Overview

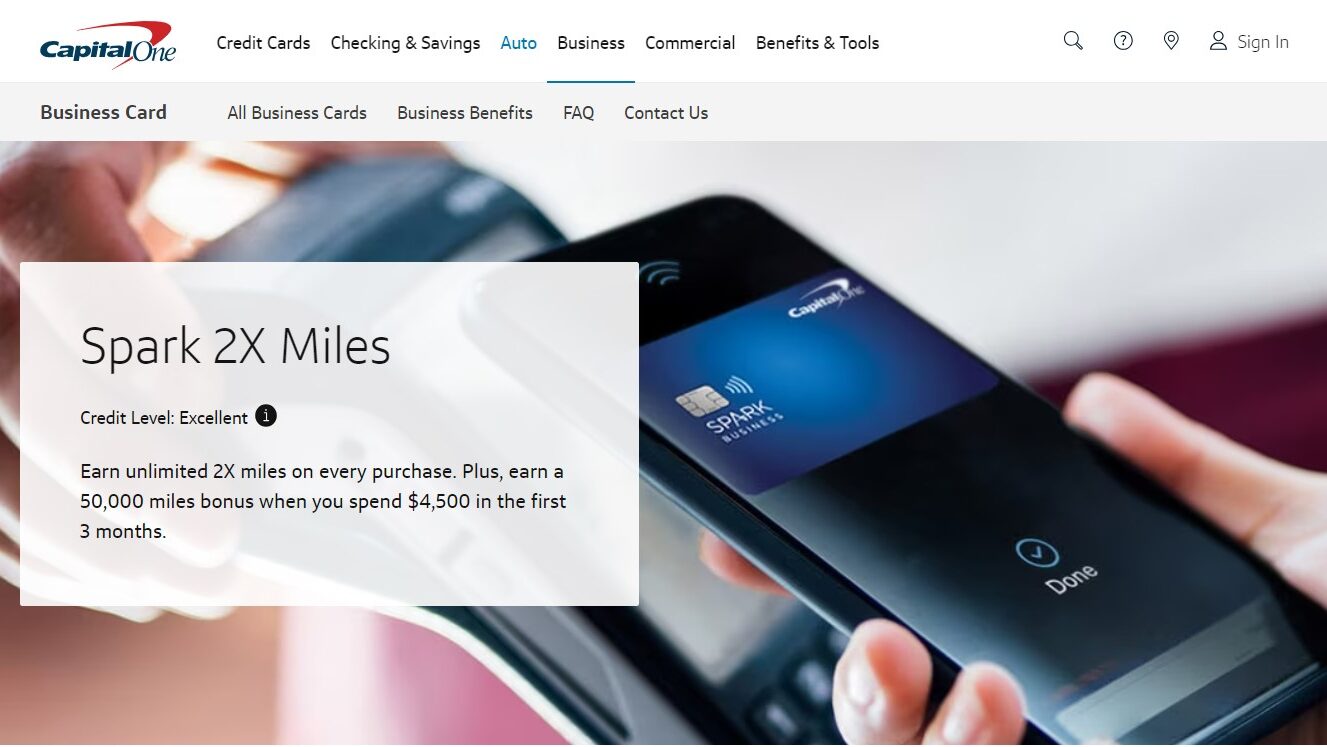

What is Spark Miles for Business Credit Card?

The Capital One Spark Miles for Business credit card is a rewards card designed for small business owners who want to earn unlimited miles on everyday business purchases for travel or other redemptions. It offers a generous sign-up bonus and a straightforward rewards structure, making it a good option for businesses focused on accumulating travel rewards.

Why Use the Capital One Spark Miles for Business Credit Card?

