Overview

What is Monzo?

Monzo isn’t your traditional bank; it’s a mobile-first financial app designed to empower you with complete transparency and control over your money. With a focus on user-friendly features, no hidden fees, and real-time budgeting tools, Monzo gives you the flexibility and insights you need to manage your finances with confidence.

Why Choose Monzo?

Seeking a transparent and convenient banking solution that puts you in control? Here’s why Monzo stands out:

- No Monthly Fees: Enjoy fee-free banking with no minimum balance requirements.

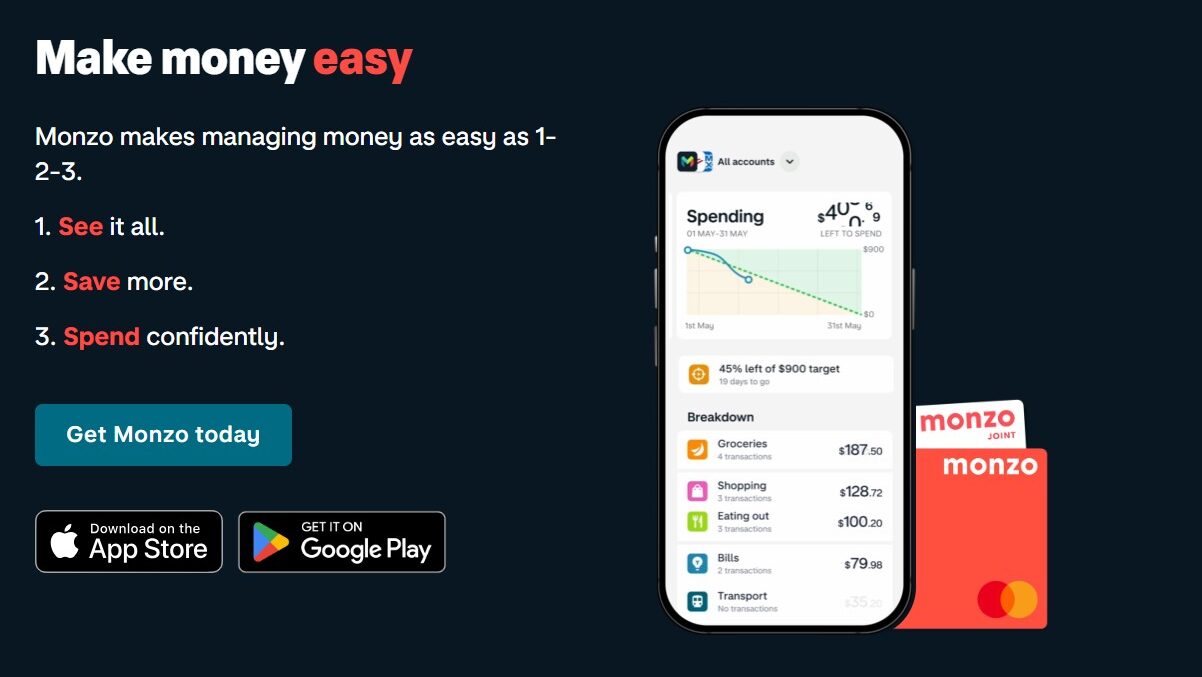

- Mobile-First Banking: Manage your finances seamlessly through the award-winning Monzo mobile app.

- Real-Time Spending Notifications: Get instant alerts on your spending activity, staying informed about your finances in real-time.

