Overview

What is SoFi Banking?

Ditch the limitations and fees of traditional banks. SoFi Banking isn’t just another checking account; it’s a modern and innovative banking solution designed to empower you to take control of your finances. Ditch the monthly fees, limited interest rates, and fragmented financial tools and focus on earning high APY interest, managing your money effortlessly, and accessing member-exclusive benefits. SoFi Banking offers a suite of features that help you grow your money, stay on top of your finances, and plan for your future, all within a user-friendly and secure mobile app.

Why Choose SoFi Banking?

Feeling frustrated with low interest rates, excessive bank fees, and a lack of innovative features? SoFi Banking offers a compelling solution:

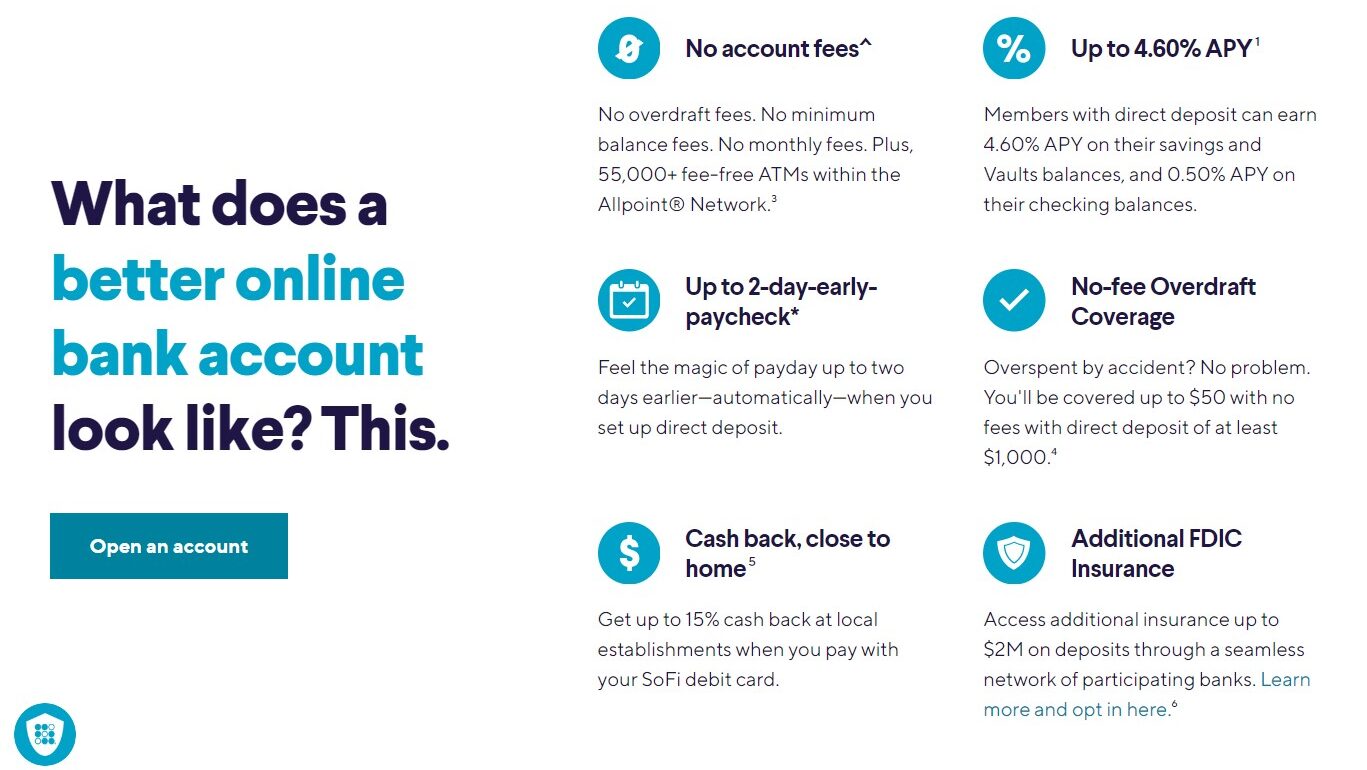

- High-Yield Checking Account: Earn a competitive APY on your everyday banking, putting your money to work for you.

- Free Debit Card with Rewards: Enjoy cash back rewards on everyday purchases with your SoFi debit card.

