Overview

What is Current?

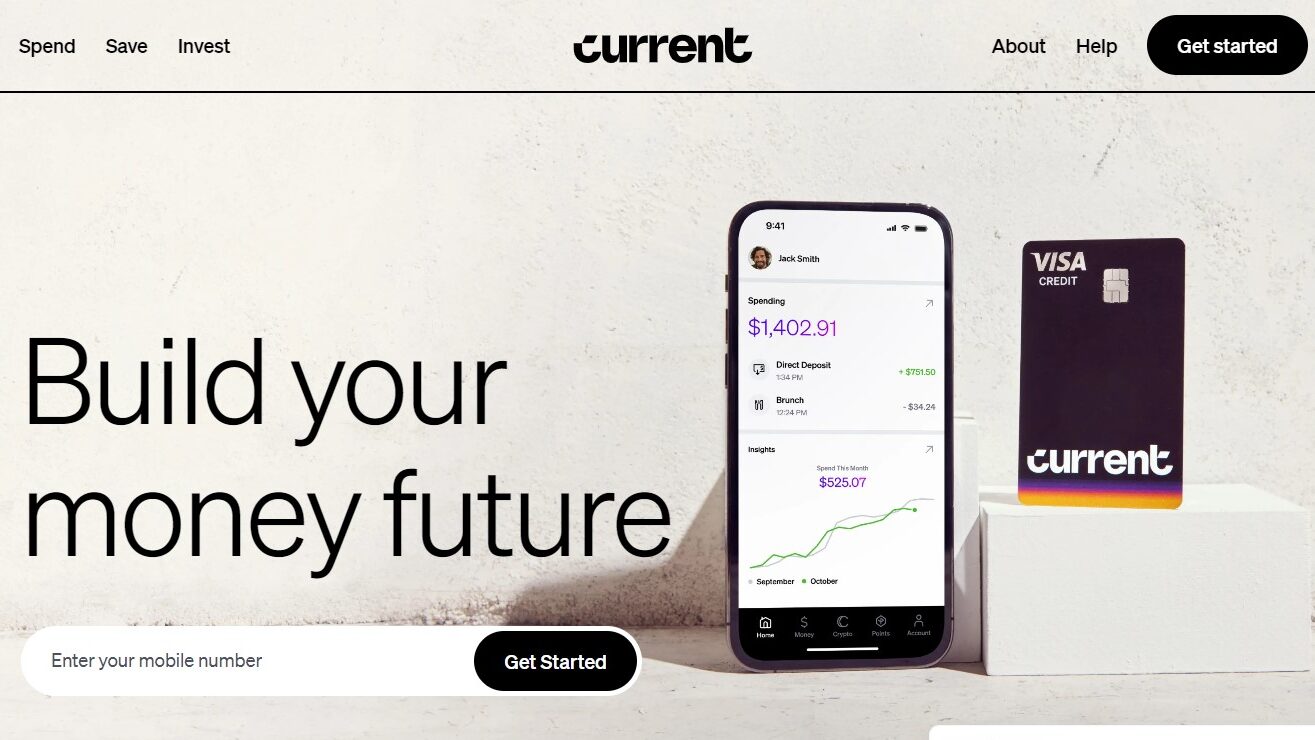

Traditional banks can feel outdated and full of hidden fees. Current offers a different approach. It’s a modern mobile banking app designed to help you manage your money smarter and spend with confidence. With features that encourage saving, provide instant spending notifications, and reward responsible banking, Current empowers you to take control of your finances and build a healthier financial future.

Why Choose Current?

Seeking a transparent and rewarding banking experience built for the modern world? Here’s why Current stands out:

- No Monthly Fees: Enjoy fee-free banking with no minimum balance requirements.

- Mobile-First Banking: Manage your finances seamlessly through the user-friendly Current mobile app.

- Instant Spending Notifications: Stay on top of your finances with real-time spending alerts for every transaction.

- Overdraft Protection (Subject to Eligibility): Avoid overdraft fees with Current’s SpotMe feature, which advances small amounts to cover debits.

- Savings Pods (Optional): Set financial goals and earn interest on your savings with separate spending and saving accounts.

- Rewards Program (Subject to Change): Earn cashback rewards on debit card purchases at select merchants.

Who is Current For?

Current caters to individuals seeking a transparent and mobile-centric banking experience:

- Young Professionals and Students: Manage your finances on the go with the convenient mobile app.

- Budget-Conscious Individuals: Benefit from fee-free banking and avoid unnecessary charges.

- Savers and Goal-Setters: Reach your financial goals with separate savings pods and earn interest.

- Tech-Savvy Users: Embrace the convenience of mobile-centric banking with real-time spending notifications.

- Anyone Who Wants to Spend Smarter: Current’s features help you stay informed and make informed financial decisions.

Current goes beyond traditional banking, offering a modern and transparent platform designed to empower you to manage your money smarter and spend with confidence. With its focus on convenience, fee-transparency, and rewarding responsible financial behavior, Current is the perfect choice for individuals seeking to take control of their finances and build a brighter financial future.