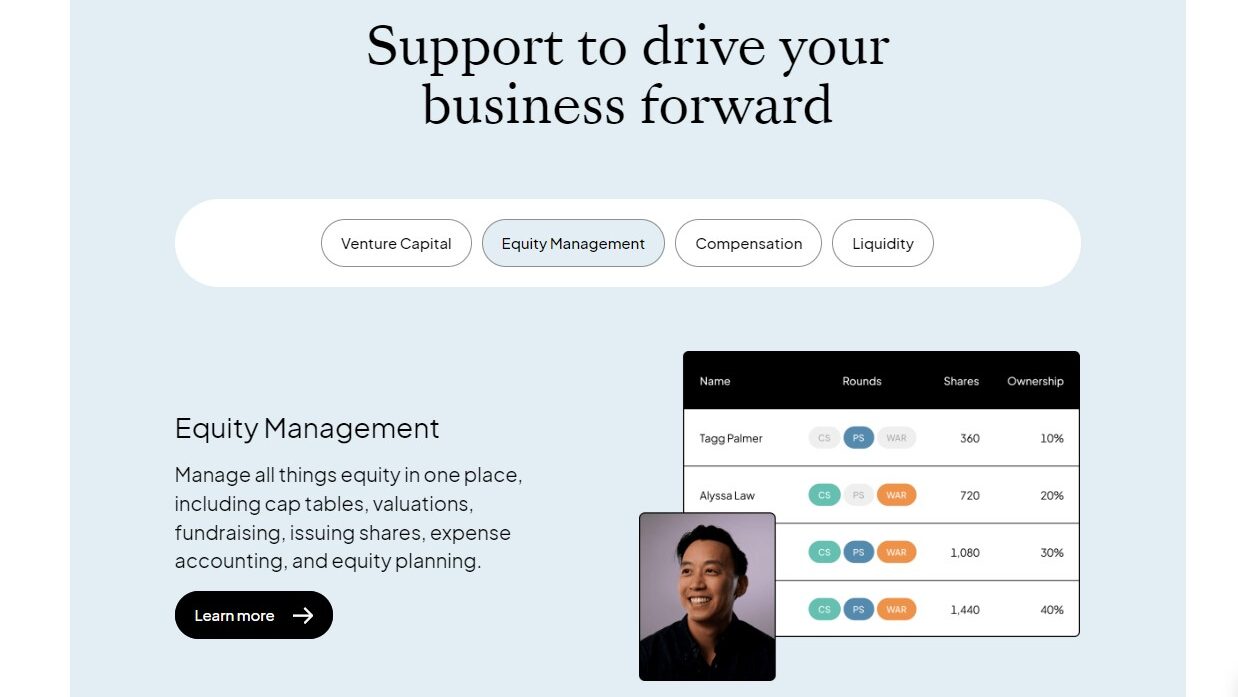

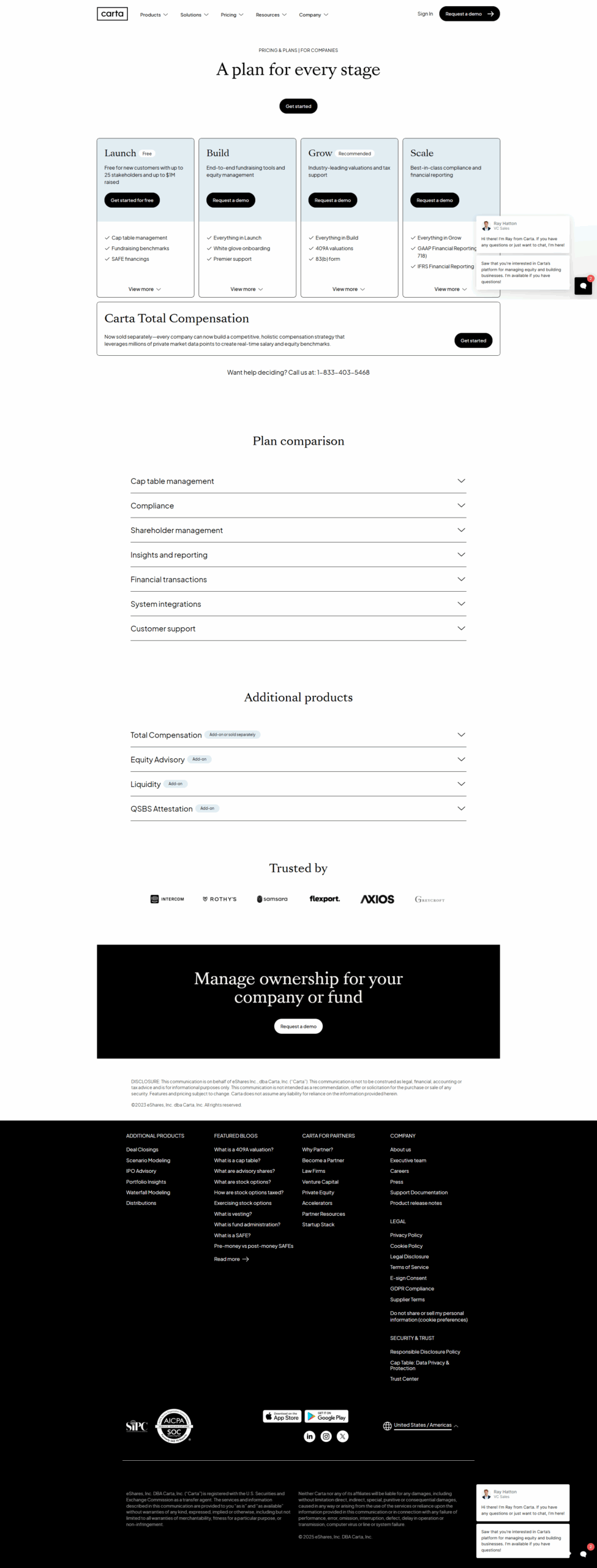

Streamline Equity Management with Carta – The All-in-One Solution for Startups

Carta, a leader in the Fintech and Banking category, simplifies equity management for startups of all sizes. Say goodbye to complex spreadsheets—Carta provides a comprehensive platform to manage your cap table, issue stock options, facilitate fundraising, and ensure compliance with ease. Ready to empower your founders, employees, and investors? Explore exclusive deals. For more fintech tools, check out Stripe, Chase for Business,, and Affirm for Business.

Why Choose Carta?

Struggling with cumbersome cap tables, inefficient equity issuance processes, and difficulty maintaining compliance? Carta offers a compelling solution:

- Effortless Cap Table Management: Maintain a centralized and up-to-date record of your company’s ownership structure with Carta’s intuitive cap table tools.

- Simplified Equity Issuance: Grant stock options and other forms of equity to founders, employees, and investors with a few clicks.

- Streamlined Fundraising: Manage fundraising rounds efficiently with Carta’s built-in tools for investor communication, document management, and e-signatures.

- Automated Compliance Tools: Ensure you meet all regulatory requirements with Carta’s automated tools for legal document generation, filing reminders, and data security.

- Real-Time Valuation Tools: Gain valuable insights into your company’s valuation with Carta’s data-driven analytics and reporting features.

- Global Equity Management: Carta caters to companies with international operations, supporting multiple currencies and regulations.

- Secure and Scalable Platform: Your data is protected with Carta’s robust security measures, ensuring peace of mind as your company grows.

Who is Carta For?

Carta empowers businesses and individuals at all stages of the startup journey:

- Founders & CEOs: Focus on building your business with the confidence of knowing your equity is managed effectively.

- HR & Finance Teams: Simplify equity administration and streamline workflows with Carta’s automation capabilities.

- Employees: Access your equity information easily and stay informed about your ownership stake.