Here are some of the key benefits of the Capital One Spark Miles for Business credit card:

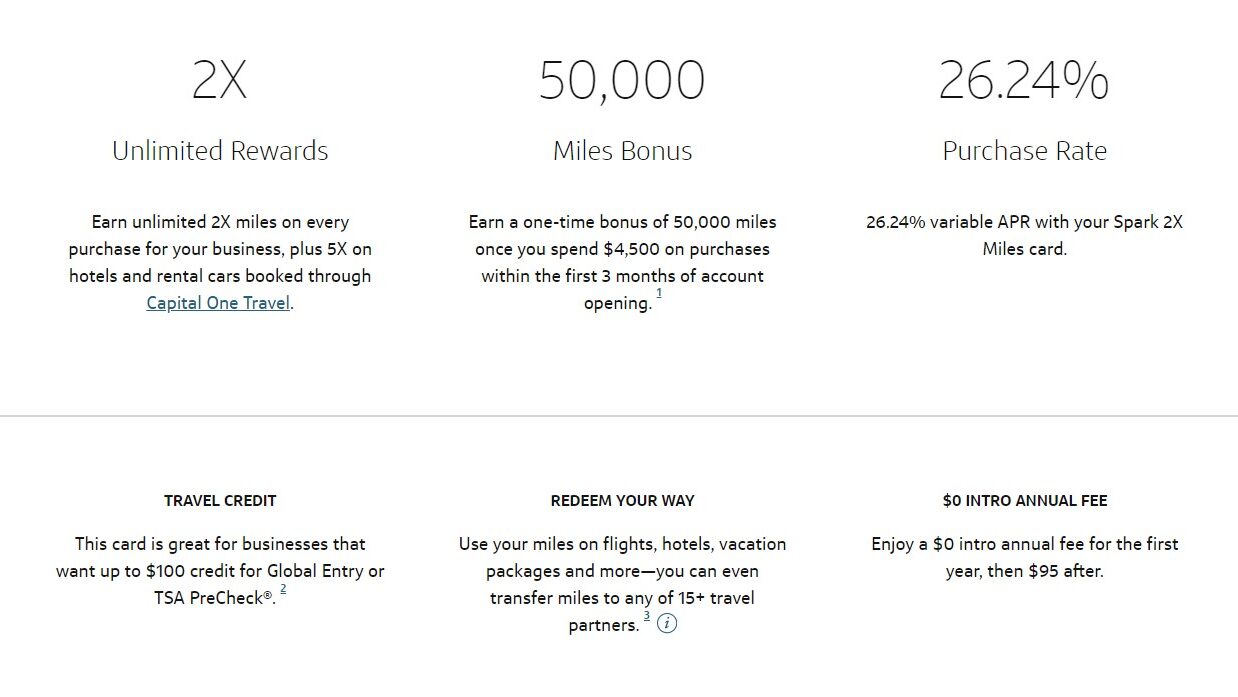

- Unlimited Miles: Earn unlimited 2x miles on all qualifying purchases with no limit, allowing you to maximize your rewards potential on all your business spending.

- Bonus Miles: Enjoy a welcome bonus of 50,000 miles after you spend $4,500 in the first 3 months from account opening. This jumpstart on your miles allows you to redeem for rewards sooner.

- Travel Flexibility: Redeem miles for travel through Capital One Travel or transfer them to partner travel loyalty programs for added flexibility in choosing your travel rewards.

- No Foreign Transaction Fees: Make international purchases without worrying about additional fees, making it a convenient option for business owners who travel globally.

- Purchase Protection: Included coverages like extended warranty and purchase protection offer added security to your business purchases, enhancing peace of mind.

Who is the Capital One Spark Miles for Business Credit Card Right For?

The Capital One Spark Miles for Business credit card is ideal for:

- Frequent Business Travelers: This card is ideal for businesses with frequent travel expenses, offering significant rewards for accumulating travel points.

- Businesses Focused on Rewards: This card, offering unlimited miles earning and a welcome bonus, suits businesses focused on maximizing travel or other rewards.

- Small Businesses Without Employee Cards: If you don’t need employee cards, the Capital One Spark Miles for Business offers a straightforward rewards program without the added cost of extra cards.

The Capital One Spark Miles for Business credit card provides an unlimited miles earning structure and a travel-focused rewards program. With its bonus miles, travel flexibility, and added benefits like purchase protection, the Capital One Spark Miles for Business is a strong contender for small businesses seeking a rewards card to maximize their return on travel spending.