamless Collaboration: Foster teamwork with intuitive tools that enable financial teams to track, monitor, and report payment operations collaboratively.

Who is Modern Treasury For?

Modern Treasury caters to a diverse audience, including:

- Growth-Focused Startups: Automate financial workflows and handle growing transaction volumes efficiently.

- Mid-Sized Businesses and Enterprises: Enhance financial accuracy and simplify integrations with banking systems for scale.

- Finance and Accounting Teams: Save time on repetitive tasks like reconciliation and ensure error-free operations.

- Payment-Heavy Industries: Support high transaction volumes with reliable and secure payment management tools.

Modern Treasury revolutionizes the way businesses handle payment operations by offering a streamlined and user-focused approach to treasury management. Whether you aim to save time, improve financial accuracy, or optimize processes, Modern Treasury provides the tools needed to scale your financial operations effectively. From small startups to large firms, it empowers organizations with the infrastructure to succeed in the modern payments landscape.

Modern Treasury Satisfaction and Score

Modern Treasury Score and Review

See Modern Treasury pros cons, the conclusions and the subscribed score

See how Modern Treasury works on Video

Modern Treasury Pricing and Features

Modern Treasury Product Experience

Steps to Cancel Modern Treasury Subscription

Modern Treasury Pricing

Steps to Cancel Modern Treasury Subscription.

Canceling your Modern Treasury subscription is a straightforward process. You can follow a few simple steps to initiate the cancellation or explore options to switch to a different plan. For detailed instructions, refer to Modern Treasury Cancellation Guide.

Most frequent question about Modern Treasury

Modern Treasury is a financial technology company that provides software solutions for businesses to manage and automate their payments and banking operations.

Modern Treasury’s platform allows businesses to streamline their payment processes, automate repetitive tasks, and gain real-time visibility into their financial transactions. This can help businesses save time and reduce the risk of errors in their financial operations.

Yes, Modern Treasury takes security seriously and employs industry-standard encryption and security protocols to protect customer data and transactions. The platform is also compliant with regulatory requirements to ensure the safety of your financial information.

Yes, Modern Treasury offers integrations with popular accounting software platforms such as QuickBooks, Xero, and NetSuite. This allows businesses to seamlessly sync their financial data and streamline their accounting processes.

To get started with Modern Treasury, you can request a demo on their website and speak with a representative to learn more about their solutions and pricing options. The team at Modern Treasury can also help you set up and customize the platform to meet your specific business needs.

Try these alternatives of Modern Treasury

Wells Fargo offers personalized banking solutions, digital convenience, expert guidance, and nationwide support. Tailored to individuals, families, homeowners, small businesses, and investors, it empowers financial control and growth with security and reliability.