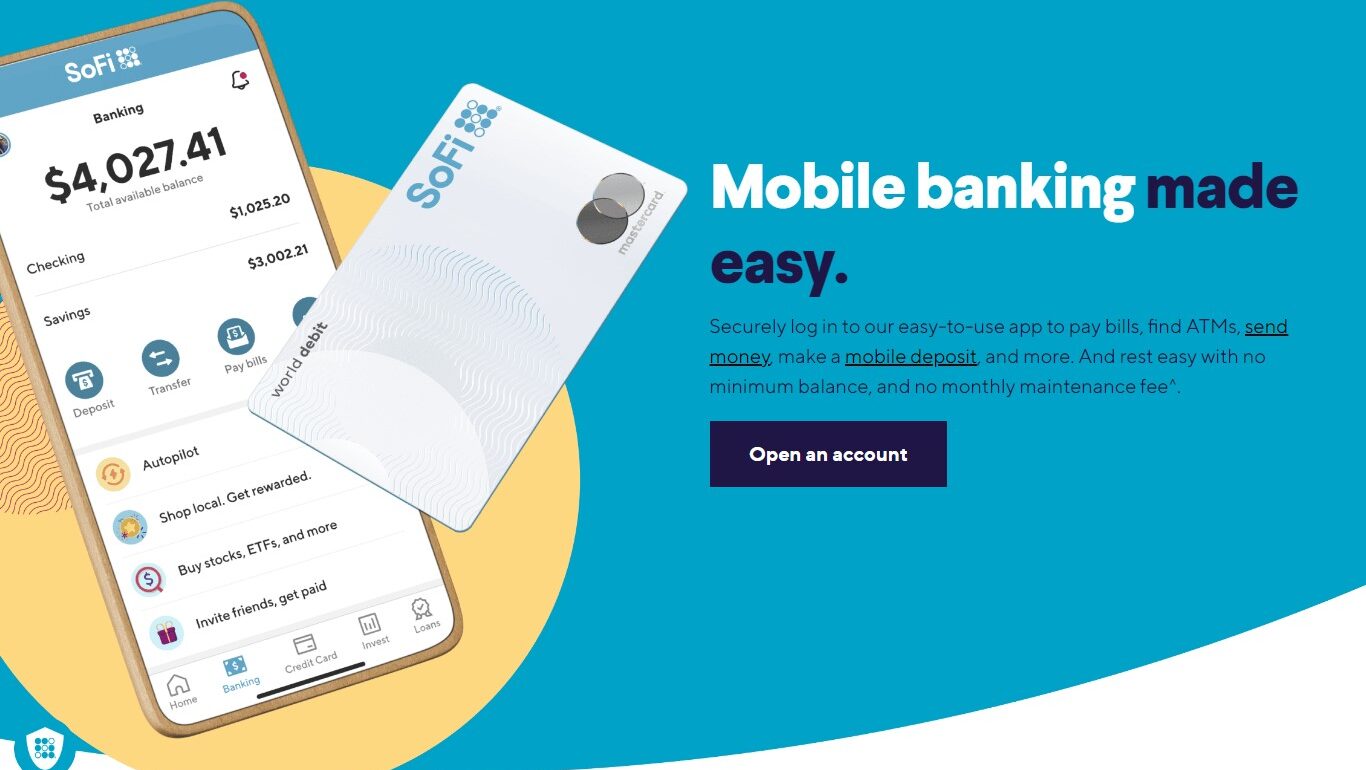

- Hassle-Free Mobile Banking: Manage your finances anytime, anywhere with SoFi’s intuitive mobile app.

- Free ATM Withdrawals: Access your cash at over 55,000 ATMs nationwide without incurring fees.

- Mobile Deposit: Deposit checks quickly and easily with your smartphone camera.

- Financial Tools & Budgeting Features: Set financial goals, track your spending, and stay on budget with SoFi’s helpful tools.

- Member-Exclusive Benefits: Gain access to exclusive perks and discounts from SoFi partners.

Who is SoFi Banking For?

SoFi Banking empowers everyone to manage their finances confidently:

- Young Professionals: Get started on the right foot with a high-yield checking account and budgeting tools.

- Tech-Savvy Individuals: Enjoy the convenience and control of mobile-first banking.

- Savers & Investors: Earn a competitive interest rate on your everyday banking while exploring SoFi’s wealth management products.

- Budget-Conscious Consumers: Manage your finances effectively with free tools and avoid unnecessary bank fees.

- Anyone Looking for a Better Banking Experience: If you’re ready to ditch the limitations of traditional banks, SoFi Banking offers a refreshing alternative.

SoFi Banking stands out as a leader in the digital banking revolution. Its commitment to high-yield interest rates, free features, mobile banking convenience, member benefits, and a focus on financial wellness makes it an attractive choice for anyone seeking to ditch traditional banking frustrations, manage their money smarter, and achieve their financial goals.