Break free from the constraints of conventional banks and credit cards. Brex, a leader in the Fintech and Banking category, offers a bespoke solution for high-growth startups, providing essential financial tools for success. With Brex, bypass restrictive credit limits and cumbersome approval processes to focus on scaling your business and managing expenses effectively. Explore exclusive deals. Consider alternatives like Stripe, Revolut, Wise, Carta, and Chase.

Why Choose Brex?

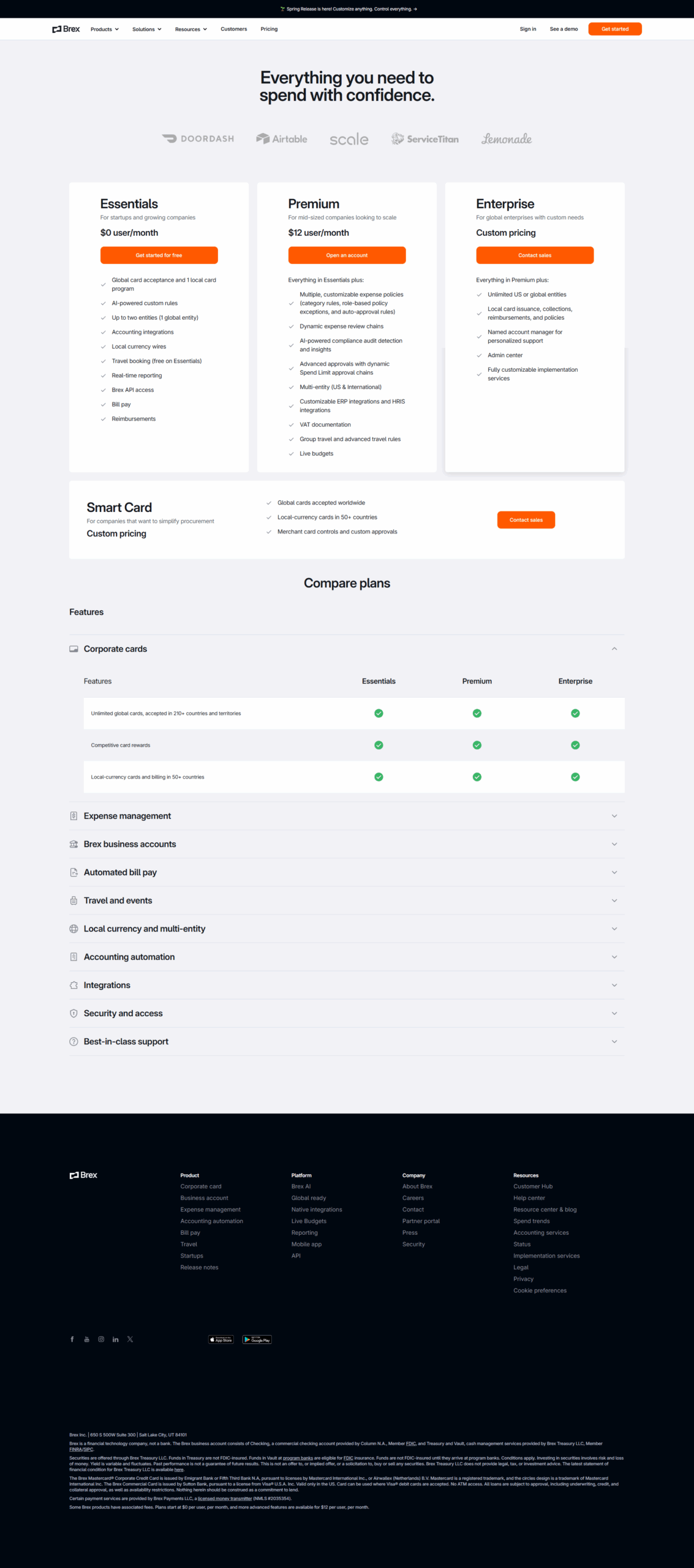

Struggling with limited credit options, inflexible banking solutions, and difficulty managing your startup’s finances effectively? Brex offers a compelling solution:

- High Credit Limits: Brex tailors credit limits based on your startup’s potential, not just your traditional credit score, ensuring you have the capital you need to grow.

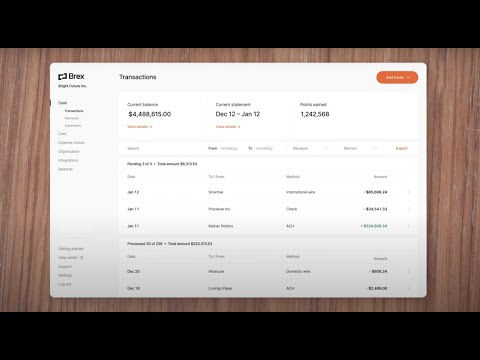

- Seamless Expense Management: Issue corporate cards to your team and leverage automated expense tracking tools for effortless spending management.

- Fast and Secure Payments: Enjoy same-day liquidity and instant access to funds with Brex’s efficient payment processing system.

- Reward Programs Tailored for Startups: Earn rewards on your spending that can be reinvested into your business, like billboard advertising or team offsites.

- Founder-Friendly Financial Tools: Access valuable financial insights, forecasts, and tools specifically designed to support startup growth.

- Dedicated Customer Support: Benefit from exceptional customer support from a team that understands the unique needs of high-growth startups.

Who is Brex For?

Brex empowers founders and teams at high-growth startups across various industries:

- Early-Stage Startups: Secure the financial resources you need to launch and scale your innovative idea.

- Venture-Backed Companies: Manage your finances efficiently and impress investors with a robust financial infrastructure.

- Fast-Growing Businesses: Streamline your financial operations and free up valuable time to focus on strategic growth initiatives.

- Tech Startups: Benefit from a financial partner that understands the specific challenges and opportunities faced by technology companies.

- Ambitious Founders: Focus on building the future of your business with Brex as your trusted financial partner.

Brex stands out as a leader in the financial services landscape for startups. Its commitment to high credit limits, seamless expense management, fast payments, unique reward programs, founder-friendly tools, and exceptional support makes it an attractive choice for ambitious founders seeking to ditch traditional financial limitations, empower their teams, and propel their startups towards success.