Overview

What is Wise?

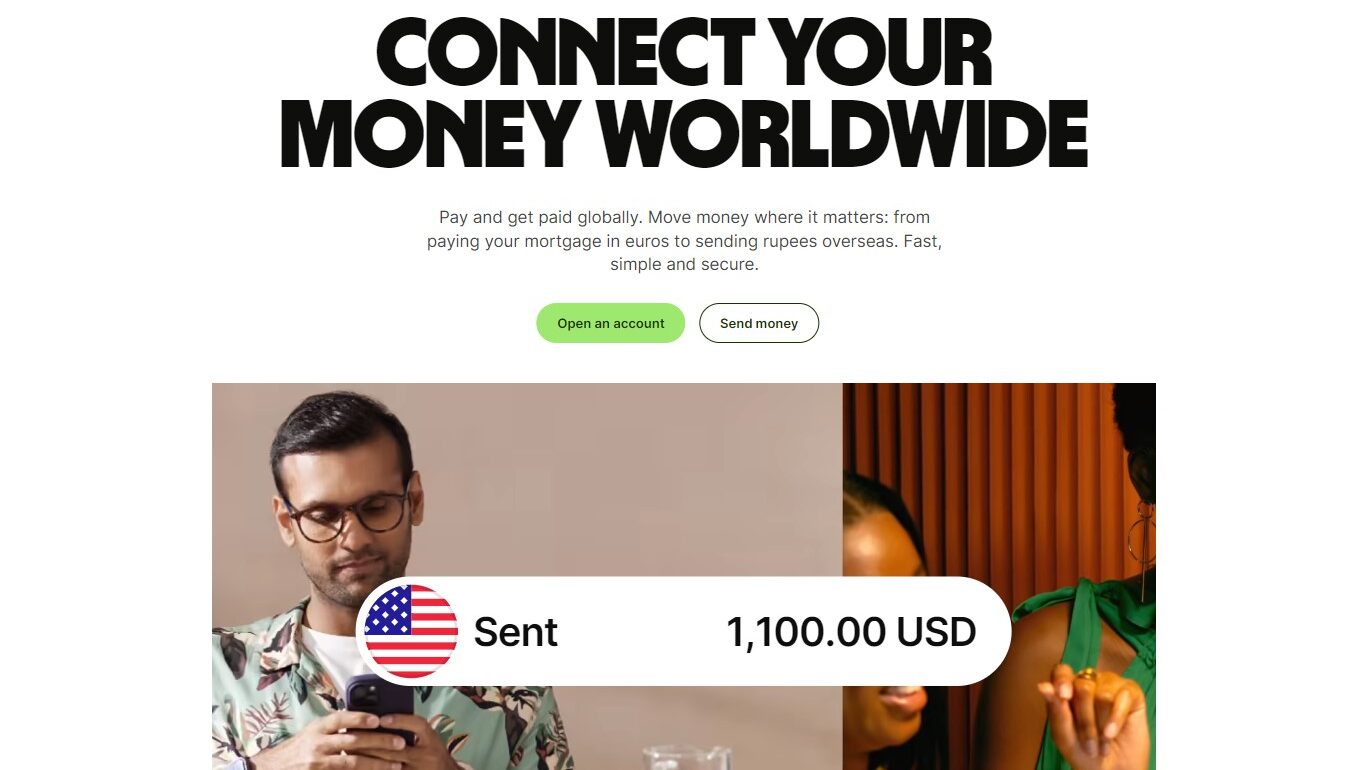

Forget hidden fees and unfair exchange rates. Wise isn’t your typical money transfer service; it’s a transparent and convenient platform designed to save you money when sending and managing your finances internationally. With a focus on competitive exchange rates, low fees, and a user-friendly platform, Wise empowers you to move your money globally with confidence and ease.

Why Choose Wise?

Looking for a cost-effective and transparent way to send money internationally? Here’s why Wise stands out:

- Competitive Exchange Rates: Enjoy mid-market exchange rates with no hidden fees, ensuring you get the most out of your transfer.

- Low Transfer Fees: Benefit from transparent and upfront fees so you know exactly what you’re paying before you send.

- Fast and Secure Transfers: Get your money where it needs to be quickly and securely, with real-time tracking.

- Hold and Manage Multiple Currencies: Open a multi-currency account to hold, convert, and spend money in over 40 currencies.

- Debit Card for International Spending: Order a Wise debit card to spend your money abroad with minimal fees.

Who is Wise For?

Wise caters to individuals and businesses seeking a transparent and affordable solution for international finance:

- Frequent Travelers: Manage your travel funds hassle-free with the Wise debit card and competitive exchange rates.

- International Workers and Students: Send and receive payments from abroad with low fees and secure transfers.

- Businesses Making International Payments: Pay employees, contractors, and suppliers globally at a fraction of the cost of traditional banks.

- People with Family Abroad: Support loved ones internationally with fast and affordable money transfers.

- Anyone Transferring Money Overseas: Wise offers a convenient and cost-effective way to move your money across borders.

Wise goes beyond a simple money transfer service, offering a transparent and user-friendly platform designed to save you money on your international transactions. With its focus on competitive rates, low fees, and multicurrency features, Wise is the perfect choice for individuals and businesses seeking a hassle-free and affordable way to manage their finances internationally.