Save about 2% in your fees with Chase Ink Business Preferred

The Ink Business Preferred card offers flexible rewards for business spending, including travel, shipping, advertising, and more, along with valuable travel benefits and purchase protection.

How to reduce the cost of Ink Business Preferred fee

i – Tricks are what we like to call direct ways to reduce your fees.

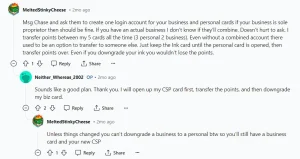

Create one log-in account for your business and personal cards.

Chase enables point transfers between your cards, ensuring that even if you downgrade, you won’t lose your accumulated points.

How to implement a Workaround to reduce fees for Ink Business Preferred

i – A workaround is using another tool to reduce your fees.

- We haven’t found any current workarounds to reduce your fees

Negotiate with Support. Customer support details of Ink Business Preferred

i – Speak with the Ink Business Preferred support team.

Chase Credit Card Cardmember Service : 1-800-432-3117

Discuss Usage Patterns: Contact support and discuss your current usage patterns. They might offer discounts based on your specific needs and historical data.

Negotiate Renewal Rates: Before your subscription renews, negotiate renewal rates with support. Loyalty and commitment to the platform can sometimes lead to better pricing.

Use this for help: Customer support list or google

Switch to Alternative for Ink Business Preferred

i – Here is a list of similar products that are similar you can switch to for savings.

- American Express Blue Business Cash Card: The American Express Blue Business Cash Card offers 2% cash back on all eligible purchases up to $50,000 per calendar year, making it a simple yet rewarding option for small businesses.

- Capital One Spark Cash Plus: With unlimited 2% cash back on every purchase, the Capital One Spark Cash Plus is a solid choice for businesses seeking straightforward rewards and flexibility in redeeming cash back.

- Discover it Business Card: The Discover it Business Card offers 1.5% cash back on all purchases, with no annual fee and a unique feature where Discover matches all the cash back earned at the end of the first year.

- Citi Double Cash Card: The Citi Double Cash Card earns 2% cash back on every purchase — 1% cash back when you buy, and an additional 1% cash back as you pay for those purchases. It’s a straightforward option for businesses looking for consistent cash back rewards.