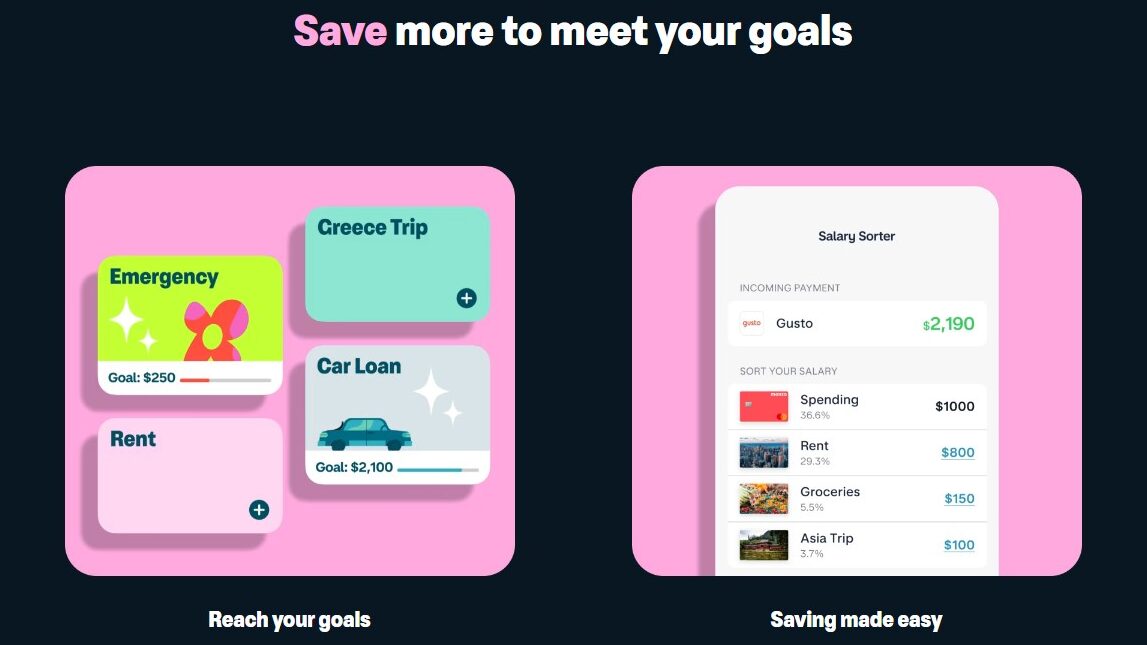

- Track Your Budget Easily: Set budgets and goals within the app and monitor your progress effortlessly.

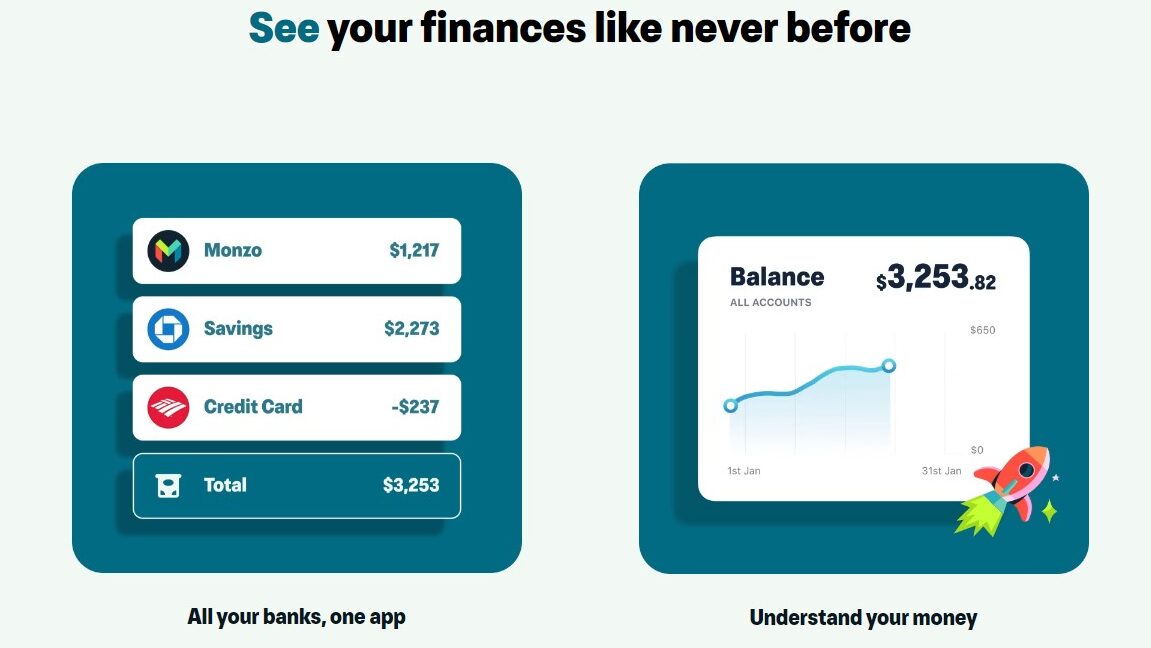

- Manage All Your Accounts (Optional): Connect your other bank accounts to see your entire financial picture in one place. (Subject to security verification)

- Global Spending (Limited Fees): Use your Monzo debit card abroad with minimal fees on transactions and ATM withdrawals.

Who is Monzo For?

Monzo caters to individuals seeking a modern and transparent banking experience:

- Young Professionals: Manage your finances on the go with the convenient mobile app and stay informed with instant spending notifications.

- Budget-Conscious Individuals: Benefit from fee-free banking and track your spending effectively with built-in budgeting tools.

- Frequent Travelers: Enjoy hassle-free international spending with minimal fees.

- Tech-Savvy Users: Embrace the convenience of mobile-centric banking with real-time features.

- Anyone Seeking Control: Monzo empowers you to manage your money on your terms, with clear and transparent information.

Monzo goes beyond traditional banking, offering a user-friendly and transparent platform designed to empower you to take charge of your finances. With its focus on convenience, fee-free banking, real-time insights, and flexible features, Monzo is the perfect choice for individuals seeking a modern and transparent way to manage their money.