Overview

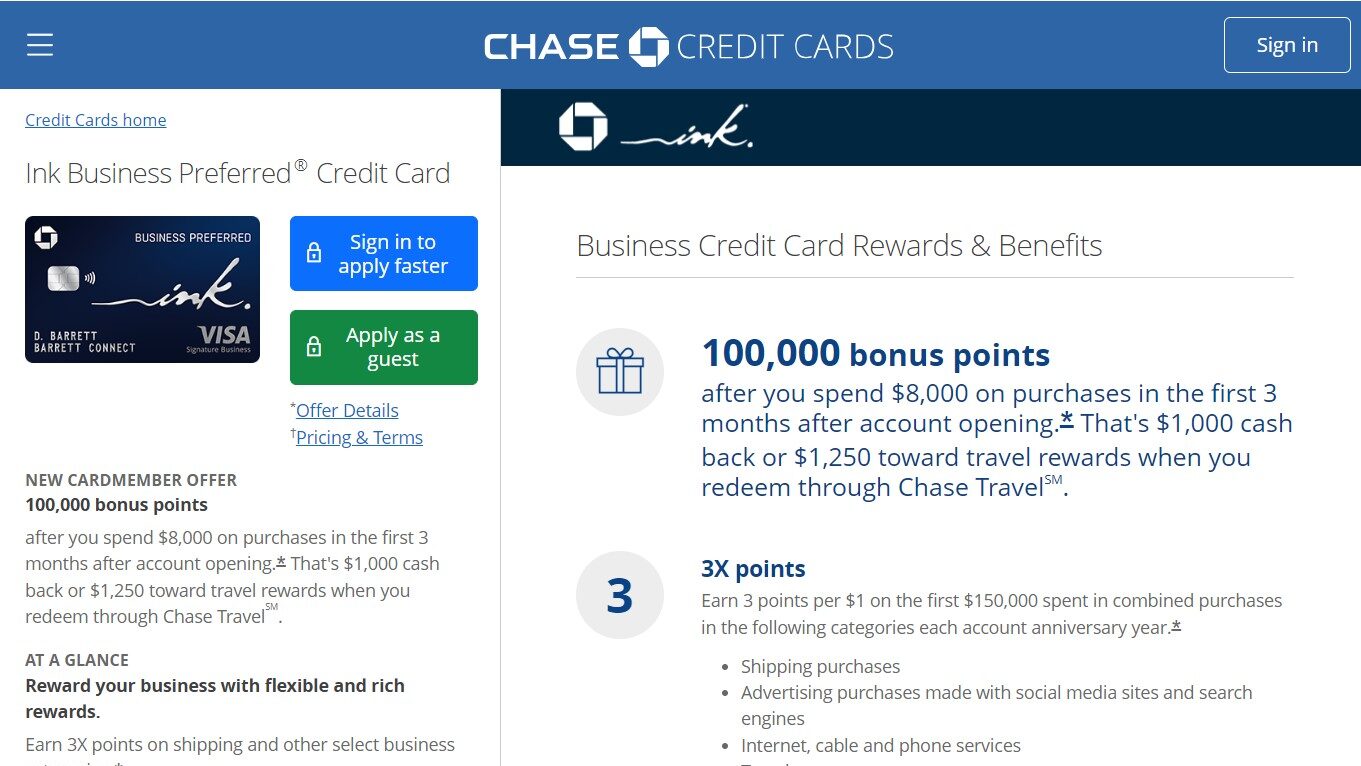

What is the Chase Ink Business Preferred Credit Card?

The Chase Ink Business Preferred Credit Card is a rewards credit card designed for small business owners who want to earn points on everyday business purchases and maximize their travel rewards. It offers a generous sign-up bonus, bonus points in several spending categories, and travel-focused redemption options.

Why Use the Chase Ink Business Preferred Credit Card?

Here are some of the key benefits of the Chase Ink Business Preferred Credit Card:

- Large Sign-up Bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. This bonus can be redeemed for valuable travel rewards or cash back.

- Ongoing Rewards: Earn 3x points on the first $150,000 spent in combined purchases in select business categories each account anniversary year. These categories include travel, shipping, internet, cable and phone services, and advertising on social media and search engines.

- Travel-Friendly: Redeem points for travel through Chase Travel for 25% more value, effectively increasing your points earning potential. You can also transfer points to several airline and hotel partners for added flexibility.

- Employee Cards: Add authorized users at no additional cost, allowing you to earn rewards on employee spending and streamline business expenses.

- Business Insurance: Card benefits include cell phone coverage and purchase protection, offering some built-in insurance for common business needs.

Who is the Chase Ink Business Preferred Credit Card Right For?

The Chase Ink Business Preferred Credit Card is ideal for:

- Small Business Owners: This card caters to small businesses that spend money on travel, shipping, advertising, and other covered categories.

- Frequent Travelers: Business owners who travel frequently can benefit from the bonus points, travel redemption options, and built-in travel insurance.

- Points Maximizers: The signup bonus and ongoing rewards can be lucrative for maximizing travel or cashback rewards potential.

The Chase Ink Business Preferred Credit Card offers a compelling combination of rewards potential, travel benefits, and business-centric features. For small business owners who value flexible rewards and travel perks, the Chase Ink Business Preferred Credit Card is a strong contender.