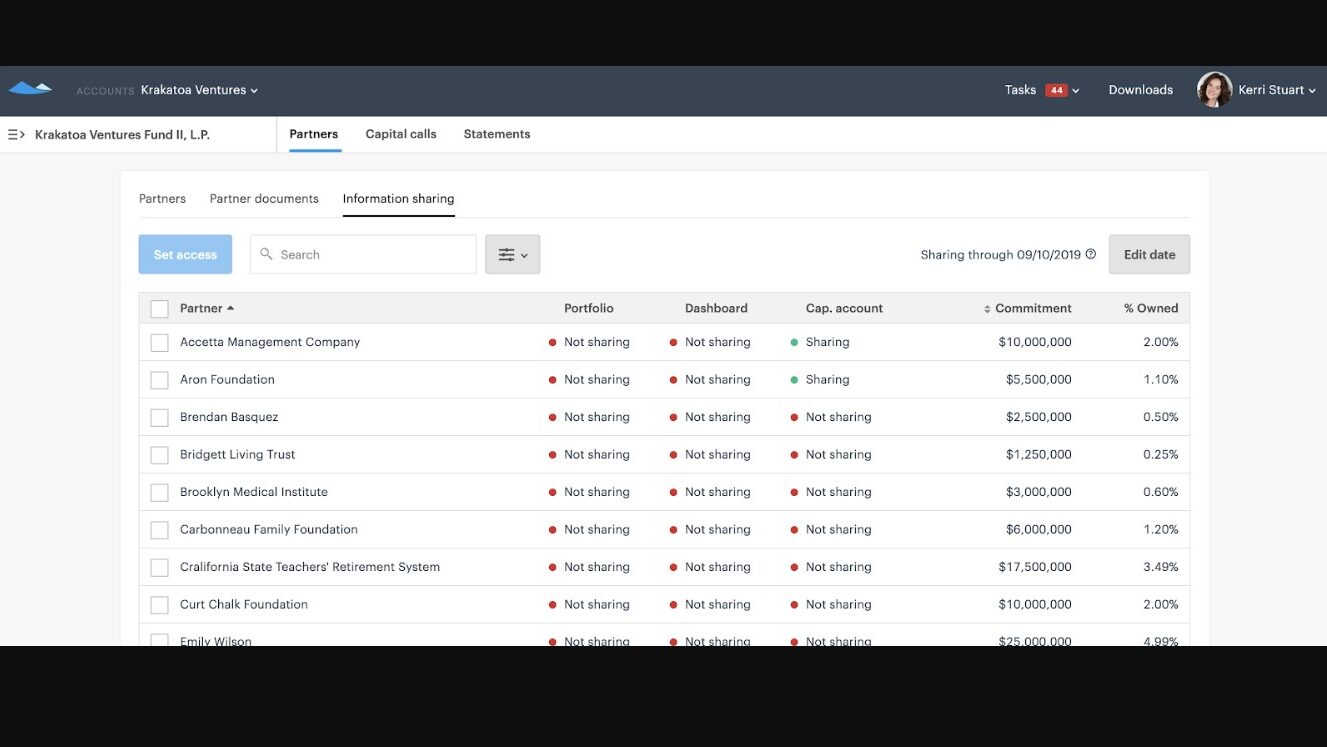

- Investors: Invest with confidence with access to transparent ownership data and secure communication channels.

- Lawyers & Advisors: Carta provides a central platform for legal document management and collaboration.

- Early-Stage Startups: Establish a strong foundation for ownership management from the very beginning.

- Growth-Stage Companies: Scale your equity management efficiently as your company expands.

Carta stands out as a leader in the equity management landscape. Its commitment to effortless cap table management, simplified equity issuance, streamlined fundraising, automated compliance, real-time valuation tools, global capabilities, and a secure platform makes it an attractive choice for startups seeking to ditch manual processes, empower stakeholders, and build a strong foundation for long-term success.